Blog

Another Foul Housing Headline. Negative Feedback Loop in Progress

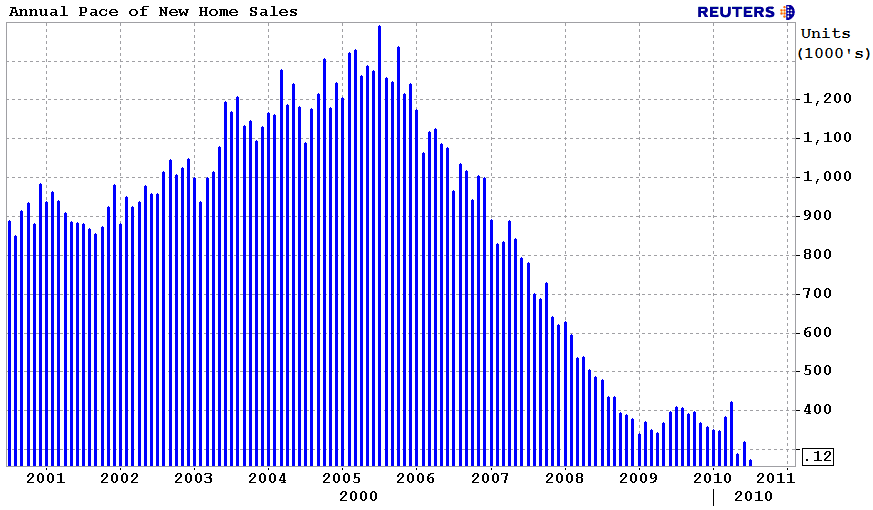

The Census Bureau and the Department of Housing and Urban Development have released New Residential Home Sales data for July 2010. </p

Surprise! New Home Sales Hit a New Record Low. AGAIN! </p

Excerpts from the Release…</p

Sales of new single-family houses in July 2010 were at a seasonally adjusted annual rate of 276,000. This is 12.4 percent below the revised June rate of 315,000 and is 32.4 percent below the July 2009 estimate of 408,000.</p

</p

</p

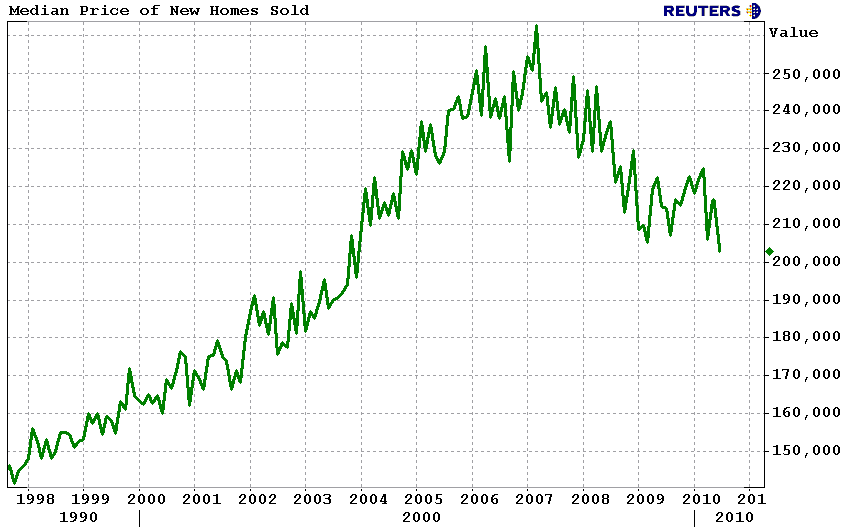

The median sales price of new houses sold in July 2010 was $204,000. This is the lowest median price since December 2003. The average sales price was $235,300. </p

</p

</p

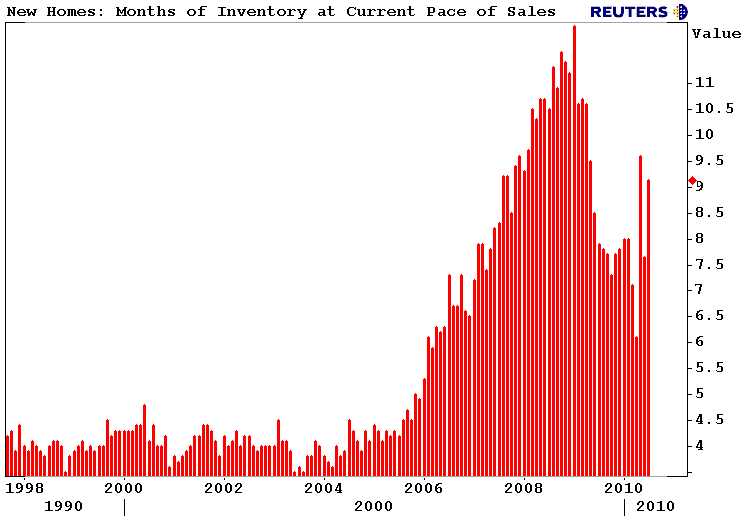

The seasonally adjusted estimate of new houses for sale at the end of July was 210,000. This represents a supply of 9.1 months at the current sales rate.</p

</p

</p

Three months after the home buyer tax credit expired….</p

HOUSING

</p

IS</p

STAGNANT</p

This should come as no surprise to folks working in the industry. Uncertainty is abundant in all sectors of the economy and prospective (qualified) homeowners are too worried about further declines in home prices to buy a house right now. When investing outlooks are unusually cloudy and the market's strategic perspective is stuck in the “here and now”, a brutal negative feedback loop can arise. Some may refer to this phenomenon as a “downward spiral”, where negative data leads to more negative data.</p

Plain and Simple: Although mortgage rates are at all-time lows and home affordability is at an all-time high, fence sitting home buyers are waiting for proof that home prices have hit bottom before making the biggest investment decision of their life. While they wait for a clear cut buy signal, home prices will fall further and home buyer pessimism will intensify which will lead to more weak housing data. And the downward spiral begins…</p

I am officially kicking a dead horse but this is what we were saying last October, before the original tax credit expired: </p

“We could go on and on about the industry, lender, and borrower specific problems limiting the housing recovery, however we believe the general big picture economic environment is providing enough roadblocks to recovery on its own. Thus, we will continue to state that until the labor market stabilizes and jobs start being created, the housing marketrn will undergo a slow, frustrating recovery process (for mortgage and real estate professionals especially)”</p

Structural weakness in housing demand is now out in the open for everyone to see. Jobs were the issue before the tax credit and jobs are still the issue after the tax credit. Sadly, because it's an election year and the economy is the biggest issue on the ballot, firms probably won't be hiring until after the new class is seated on Capitol Hill and new policies take shape. This implies we should be expecting home purchase demand to fester at record lows for at least for the rest of the year. I hope I'm wrong…

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment