Blog

Commercial and Multifamily Mortgages Outperforming Overall Bank Holdings

Commercial and multifamily mortgages continue to have the lowestrnrates of charge-offs of any loan types at banks and thrifts and perform betterrnthan the overall loan portfolios at those institutions according to thernMortgage Bankers Association (MBA).

In response to what it referred to as a great deal ofrndiscussion and conjecture about those loans in recent months, MBA updated an earlierrn”DataNote” analysis of commercial and multifamily mortgage data fromrnthe 4th quarter of 2008 with data from the same period in 2009.

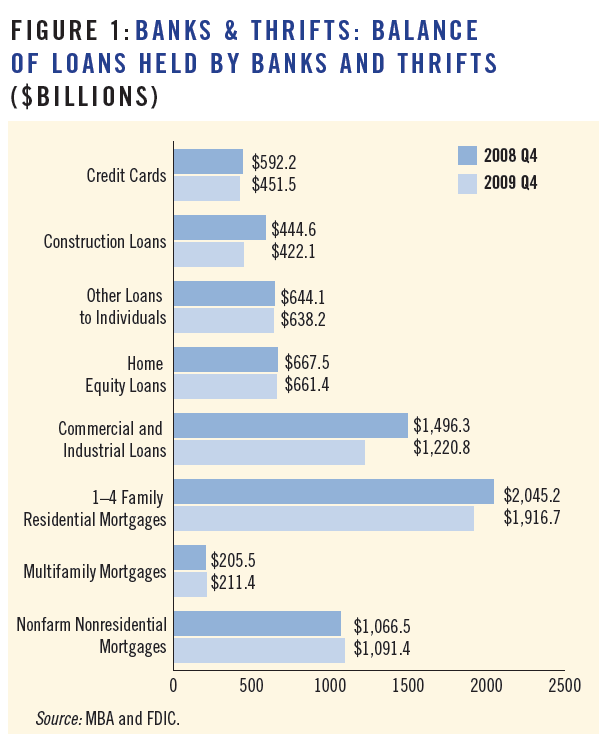

The report states that 56 percent of the assets held by banksrnand thrifts at the end of 2009 consisted of loans and leases, a category thatrnincludes 1-4 family mortgages, home equity loans, credit cards and otherrnconsumer loans, commercial mortgages, multifamily mortgages, constructionrnloans, and commercial and industrial loans. rnOne to four family residential loans constitute the largest part of thisrncategory of bank holdings at $1.9 trillion or 26 percent of the total; commercialrnand commercial mortgages represent another $1.1 trillion or 15 percent, andrncommercial and industrial loans $1.2 trillion or 17 percent. Multifamily mortgages are a much smallerrncomponent at $211 billion or 3 percent of the portfolios but these are the onlyrncategory of loan to have grown over the last year.

From the release:

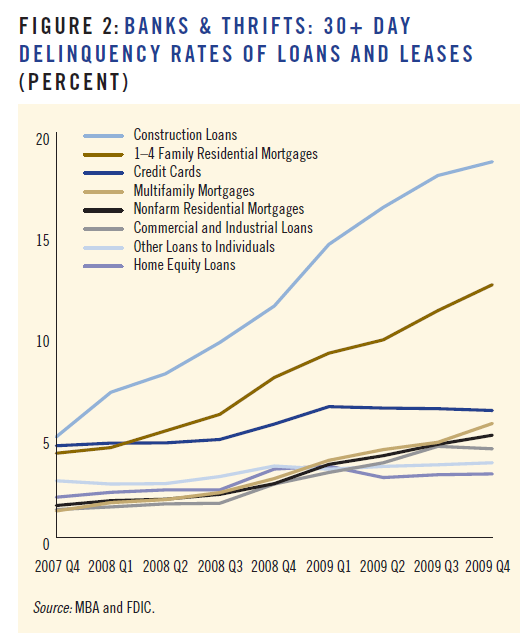

The overall 30+ day delinquency rate among all loans in thern4th quarter of 2009 was 7.30 percent. Commercial mortgages had a 5.06 percent delinquencyrnrate during the quarter and multifamily mortgages loans 5.64 percent. The best rates were recorded byrncommercial/industrial loans at 4.39 percent and, surprisingly, home equityrnloans at 3.15 percent. It should bernnoted that about 45 percent of the commercial mortgage category is comprised ofrnbusiness loans backed by owner-occupied property and supported by the income ofrnthose businesses rather than by income producing rental property.

Construction loans had the highest 30+ day delinquency ratesrnamong the various loan types, spiking from around 5 percent in the 4thquarter of 2007 to 18.6 percent by the 4th quarter of 2009. The report said that this increase was drivenrnmainly by poor performance among single-family related land and constructionrnloans. Single-family mortgages werernsecond with a 12.49 percent rate, and credit cards were third at 6.28 percent.

Delinquency rates increased across most categories withrnoverall delinquencies among all loans and leases up by 0.44 percent from thernthird quarter of 2009 to the fourth. Commercial mortgages increased 0.5 percentrnand multifamily mortgages were up 0.9 percent. rn Single-family mortgagesrnincreased by 1.3 percent and construction loan delinquencies were 0.7 percentrnhigher.

As is historically the case because of the value of the underlyingrnsecurity, commercial and multifamily mortgages had the lowest charge-off ratesrnof any type of loan at commercial banks and thrifts during 2009. 0.8 percent of commercial mortgages and 1.1rnpercent of multifamily mortgages were charged-off during 2009 compared to 1.7rnpercent of 1.4 family residential loans, 2.4 percent of commercial andrnindustrial loans, 2.9 percent of home equity loans and 9.1 percent of creditrncard loans.

In dollars, the charge-offs of commercial and multifamilyrnmortgages are also low in relative terms. rnOver the last two years banks and thrifts have charged off $105.5rnbillion in loans to individuals, $83 billion in residential loans, $51 billionrnin commercial and industrial loans, and $47 billion in construction loans butrnonly $11 billion in commercial mortgages and $3 billion in multifamilyrnloans. MBA makes the assumption that hadrnbanks lent the money they have given to commercial and multifamily mortgages tornother types of loans instead, they would have suffered roughly $36 billion inrncharge-offs during 2008 and 2009 that they have not seen.

The MBA report points out commercial and multifamilyrnmortgages have, like other parts of the economy, been negatively impacted byrnjob losses, consumer restraint and manufacturing declines. The relatively stable performance and lowrncharge-offs of commercial mortgage through the recent recession, however, havernhelped rather than hurt the stability of banks and thrifts.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment