Blog

CoreLogic says Shadow Inventory "Persistent"

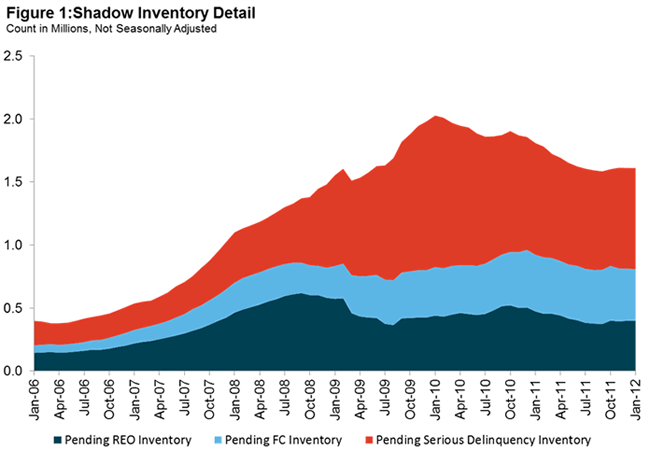

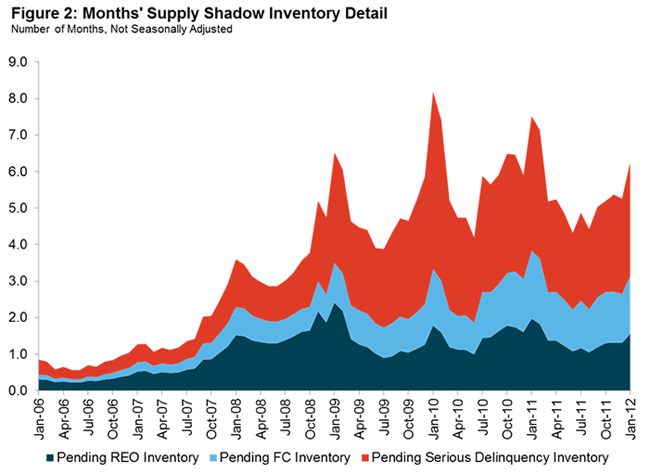

A report released this morning byrnCoreLogic shows that the shadow inventory, composed of homes that are either inrnbank owned real estate (REO), in the foreclosure process, or seriouslyrndelinquent, continues to be, as CoreLogic’s CEO Anand Nallathambi said, “persistent.” The residential shadow inventory as ofrnJanuary was virtually unchanged from the last CoreLogic report based on Octoberrndata, at 1.6 million units, a six month supply at the current sales rate.</p

CoreLogic estimates the currentrnstock of properties in the shadow inventory, also known as pending supply, byrncalculating the number of distressed properties not currently listed onrnmultiple listing services (MLSs) that are seriously delinquent, in foreclosurernand real estate owned (REO) by lenders. Transition rates of “delinquencyrnto foreclosure” and “foreclosure to REO” are used to identifyrnthe currently distressed non-listed properties most likely to become REOrnproperties. Properties that are not yet delinquent, but may become delinquentrnin the future, are not included in the estimate of the current shadowrninventory. Shadow inventory is typically not included in the official metricsrnof unsold inventory. </p

On a year-over-year basis the inventoryrnwas down from 1.8 million units or an 8-months’ supply in January of lastrnyear. At present the flow of newrnseriously delinquent (90+ days) mortgages into the shadow inventory is beingrnoffset by the roughly equal liquidation of properties through REO andrnpre-foreclosure sales.</p

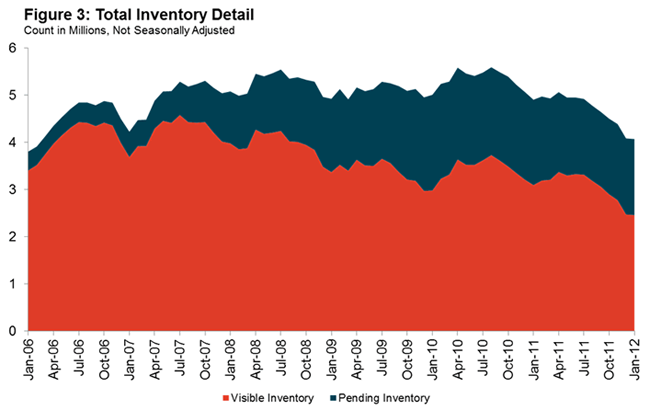

Based on current estimates of thernvisible inventory (both distressed and non-distressed), the 1.6 million unitsrnin the shadow inventory represent half of the 3 million properties that arerncurrently seriously delinquent, in foreclosure, or in REO. For every two homesrnavailable for sale, there is one home in the “shadows.” The shadow inventory includes 800,000 unitsrnthat are seriously delinquent (3.1-months’ supply), 410,000 that are in somernstage of foreclosure (1.6-months’ supply) and 400,000 are already in REOrn(1.6-months’ supply).</p

</p

</p

</p

</p

</p

</p

“Almost half of the shadowrninventory is not yet in the foreclosure process,” said Mark Fleming, chiefrneconomist for CoreLogic. “Shadow inventory also remains concentrated inrnstates impacted by sharp price declines and states with long foreclosurerntimelines.” Florida, California,rnand Illinois together account for more than one third of the shadowrninventory. Those states along with NewrnYork, Texas, and New Jersey account for one half. </p

“The shadow inventory remainsrnpersistent even though many other metrics of the housing market show signs ofrnimprovements.,” Nallathambi said. “Inrnsome hard-hit markets the demand for REO and distressed property is nowrnoutstripping supply. As we move into what is traditionally the peak sellingrnseason for real estate, servicers will certainly be watching closely to see ifrnnow is the time to move more inventory out of the shadows. </p

Even through there have been over 3rnmillion distressed home sales since January 2009, the shadow inventory inrnJanuary was at the same level as in January 2009, the period when home pricesrnwere falling the fastest.</p

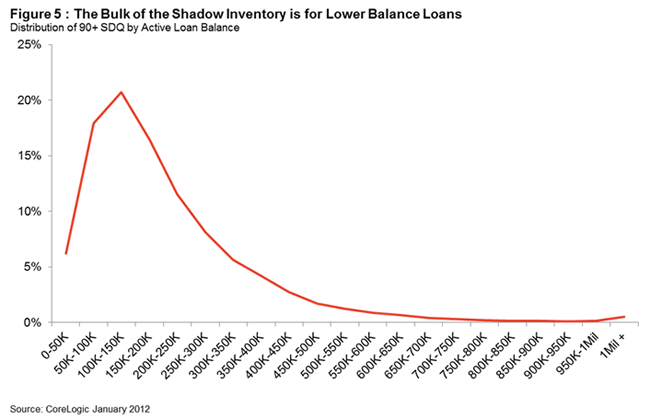

Loans with outstanding balancesrnbetween $100,000 and $125,000 represent the highest concentration in the shadowrninventory and the decline in the overall supply of homes versus one year ago isrnbeing driven by a decline in higher balance loans while the supply of loans withrnbalances under $75,000 is up three percent from January 2011</p

</p

</p

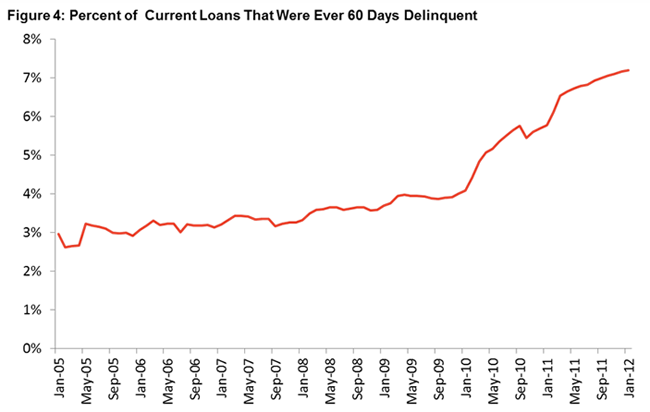

Of all mortgaged homeowners in therncountry, 15.5 percent have been over 60 days delinquent at some point in thernpast, up from 14.3 percent one year ago. rnThe percentage of borrowers who are current on their mortgages but havernbeen 60 or more days delinquent at some point was 7.2 percent in Januaryrncompared to 5.7 percent one year earlier. rn</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment