Blog

California Home Price Increases Double National Gains

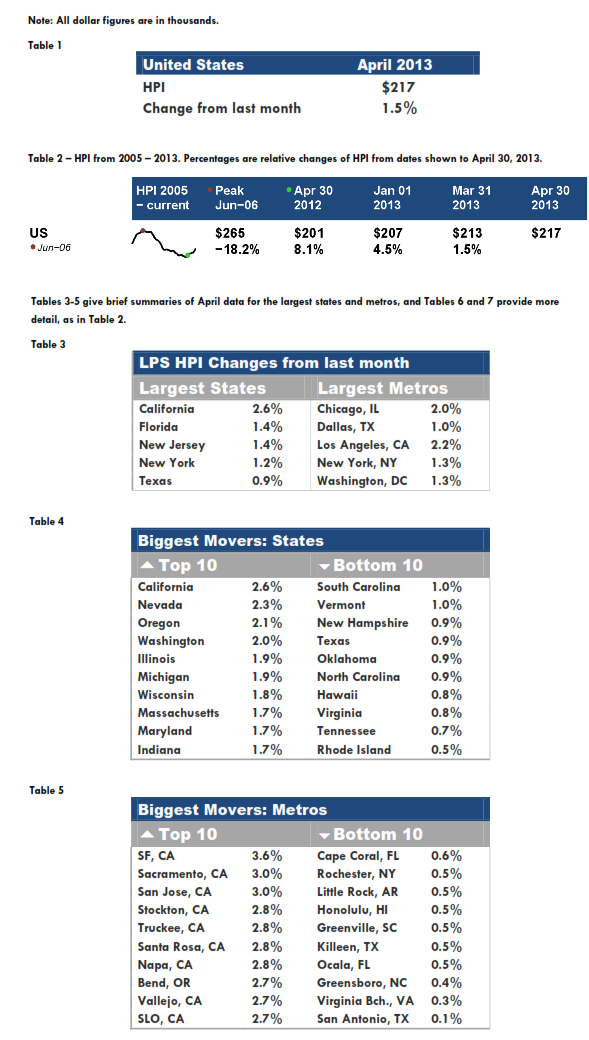

Home prices</bcontinue to make substantial gains in most areas of the country with some areasrnin California seeing an increase of as much as 3 percent in the LenderrnProcessing Service (LPS) Home Price Index (HPI) in a single month. LPS released its HPI report for April and putrnthe nationwide HPI at $217,000, a 1.5 percent increase from March and up 4.5rnpercent from April 2012.</p

Californiarnsaw the greatest month-over-month increase in the HPI, up 2.6 percent for thernmonth to $351,000 and a 17.9 percent increase for the year. It was followed by Nevada where the indexrnincreased 2.3 percent from March, Oregon, 2.1 percent; Washington, 2.0 percentrn(a 9.5 percent increase year-over-year); and Illinois and Michigan each at 1.9rnpercent. Illinois was up 4.6 percent on an annual basisrnand Michigan increased 9.4 percent. No annualrnfigure was given for Nevada.</p

Evenrnthose states at the bottom of the list had solid monthly increases. Rhode Island had the smallest change, 0.5rnpercent, followed by Tennessee at 0.7 percent, and Virginia and Hawaii, each atrn0.8 percent. </p

Amongrnmetropolitan areas San Francisco had the strongest showing, a 3.6 percentrnincrease, with Sacramento and San Jose increasing by 3 percent. All three cities had year-over-year pricerngrowth exceeding 20 percent. Nine of the ten biggest movers amongrnmetropolitan areas were in California, the single exception being Bend, Oregon,rnnumber seven at 2.8 percent. Again,rnthose metropolitan areas with the smallest monthly movement were all inrnpositive territory; San Antonio, up 0.1 percent, Virginia Beach, 0.3 percent;rnand Greensboro, North Carolina, 0.4 percent. </p

LPS’srnHPI uses a repeat sales analysis based on April residential real estaterntransactions and information from its own loan-level databases. The analysis covers more than 15,500 U.S. ZIPrncodes and represents the price of non-distressed sales by taking into accountrnprice discounts for bank owned real estate (REO) and short sales.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment