Blog

Case Shiller notes "Significant Slowdown" in Home Price Gains

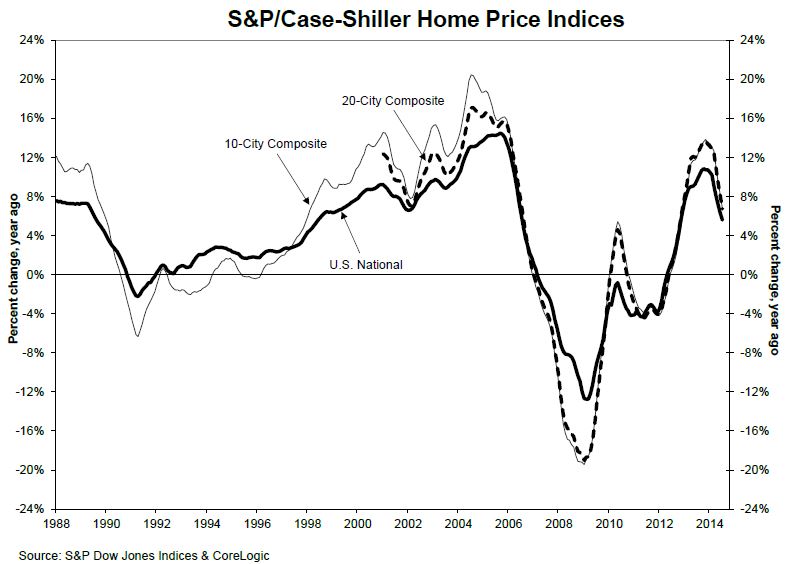

There was what the S&P/Case-Shiller Home Price Indicesrncalled “a significant slowdown in price increases in July S&P DowrnJones Indices said today. Nineteen of the 20 cities in the survey saw arnlower year-over-year gain in July than they had registered in the previousrnmonth and only three cities still showed increases in the double digits. </p

The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 5.6rnpercent annual gain in July 2014rncompared to a 6.2 percent annual increase in June. The 10- and 20-City Composites showed year-over-year increases of 6.7rnpercent, a substantial decline from the 8.1 percent gain for each during the 12rnmonths ended in June. Las Vegas, Miami and San Francisco were the only citiesrnto report double-digit annual gains. Cleveland’s rate remained unchanged at +0.9 percent for the 12 months ending July 2014.rn</p

On a month-over-month basis the 10-City and 20-City Composite Indices<bincreased 0.6 percent each and the National Index rose 0.5 percent. The increases from May to June were 1.0rnpercent for the composites and 0.9 percent for the National Index. SanrnFrancisco, where prices have skyrocketed in the last dozen months, was the onlyrncity without a gain from June to July; prices there declined by 0.4 percent,rnthe first decline for the city this year and its largest drop since Februaryrn2012. Of the remaining cities 17 hadrnsmaller gains than in June and for in only one, New York City, did the Julyrnincrease exceed 1 percent. </p

</p

</p

“The broad-based decelerationrnin home prices continuedrnin the most recent data,” DavidrnM.rnBlitzer, Chairman of the Index Committeernat S&P Dow Jones Indices said. “However, home prices continue to rise at two tornthree times the rate of inflation. The slower pace of homernprice appreciation is consistent with most of the other housingrndata on housing startsrnand home sales. The rise in August newrnhome sales — which arernnot covered by the S&P/Case-Shiller indices – is arnwelcome exception to recent trends.</p

Of note, he said, are Las Vegas,rnone of the most depressedrnhousing markets in the recession,rnwhich is still leadingrnthe cities withrn12.8 percent year-over-year increase, and Phoenix, the first city tornsee double-digit gains backrnin 2012, which posted its lowest annual returnrnof 5.7 percent since February 2012.</p

</p

</p

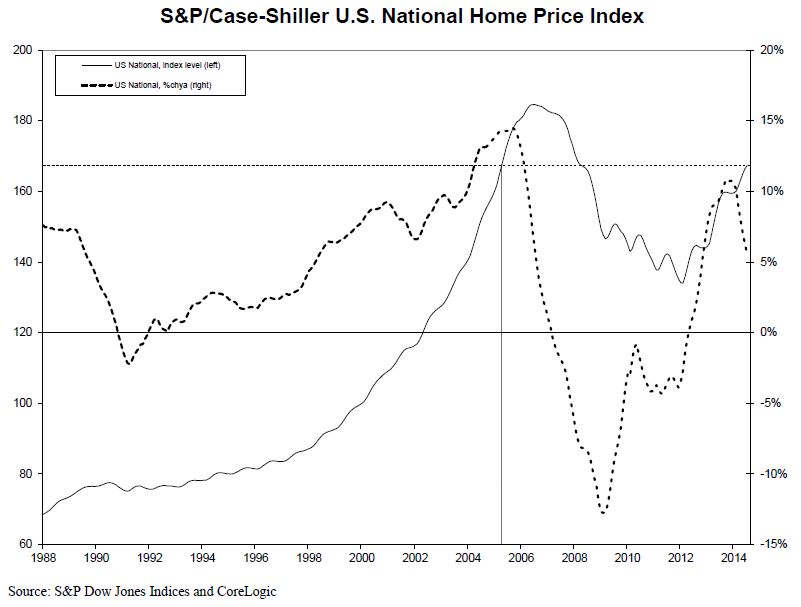

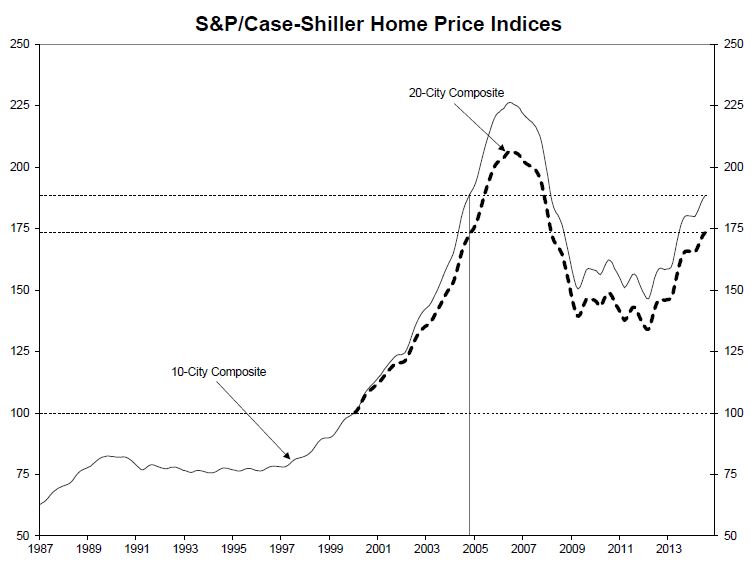

As of July 2014, average home prices across the United Statesrnas registered by the National Index are back to their levels postedrnin the spring of 2005. rnThe levels of the 10- and 20-City Composites show prices back to thernlevels in the autumn of 2004. Measuredrnfrom their June/Julyrn2006 peaks, the peak-to-current decline for both Composites is approximately 16-17 percent. The recovery from the March 2012 lows is 28.6 percent and 29.3rnpercent for the 10-City and 20-CityrnComposites.</p

While all cities continue to continue to post year-over-year gains, not one managed to show improvement. San Francisco decelerated the most from an annual returnrnof +13.2 percent last month to +10.3rnpercent in July. Cleveland remained steady at +0.9 percent year-over-year and continued to underperform the other MSAs by arnwide margin.</p

</p

</p

The S&P/Case-Shiller Home Price Indices are constructed to track the price path of typical single-family homes located in each metropolitan area provided. Each index combinesrnmatched price pairs for thousandsrnof individual houses from the availablernuniverse of arms-length sales data. The S&P/Case-Shiller National U.S. Home Price Index tracks the value of single-family housing within the United States. The index is a composite of single-family home price indicesrnfor the nine U.S. Census divisions. The indices have a base value of 100 in Januaryrn2000; thus, for example,rna current index value of 150 translates to a 50 percent appreciation rate sincernJanuary 2000 for a typical home locatedrnwithin the subject market.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment