Blog

Baby Boomer Attitudes on Housing Might Surprise You

A survey of attitudes toward housingrnreleased on Thursday by The Demand Institute indicates that the Baby Boomrngeneration still has no intention of aging gracefully. In fact, when it comes to housing it appears fewrnintend to yield at all to their advancing years. </p

The Institute, a nonprofit run by the ConferencernBoard and the Nielson ratings people, surveyed 4,000 households last year inrnwhich residents qualified as members of that huge post-war generation bornrnbetween 1944 and 1963 about their future housing plans. </p

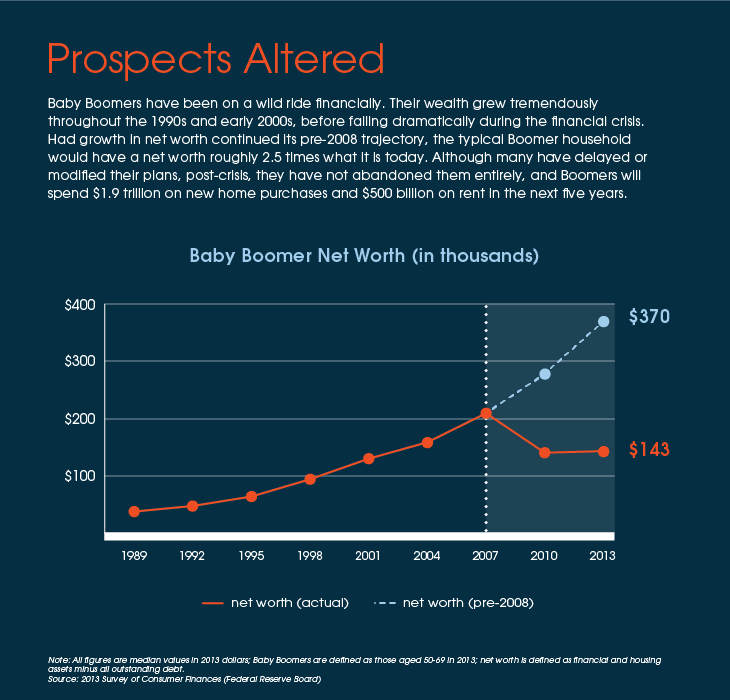

The survey found that as a group BabyrnBoomers had a median net worth of $200,000 in 2007 and were on their way tornaccumulate nearly $370,000 by 2013. Insteadrnthe recession sent many off the rails and at the time of the survey that medianrnnet worth was down to a median of $143,000. Although many Boomers have delayed or modifiedrntheir plans due to the recession they have, the Institute says, not abandonedrnthem entirely. Over the next five yearsrnit is expected they will spend $1.9 trillion on new home purchases and $500rnbillion on rent.</p

</p

</p

Whether for financial reasons or byrnchoice the majority of the generation is still working but 58 percent plan tornretire within five years. Among youngerrnmembers, those 50 to 59 at the time of the survey, only 23 percent were retired</bwhile 34 percent planned to be within that time frame. Sixty-nine percent of the older group, thosern60 to 69 years of age, were already retired and 80 percent had plans.</p

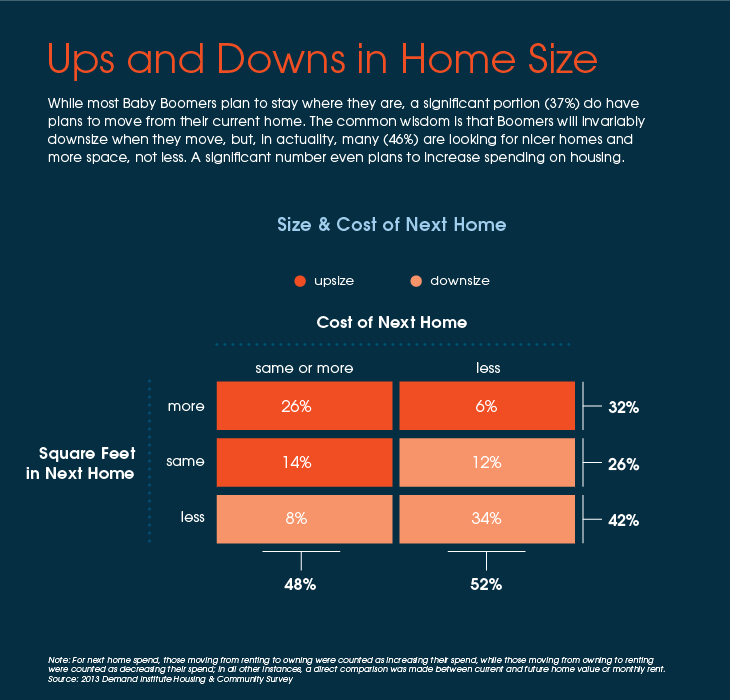

Whatever their working plans, the surveyrnfound that the generation has some counterintuitive plans for theirrnhousing. Thirty-seven percent said theyrnplan on moving, but while the common wisdom has older folks downsizing as theyrnage, 46 percent of those who plan to change locations are looking for nicerrnhomes or more space. Nearly half plan tornspend as much or more money on housing after they move.</p

</p

</p

The Institute says the 46 percent ofrnthose respondents who are looking for a larger home or plan to spend as much orrnmore as they currently do are less affluent than the respondents overall andrnmany delayed their housing plans because of the recession and its impact onrntheir finances. They have median netrnworth of $40,000 and currently live in a home with a median of 1,200 squarernfeet. “Downsizers” on the other handrnlive in a median 2,000 square foot home (compared to 1,600 for all respondents)rnand have median net worth of $322,000.</p

“Upsizers are finally looking tornpurchase their dream home,” the report says. rn”Many in this group will move from renting to owning, but they are notrnnecessarily looking to spend lavishly – the median price of their next home willrnbe $180,000, less than the $200,000 of the more affluent “Downsizers.”</p

The “Downsizers” are either looking forrna smaller home or to spend less for a home similar in size as they own orrncurrently occupy. “Many are currentlyrnliving in larger, more expensive homes that will be difficult to maintain as theyrnage. But just because they are lookingrnfor smaller homes, it doesn’t mean they are necessarily looking to settle. Many will seek homes with high-end finishesrnand nearby services and amenities.”</p

Those who plan to move won’t gornfar. Sixty-seven percent say they willrnstay in the same state and a quarter plan to stay within 10 miles of theirrncurrent homes. The remaining third arernmotivated as much by wanting to live closer to family as they are by a changernof scenery or climate. Maintainingrnconnections to friends and community is an important consideration and onlyrnabout 20 percent of those who will move are interested in residing in a seniorrncommunity or retirement setting.</p

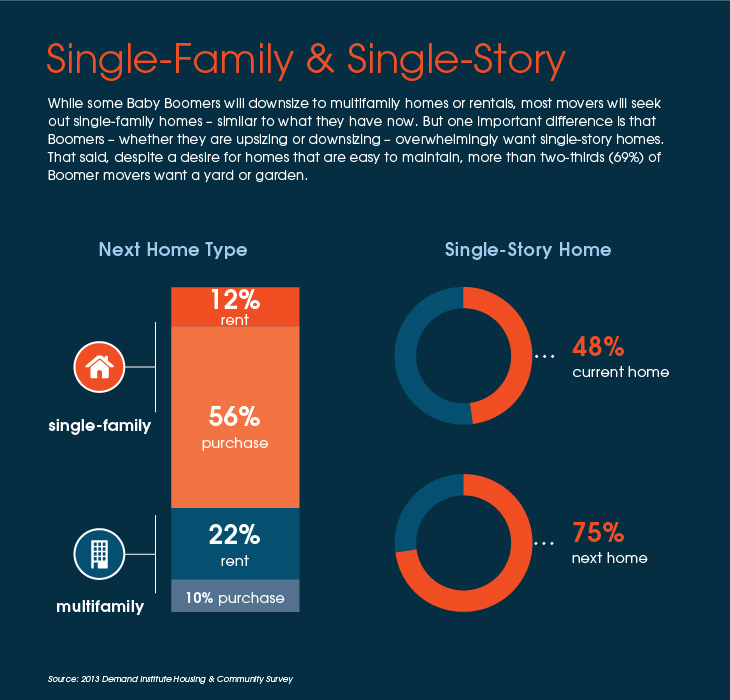

Whether downsizing or not, most BabyrnBoomers who plan to move will continue to live in single family homes and mostrnintend to buy. While slightly less thanrnhalf currently live in one-level homes one is an overwhelming choice for thernnext home. Despite the maintenance, mostrnstill want a house with a garden or yard.</p

</p

</p

The postwar generation is carrying muchrnmore mortgage debt than did earlier generations at the same stage of life – arnmedian of $118,000. This is an increase ofrn142 percent since 1992 when the median was $48,743. But this is a generation that has never shiedrnaway from debt and 56 percent of those who plan to purchase their next home saidrnthey will seek a mortgage to do so. Seventy-sevenrnpercent are confident they will qualify.</p

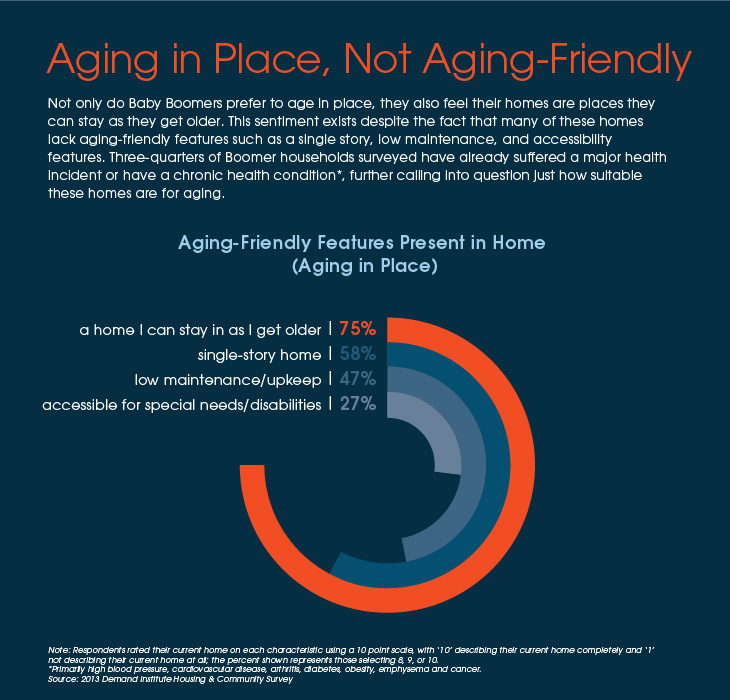

But back to those Baby Boomers who planrnto stay put. The Institute says that notrnonly do they prefer to age in place, they also feel their homes are set up tornallow them to do so. This despite thernfact that many lack “aging-friendly features.” rnIn addition, three quarters of those households surveyed have alreadyrnhad a major health incident or have a member with a chronic healthrncondition. This, the report says, furtherrncalls into question just how suitable these homes will be in the coming years. </p

</p

</p

These agers-in-place also show littlernmotivation to change the accommodative features of their homes. While 39 percent say they have plans to do a<bmajor home improvement in the next three years, making the home more agingrnfriendly does not top their list of reasons for doing so.</p

</p

</p

The Institute asks if all Boomers arernmaking the most prudent housing decisions as they approach retirement. “Not necessarily,” they say. “Regardless, their decisions will havernimportant implications as this generation, once again, does it their way.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment