Blog

Consumer Sentiment On Housing Improves Despite Broader Economic Concerns

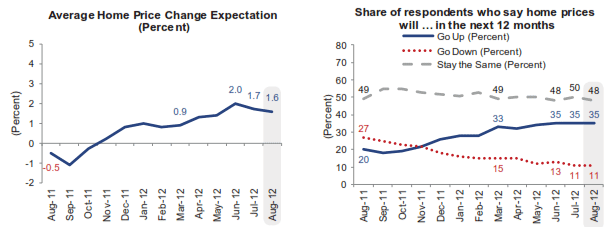

Consumer attitudes toward housing appearrnto have stabilized, largely unchanged over the last few months but at levels markedlyrnhigher than last year. Results from Fannie Mae’s National Housing Survey forrnAugust showed that thirty-five percent of survey respondents expect home pricesrnto rise over the next year, unchanged from June and July, but up from 20rnpercent in August 2011. </p

The percentage of those who expectrnfurther price declines was also unchanged from the two previous months at 11rnpercent while the percentage of respondents expecting prices to remain stagnantrnhas remained virtually unchanged, varying between 48 and 50 percent for thernlast 12 months. Among those expecting arnprice increase the average bump expected was 1.6 percent </p

</p

</p

Fannie Mae’s monthly survey involves arnrolling panel of 1,002 respondents representing homeowners with and withoutrnmortgages and renters. Panel members arernasked 100 questions via a live telephone interview about their attitudes towardrnowning and renting a home, mortgage rates, the economy, and their personalrnfinances.</p

Asked about the health of thernmarket, 73 percent of respondents felt it was a good time to buy a house, arnnumber that has remained flat for the last six months and is up only fourrnpoints from August 2011. However, whilernthe numbers are still small, the percentage of persons who felt it is a goodrntime to sell has doubled in the same period, climbing from 9 percent lastrnAugust to 18 percent in the recent survey.</p

</p

</p

More people think that the currentrnmortgage rates are too good to last. rnHigher rates within the next 12 months are now expected by 40 percent,rnup from 36 percent in July.</p

Expectations about rent increasesrnhave eased a bit with 44 percent expecting rents to rise compared to 47 percentrnin June. The percentage expecting rentsrnto decrease is still negligible but rose from 3 percent in July to 5 percent inrnAugust. The rent increase expectedrndecreased to 3.2 </p

</p

</p

The percentage of respondents whornsay they would buy if they were going to move increased slightly to 67 percent,rnwhile 28 percent would rent.</p

Consumerrnattitudes toward the housing market remain modestly positive, despite signs ofrnincreased concern over the direction of the economy,” said Doug Duncan, seniorrnvice president and chief economist of Fannie Mae. “While the latest resultsrnshowed a pickup in the share of consumers expecting mortgage rates to rise,rnreflecting the uptrend of long-term interest rates since mid-July, that mayrnsoon change. Friday’s disappointing jobs report underpins the gradual nature ofrnthis year’s housing recovery and supports our view that the muted economicrnrecovery is still subject to downside risk and that additional Fed easing willrnsoon be forthcoming.”</p

Optimism about housing did notrnextend to the nation’s economy or the respondent’s personal financialrnsituation. Respondents saying therneconomy is on the right track declined slightly to 33 percent and is down 5rnpoints from the May peak while the wrong track responses went from 58 percentrnto 60. Despite the waning optimism,rnwrong track responses were down 18 points from August 2011 and right track responsesrnhave doubled.</p

</p

</p

Questions about personal financesrnelicited slightly more positive responses since July with 15 percent sayingrnthey thought things would get worse over the next 12 months, a two point drop,rnwhile those who expected no change or improvement were both steady at slightlyrnover 40 percent.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment