Blog

20 Percent of May Refinances were HARP

The changes to the HARP program thatrnwere put in place last fall seem to be having an affect according to datarnreleased this morning by the Federal Housing Finance Agency (FHFA). The Administration made significant “enhancements”rnto the Home Affordable Refinance Program administered by FHFA after thernoriginal program launched in 2009 failed to attract the volume of borrowersrnoriginally anticipated. </p

HARP 2.0, as the new version of thernprogram is commonly called, eliminated any eligibility ceiling on loan-to-valuern(LTV) ratios and some risk based fees for borrowers who refinanced intornshort-term mortgages and reduced fees for other borrowers. The new program also waived some of thernrepresentations and warranties required of lenders, and eliminated the need forrna new property appraisal where a reliable automated valuation model estimate ofrnvalue was available.</p

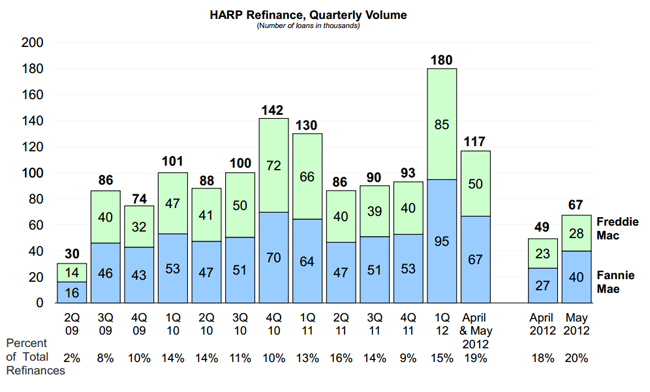

No doubt aided by record low interestrnrates, HARP refinancing has taken off in the last few months. The program was responsible for 20 percent ofrnall refinancing done during the month of May, the highest percentage in thernhistory of the program. The number ofrncompleted refinances for underwater borrowers in the first five months of 2012rnexceeded the total number of such refinances during the whole of 2011.</p

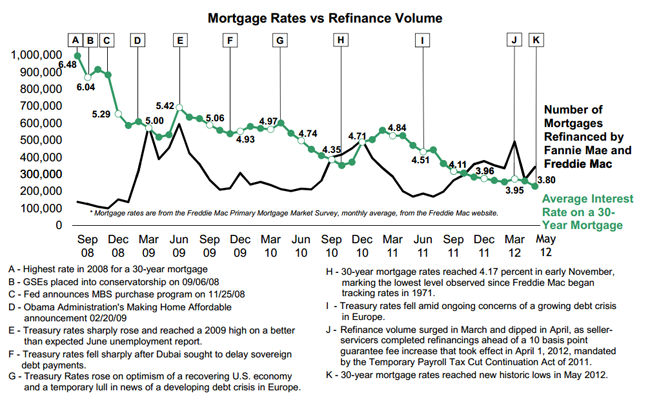

As the table below shows, while interestrnrates are helping a lot of people refinance, other factors have also impactedrnrefinancing over the last four years as the market has sought to recover fromrnthe housing meltdown.</p

</p

</p

In May there were 341,209 propertiesrnrefinanced through Fannie Mae and Freddie Mac and 1,787,223 so far inrn2012. Fannie Mae was responsible for 68rnpercent or 230,523 of the May transactions and 65 percent or 1,169,063 of allrn2012 refinancing to date while Freddie Mac’s refinances totaled 110,686 andrn618,160. A total of 67,456 of the May refinancesrnwere done through HARP and 297,103 of those completed so far in 2012. The proportion of HARP loans done throughrnFreddie Mac relative to Fannie Mae was much higher than for refinances in generalrnwith the smaller GSE accounting for 41 percent of HARP refinances in May and 46rnpercent of those year-to-date. </p

</p

</p

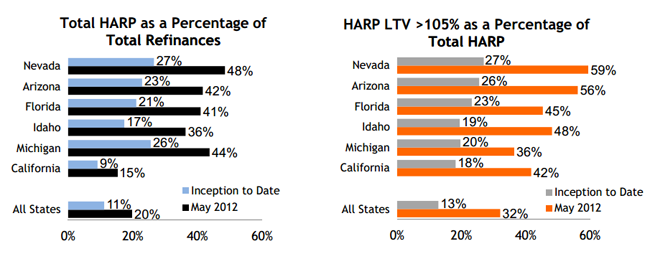

While it was the removal of the previousrn125 percent LTV ceiling that elicited the most interest when HARP 2.0 wasrnunveiled, that feature is only a small factor in recent HARP refinances. Only 2,954 or 4.4 percent of May HARP loansrnand 11,118 or 3.7 percent of loans so far in 2012 have had loan-to-value ratiosrnin excess of 125 percent. More thanrnhalf, in fact, have had LTV’s in the 80 to 105 percent range.</p

</p

</p

While not a lot of borrowers are takingrnadvantage of the fee elimination incentives offered for borrowers picking 15rnand 20 year mortgage terms 15 percent of borrowers so far this year have chosenrnthe shorter term alternatives compared to 10 percent in 2010. In May that number spiked to 19 percent.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment