Blog

Applications, Prices, and Condo Sales Get Second Look

Recent postings on CoreLogic’s Insights Blog have a couple ofrndifferent views of some of the housing numbers generally taken at face value byrnthose of us who follow them. Mortgagernapplications, cash sales, and home prices all got a second look and somewhatrncontrarian look. </p

In a posting titled Cash is all the Rage Thomas Vitlo says that while CoreLogic hasrnconsistently highlighted the cash share of home sales it hasn’t focused on thernshare of cash sales in the condo/coop subgroup. rnWhat is striking about this data is the high numbers of condos beingrnpurchased for cash in select states. Slightly more than 80 percent of condo salesrnin Nevada and Florida, more than 75 percent in New York and Alabama and nearly 68rnpercent in Arizona have been all-cash and these five states account for overrnhalf of such condo sales in the country. rn</p

Looking at trends in the two highestrncash-sale states Vitlo found there were three distinct time categories involvedrnover the January 2000 to January 2013 period. rnDuring the pre-recession period – 2000 to 2007, credit was readilyrnavailable to purchase condos and Nevada and Florida had an average condo cashrnshare of 22.9 percent and 35.4 percent respectively. During the recession period, shares in therntwo states spiked and in the average post-recession shares have averaged closernto their current level. </p

Vitlo concludes that during the recession, credit standards tightened andrnthe market contracted, making it more difficult to finance a condo. Now post-recession, investors play anrnincreasing role in condo sales and the market continues to shrink. “The effect of the recession has pushed condorncash shares much higher than pre-recession levels over the past five years andrnit doesn’t look like that is changing in the short term.”</p

In a second entry, Sam Khater concludes New Home Prices are not Rising as Fast as YournThink. While the numbers show thatrnnew home prices increased 18 percent between 2010 and 2013 there is more thanrnordinary appreciation involved. While thernprice increases reflect a very tight supply of new homes a second factor is thernchanging nature of the homes being built. rn</p

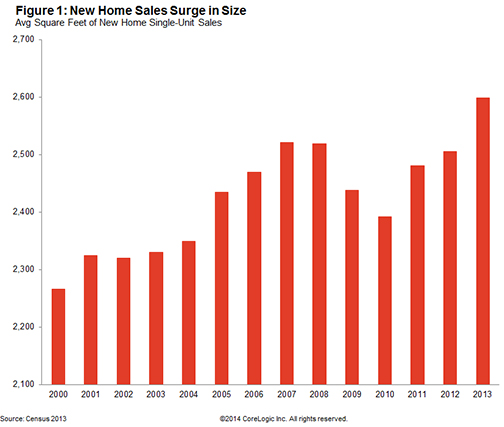

Since 2010 the size of a typical newrnhome has increased by 9 percent to 2,598 square feet. In addition they now come with additionalrnfeatures such as more bedrooms, bathrooms, and fireplaces. </p

</p

</p

Khater says that when adjustments are made to account for bigger and better,rnone sees a quite different picture. ThernCensus Bureau’s constant-quality new home price index puts the 2010-2013 pricernappreciation at 9 percent, half of the raw number usually reported. These differences are even greater in what herncalls “smaller geographies” and he cites the Midwest where there was a 19rnpercentage point difference between the 7 percent appreciation on thernconstant-quality index and the appreciation on the non-constant qualityrnindex. </p

Khater says that adjusting the price of new homes for quality revealsrnsmaller increases but doesn’t diminish the primary driver of appreciation, thernlack of inventory, especially for new, affordable homes. “We may be building higher quality housingrnfor tomorrow,” he says, “but it could be at the expense of access tornhomeownership.”</p

Finally, CoreLogic chief economist Mark Fleming took a closer look at thernMortgage Bankers Association’s Weekly Mortgage Applications Survey and itsrncontinuing tale of falling application volume. rnDuring the week of which Fleming wrote total applications were down 56rnpercent on an annual basis. But most ofrnthat decline was due to a 70 percent drop in refinancing activity. At the same time he notes that the MBA’srnPurchase Index was also down 14 percent since the same period in 2013 equalingrnlevels last seen in 2011. </p

But Fleming quotes Bill McBride at Calculated Risk who says the PurchasernIndex may be understating the amount of actual activity. McBride feels that small lenders arernunderrepresented in MBA’s survey from which the indices are derived and “smallrnlenders tend to focus on purchases.”</p

In addition, Fleming says, CoreLogic data shows home sales increased by 8rnpercent year-over-year in February and by 5 and 7 percent in December andrnJanuary respectively. So while thernpurchase application index has been indicating declining activity actual salesrnhave been consistently growing on an annual basis. How, Fleming asks, can that be? “One possible explanation is that increasingrncash sales could reconcile rising sales with declining purchase applications,rnbut the cash sale share is declining (down to 38 percent in December 2013 fromrn44 percent a year earlier).”</p

Still Fleming says that “declining purchase applications don’t necessarilyrnmean there are fewer originations in the current market. In fact, our datarnshows more homes are being sold and proportionally more sales are beingrnfinanced. Though the volume of purchase loans being originated is low byrnhistoric standards, the hopeful news is that the volume is, in fact, growing.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment