Blog

Case-Shiller Reports Continued Erosion in Home Prices

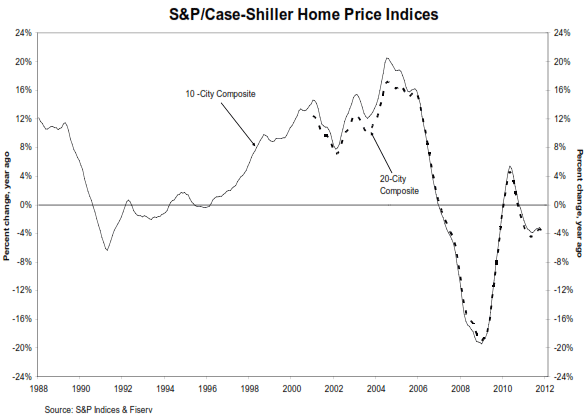

Home prices continued to fall in November according to thernS&P/Case-Shiller Home Price Indices released this morning. Both the 10-City and the 20-City Indices wererndown 1.3 percent in November compared to the previous month and for the secondrnmonth in a row19 of the cities also saw their prices inch lower. Phoenix was the only one of the 20 to post arngain in November. </p

The year-over-year price declines in November widened from those in October. The 10-City and 20-City Composites were downrn3.6 percent and 3.7 percent respectively from November 2010 to November 2011rncompared to the -3.2 percent and -3.4 percent annual rate of change inrnOctober. Thirteen of the cities in thernlarger index also saw a large drop in annual prices than they had in October. </p

Atlanta had the worst performance with its annual return down 11.8 percent. Atlanta’s prices fell 2.5 percent in Novemberrnfollowing a 5.0 percent decline in October, 5.9 percent drop in September andrn2.4 percent loss in August. As was therncase in October, only two cities, Detroit and Washington, DC saw an improvedrnannual rate, but in both cases that annual increase was lower than theirrnOctober number.</p

David Blizer, Chairman of the Index Committee at S&P Indices said,rn”Despite continued low interest rates and better real GDP growth in the fourthrnquarter, home prices continue to fall. rnAnnual rates were little better as 18 cities and both Composites werernnegative. Nationally, home prices arernlower than a year ago. The trend is downrnand there are few, if any signs in the numbers that a turning point is close atrnhand.” </p

</p

</p

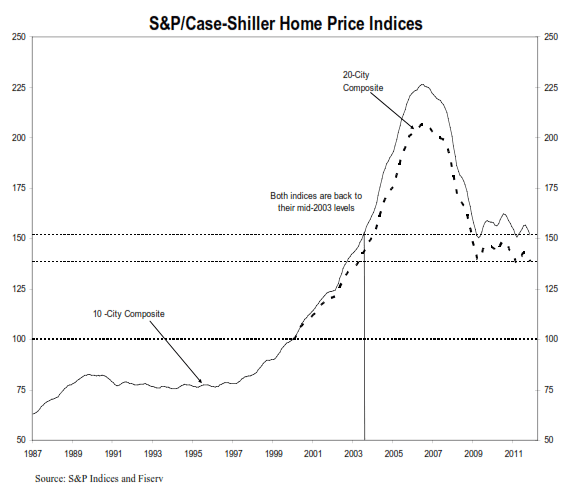

The 10-City Composite is now about 1.0 percent above its crisis low reachedrnin April 2009 and the 20-City is 0.6 percent above the low it reached in Marchrn2011. Both Composites are close to 33rnpercent off of their 2006 peak levels. rnAs of November average home prices across the U.S. are back to mid-2003rnlevels.</p

“It’s not telling us much we don’t know. A lot of people fell into the trap of looking at the upturn in housing starts at the end of the year and mistaking that for a turnaround in the housing market. That’s absolutely premature.” – Andrew Wilkinson, Chief Economic Strategist, Miller Tabak & Co., New York.</p<prnrnrnrnrnrnrnrnrnrnrn

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment