Blog

Cash Sales Dwindle, Concentrated in REO Market

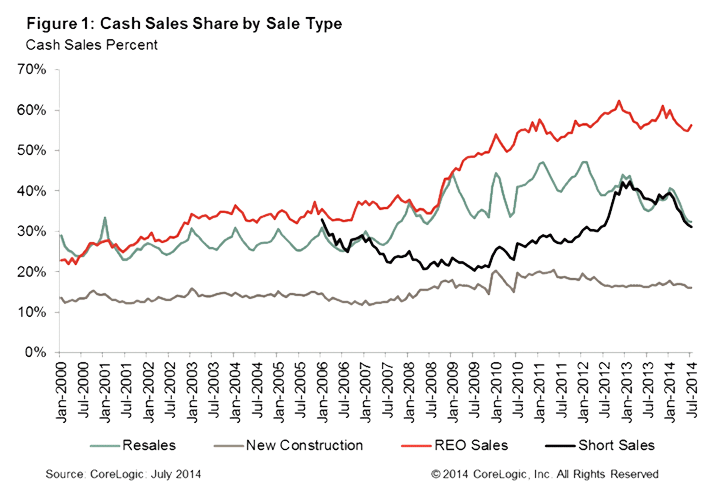

The share of home purchased with all-cash is continuingrnto drop, but even with a -3.0 percentage point change between July 2013 and Julyrn2014 they still make up nearly a third of all sales. CoreLogic said today that 32.9 percent ofrnhome sales during the month were all-cash, the lowest share since Augustrn2008. Prior to the housing crisis cashrnsales typically comprised about a quarter of all home sales. </p

The percentage of cash sales has fallen on an annualrnbasis every month since January 2013 and is now down over 10 percentage pointsrnfrom the peak of 46.3 percent in January 2011. rnOn a month-over-month basis the share of cash sales was down .10 percent.rn</p

The largest share of cash transactions were for realrnestate owned (REO) properties at 56.3 percent, but those sales have also fallenrnfrom a peak of 23 percent of all sales to 7.1 percent this past July. Thus the high percentage of cash sales amongrnthose properties had little effect on the percentage of such sales in thernmarket as a whole. Existing homes had arn32.4 percent cash share, short sales 31.1 percent, and new homes 16rnpercent. </p

CoreLogic said that the cash share of existing home sales has fallen almostrn15 points from its peak cash share of 47.1 percent in February 2011. This is a trend to watch, the company says,rnbecause it will determine the direction of cash sales in the future as thernexisting home category is now 81 percent of the residential real estate market.rn </p

</p

</p

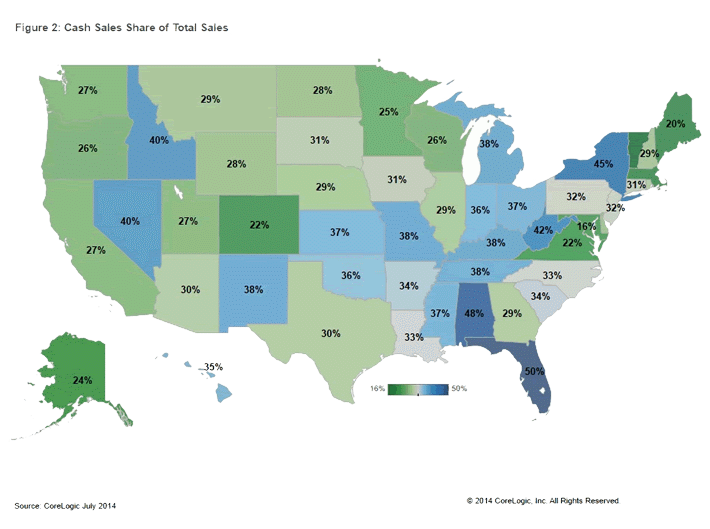

The highest share of cash sales was in Florida at 49.7 percent followed by Alabamarn(47.6 percent), New York (44.5 percent), West Virginia (42 percent) and Idahorn(39.9 percent). West Palm Beach-Boca Raton-Delray Beach had the highest sharernof cash sales among the 100 largest core metropolitan statistical areas at 57.9rnpercent. Three other Florida metros followed;rnCape Coral-Fort Myers. (57.3 percent), Miami-Miami Beach-Kendall (56.5rnpercent), North Port-Sarasota-Bradenton (55.8 percent). The Detroit-Dearborn-Livonia, Michigan arearnwith 55.8 percent rounded out the top five. The Washington, DC metro area hadrnthe lowest cash sales share at 15.4 percent.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment