Blog

Administration Adds $600 Million to State Housing "Hardest Hit" Program

Today, adding to the first Housing Finance Agency Innovation Fund for the Hardest Hit Housing Markets (the “HFA Hardest Hit Fund”), the Obama Administration announced an expansion of the initiative to target five additional states with high shares of their populations living in local areas of concentrated economic distress.

Housing Finance Agencies or HFAs are agencies or authorities created by state law that are charged with helping persons and families of low or moderate income attain affordable housing. According to the National Council of State Housing Agencies (NCHSA), its member agencies have provided mortgage financing for nearly 3 million homes in America and helped finance construction of approximately 3 million affordable rental properties. Combined, State HFAs typically fund about 100,000 mortgages a year.

The second “HFA Hardest Hit Fund” will direct up to $600 million to housing agencies in individual states to assist in the process of foreclosure prevention among unemployed homeowners and to assist those who cannot refinance because of mortgages larger than the value of their homes or because of second liens.

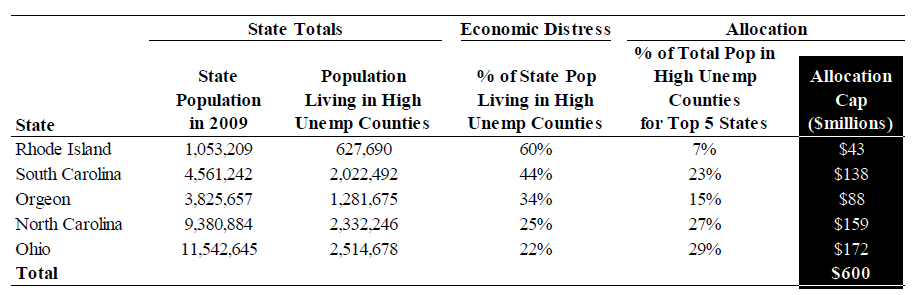

The five states that will receive allocations based on this criterion are: North Carolina, Ohio, Oregon, Rhode Island and South Carolina.

President Obama announced the first HFA Hardest Hit Fund on February 19, 2010, with up to $1.5 billion in funding. States that were allocated funds under the first HFA Hardest Hit Fund are not eligible for the second HFA Hardest Hit Fund. HFAs in states qualifying for the second Hardest Hit Fund will be required to submit plans to Treasury for review before becoming eligible for funding. Once HFAs have submitted plans to Treasury for review, and Treasury determines that the plans satisfy the requirements under the Emergency Economic Stabilization Act of 2008 (“EESA”), the plans will become eligible for funding up to a predetermined allocation cap.

Here is a recap of the details:

1. $600 Million to Help State Housing Agencies Further Address the Challenges Facing Housing Markets with the Most Concentrated Areas of Economic Distress

- Funding will go to states with the highest share of their population living in counties in which the unemployment rate exceeded 12 percent in 2009 (excluding states already eligible for Help for the Hardest Hit Housing Markets funds).

- HFAs must submit program designs to Treasury. Approaches that respond to problems caused by concentrated economic distress will be particularly welcomed.

- To receive funding, HFAs' plans must satisfy the requirements for funding under EESA. Funding will help support innovative foreclosure prevention efforts and help for unemployed homeowners.

2. Accountability and Transparency

- All funded program designs will beposted online.

- To create accountability for results, programeffectiveness measures and results will be published online.

- Programactivity will be subject to effective oversight under EESA.

3. Allocation Caps

- Allocation caps have been determined in proportion to the number of people in these five states living in counties with high unemployment, resulting in the following allocation caps:

The objective of the HFA Hardest Hit Fund is to allow HFAs to develop creative, effective approaches that consider local conditions. To provide guidance to HFAs in designing programs, Treasury has outlined below some of the possible types of programs that would meet the requirements of EESA.

- Unemployment Programs: Programs may provide for assistance to unemployed borrowers to help them avoid preventable foreclosures.

- Mortgage Modifications: Programs may provide for modification of mortgage loans held by HFAs or other financial institutions or provide incentives for servicers/investors to modify loans.

- Mortgage Modifications with Principal Forbearance: Programs may provide for paying down all or a portion of an overleveraged loan and taking back a note from the borrower for that amount in order to facilitate additional modifications.

- Short Sales / Deeds-In-Lieu of Foreclosure: Programs may provide for assistance with short sales and deeds-in-lieu of foreclosure in order to prevent avoidable foreclosures.

- Principal Reduction Programs for Borrowers with Severe Negative Equity: Programs may provide incentives for financial institutions to write-down a portion of unpaid principal balance for homeowners with severe negative equity.

- Second Lien Reductions: Programs may provide incentives to reduce or modify second liens.

Treasury will announce rules governing the submission of program designs by HFAs within two weeks and will provide a period thereafter for HFAs to submit their program designs in order to receive funding

Plain and Simple: At this point housing demand is stagnate as uncertainty regarding the road ahead continues to strain qualified home buyer confidence. Whether it be jobs, negative equity, or a flood of REO….this program gives the hardest hit states some flexibility in crafting their own prevention strategies for localized problems. Every bit of attention ($$$) that goes toward helping home prices findan acceptable bottom–based on the market's opinion– is a positive steprn toward restoring qualified investor confidence and rebuilding home demand. A clear bottom must be hit before the environment improves though. “On the fence” first time home buyers need a confidence boost that their soon to be biggest asset will not continue to lose value three months after closing. Programs like these put another layer of support under the market, they help restore qualified home buyer confidence. In the long run, whether or not these efforts prove efficient depends on job creation and the timing of bank REO sales. READrn MORE ABOUT SHADOW INVENTORY

HERE is the Treasury Release for More Detail

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment