Blog

CoreLogic: 1 in 53 Mortgages Foreclosed in 2012, 767K Total

CoreLogic presented more evidence todayrnthat the foreclosure epidemic in the U.S., while still a serious concern, isrnrapidly improving. There were 56,000rncompleted foreclosures in the U.S. in December compared to 71,000 in Decemberrn2011, a decrease of 21 percent and there were 2,000 fewer foreclosures inrnDecember than in November. As a point ofrnreference there were an average of 21,000 foreclosures completed each month inrnwhat might be considered a “normal” period from 2000 to 2006, CoreLogic said.</p

During 2012 there were 767,446 completed foreclosures orrnone in every 53 active mortgages in the country compared to 830,000 completed foreclosuresrnin 2011. Since the financial crisisrnbegan in September 2008 there have been approximately 4.1 million homes lost tornforeclosure.</p

</p

</p

The foreclosure inventory is alsorndeclining rapidly. This measure of thernnumber of homes in some stage of foreclosure declined 19.5 percent year overrnyear, from 1.5 million in December 2011 to 1.2 million. Month over month, the national foreclosurerninventory was down 4.2 percent and at the end of December represented 3 percentrnof all homes with a mortgage.</p

“The most encouragingrnforeclosure trend reported here is that the inventory of foreclosed propertiesrnis almost 20 percent smaller than a year ago,” said Mark Fleming, chiefrneconomist for CoreLogic. “This big improvement indicates we are workingrntoward resolving the backlog of the most distressed assets in the shadowrninventory.” </p

“The rate of foreclosuresrncontinues to trend down, albeit at a slower rate as we exit 2012,” saidrnAnand Nallathambi, president and CEO of CoreLogic. “This trend shouldrncontinue into 2013 and is another positive signal that the gradual healingrnprocess in the housing market is gaining traction.”</p

Five states accounted for almostrnhalf of all completed foreclosures in the country. Over the 12 months that ended in DecemberrnCalifornia had 100,000, Florida 98,000, Michigan 74,000, Texas 57,000 andrnGeorgia 49,000. </p

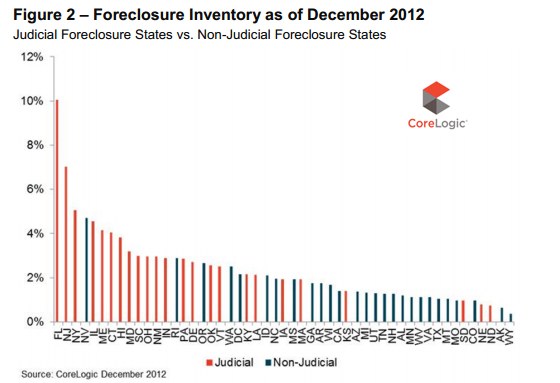

The five states with the highestrnforeclosure inventory as a percentage of all mortgaged homes were: Floridarn(10.1 percent), New Jersey (7.0 percent), New York (5.1 percent), Nevada (4.7rnpercent) and Illinois (4.5 percent).</p

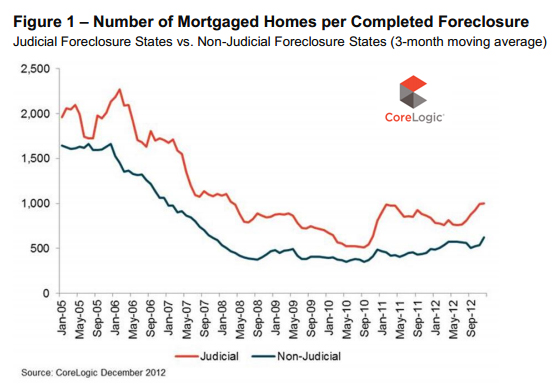

It is interesting to note that allrnof the top five states for completed foreclosures except Florida arernnon-judicial foreclosure states while all of the states with the largestrninventories except Nevada use primarily a judicial foreclosure process. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment