Blog

Case-Shiller: Seven Months of Price Declines Comes to an End

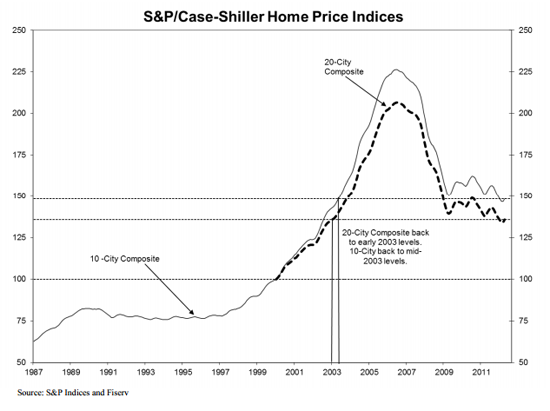

For the first time in eight months the S&P/Case-ShillerrnHome Price Indices rose over levels of the previous month. Data through April 2012 showed that onrnaverage home prices increased 1.3 percent during the month for both the 10- andrn20-City Composites.</p

Prices are still down 2.2 percent forrnthe 10-City and 1.9 percent for the 20-City over figures for one year earlierrnbut this is an improvement over the year-over-year losses of 2.9 and 2.6rnpercent recorded in March. Improvementsrnin the annual figures were also recorded by 18 of the 20 cities when comparedrnto March with only Detroit and New York faring worse. The 10-City Composite now has an index ofrn148.40 and the 20-City 135.80; the base of 100 was set in January 2000. </p

</p

</p

Nineteen of the 20 cities and bothrnComposites posted positive monthly returns, with Detroit being the onlyrnexception. Phoenix continues to leadrncities with improving trends and had a 2.5 percent increase in April and thernhighest annual rate of return among all 20 cities. Atlanta, Cleveland, Detroit, and Ls Vegasrncontinue to have average home prices below their January 2000 levels while bothrnComposites have returned to levels in the early and mid 2003 period.</p

David M. Blitzer, Chairman of the IndexrnCommittee at S&P Indices said, “With April 2012 data we finally saw somernrising home prices. While one month doesrnnot make a trend, particularly during seasonally strong buying months, the combinationrnof rising positive monthly index levels and improving annual returns is a goodrnsign.”</p

“Wernwere hoping to see some improvement in April,” Blitzer said. “First, changes in home prices are veryrnseasonal, with the spring and early summer being the most active buying months. Second, while not as strong, and we believernless reliable, the seasonally adjusted data were also largely positive, arnpossible sign that the increase in prices may be due to more than just thernexpected surge in spring sales. rnAdditionally, the last few months have seen increased sales and housingrnstarts amidst a lot of talk of better housing markets, so some price gains werernanticipated.”</p

Atlanta posted the only double-digitrnnegative annual return at -17.0 percent, its 22nd consecutive monthrnof negative annuals returns. Ten of thern20 cities saw positive annual returns – Boston, Charlotte, Dallas, Denver,rnDetroit, Miami, Minneapolis, Phoenix, Tampa, and Washington, DC. There were no new city lows in April.”</p

“Atlanta and Phoenix, two markets wernhave followed closely in 2012 for their contrasting trends, have continuedrnalong their opposite paths,” Blitzer said. rn”Atlanta continues to be the only city with double-digit negative annualrnreturns – 17.0 percent, whereas Phoenix fared the best in terms of annualrnreturns at +8.6 percent in April.”</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment