Blog

2 Million Foreclosure Prevention Actions Implemented by GSEs

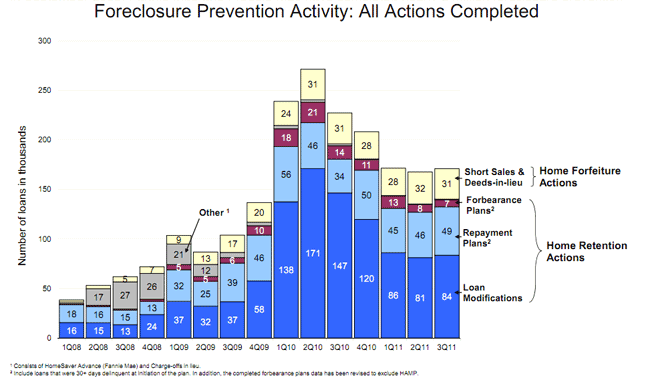

Fannie Mae and Freddie Mac, the two government sponsoredrnenterprises, reached the 2 million mark in their foreclosure prevention actionsrnduring the third quarter. Nearly onernmillion loan modifications have resulted from those actions </p

Foreclosure prevention activity picked up during the thirdrnquarter of 2011 with 171,067 actions taken compared to 167,629 in the secondrnquarter. Nearly half of the activity wasrnloan modifications and two thirds of those reduced monthly payments forrnborrowers by more than 20 percent. Foreclosurernprevention activities by the GSEs during Quarters Two and Three were asrnfollows:</p<table border="1" cellpadding="3" cellspacing="0"<tbody<tr<td valign="top"

Prevention Action</p</td<td valign="top"

Quarter 2, 2011</p</td<td valign="top"

Quarter 3, 2011</p</td</tr<tr<td valign="top"

Loan Modifications (including HAMP permanent mods)</p</td<td valign="top"

81,214</p</td<td valign="top"

83,582</p</td</tr<tr<td valign="top"

Repayment Plans</p</td<td valign="top"

45,890</p</td<td valign="top"

48,869</p</td</tr<tr<td valign="top"

Forbearance Plans</p</td<td valign="top"

7.,713</p</td<td valign="top"

7,006</p</td</tr<tr<td valign="top"

Charge-offs in Lieu</p</td<td valign="top"

602</p</td<td valign="top"

801</p</td</tr<tr<td valign="top"

Short Sales</p</td<td valign="top"

29,483</p</td<td valign="top"

28,264</p</td</tr<tr<td valign="top"

Deeds-in-lieu</p</td<td valign="top"

2,727</p</td<td valign="top"

2,545</p</td</tr<tr<td valign="top"

Total</p</td<td valign="top"

167,629</p</td<td valign="top"

171,067</p</td</tr</tbody</table

During the quarter 22,602 trial modifications under the HomernAffordable Modification Program (HAMP) were converted to permanent statusrnbringing the total number of permanent modifications under HAMP to 380,312. At the end of the quarter 42,279 borrowersrnremained in HAMP trial modification status, down from 50,923 at the end of thernsecond quarter.</p

The two million foreclosure prevention actions taken by the twornGSEs since they were put into conservatorship in August 2008 include 1,013,443rnloan modifications (including the permanent HAMP modifications) and nearly arnhalf-million repayment plans. Home forfeitures,rnprimarily short sales, have prevented foreclosure in 270,000 cases.</p

</p

</p

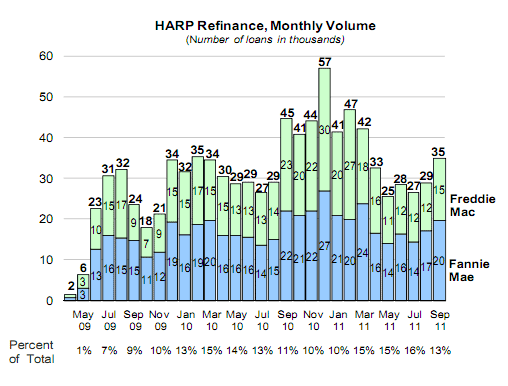

Over 90,000 homeowners took advantage of the Home AffordablernRefinance Program (HARP) during Quarter 3, an increase of 11 percent overrnQuarter 2. This brings the total numberrnof underwater borrowers served by the program since its inception in 2009 torn928,570. New criteria for HARP were announced onrnOctober 24 which will open the program to more borrowers and reduce the cost tornhomeowners and risk to lenders. FreddiernMac and Fannie Mae have participated in over nine million refinances sincernApril 1, 2009 including 1.6 million Streamlined refinances of their own loans</p

</p

</p

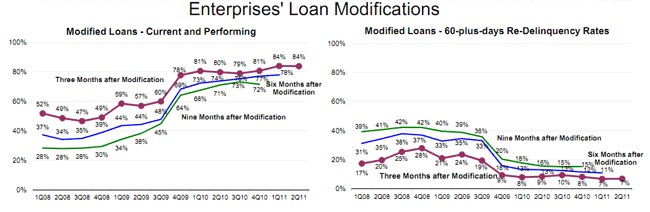

HAMP modifications continue to perform substantially betterrnthan loans modified in earlier periods. rnLoans that are 60+ days delinquent nine months after they were modifiedrnrepresent 15 percent of modified loans compared to a 39 percent redefault raternin that time frame during the first quarter of 2008. Seventy-two percent of HAMP loans are currentrnand performing at the nine-months mark.</p

</p

</p

Serious delinquency rates (90+ days) declined during thernquarter from 3.85 percent to 3.81 percent and 60+ plus delinquency was down onernpercentage point to 4.49 percent. Earlyrnstage delinquencies – 59 days or less – grew from 2.04 percent to 2.07 percent.rn</p

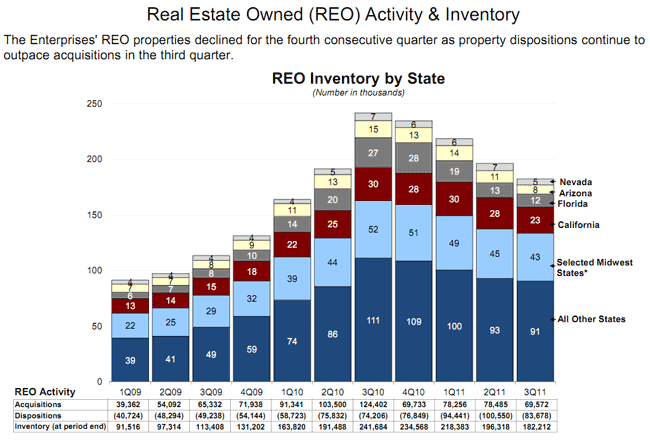

Foreclosure activity dropped with foreclosure startsrndeclining from 251,000 in the second quarter to 224,000 in the third andrncompleted third-party and foreclosure sales dropping from 94,000 torn79,000. REO inventories also eased withrn182,212 properties on hand at the end of the period compared to 196,318 thernprevious quarter. There were 69,572rnproperty acquisitions during the period and 83,678 dispositions. This was the fourth consecutive quarter thatrnREO inventories have declined.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment