Blog

CoreLogic takes a Second Look at Condo Comeback

In July Sam Khater, anrneconomist at CoreLogic, wrote about the comeback of the condo market</band how construction of units had increased from post-recession lows while thernability of the market to absorb those new units had also improved. Much of this, Khater said, came from arnnormalization of prices in two ways. </p

First he pointed tornthe boom years when the median condo price was 37 percent higher than thernmedian price of a single family detached home. rnToday there is about a 1 percent difference. </p

There was also arnroller-coastering gulf between the prices of new and existing condos. New unitsrncommanded a 29 percent premium in the 2000 to 2003 but rising prices during thernhousing boom reduced that premium to 5 percent by 2005. Then came the crash and, while most prices plummetedrnnew condo prices did not and by late 2011 the premium had been pushed to 80rnpercent. Now rising prices again havernreduced it to 43 percent, but Khater says, “Givenrnmore recent improvements in the amenities and locations of new condos, it isrnreasonable to expect the new premium to be even higher than in prior “normal” times.”</p

From that analysis Khater concludedrnthe normalization of existing condo prices was a prelude to recovery in pricesrnfor new condos. Now he has writtenrnanother post in CoreLogic’s Insight blogrnin which he says that in order to understand what’s happening with condos nowrnand in months or years to come, we have to look at another aspect of the condorncomeback: sales, on their own and as a function of all home sales.</p

</p

</p

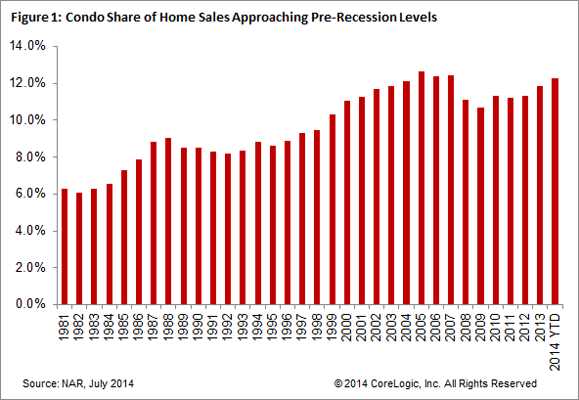

Despite the cyclical pattern ofrncondo sales during recessions, the rise in the share of home sales going torncondos has rising consistently for nearly 25 years, from 162,000 sales in 1981,rna 6.3 market share to 350,0900, a 9.2 percent share at the peak of that cyclernin 1988. As housing recovered from thern1991 recession condos were slow to come back but by 1997 sales reached 9.3rnpercent again. </p

During the mid-2000’s boom condosrnrose to a 12.7 percent share but shrunk even more than other sales, down torn10.7 percent of all sales in 2009 and then they moved sideways before pickingrnup steam again last year. This year itrnhas accounted for 12.3 percent of all home sales.</p

</p

</p

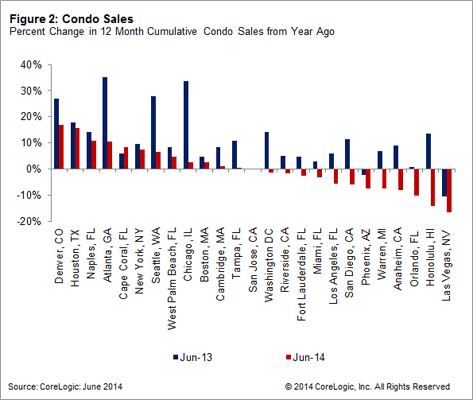

Khater points out that where condornsales get interesting is at the metro level. rnAs of June 2013, 22 of the 25 top markets had increases in condo salesrncompared to a year earlier. But thenrninterest rates rose and all housing sales cooled and only 14 of those samernmarkets showed year-over-year increases by June 2014. But looking at individual markets he foundrnthat cash sales had the largest impact on changes in sales. </p

This reveals a vulnerability inrncondo market recovery as the cash share of condo sales in the first half ofrn2014 was 53 percent and some markets are almost exclusively supported by cashrnsales. Three of the 25 markets had condorncash sales that exceeded 85 percent. Ifrnthere is a pullback in cash sales – which are mainly sales to investors – the condornmarket could be disproportionately hit.</p

On the other side of the coinrnhowever is an opportunity to increase sales. rnThe largest age cohort in the U.S. is currently 20 to 24 year olds, therngroup currently driving the rental market. rnOver the next 5 to 10 years they are likely to become first-timernhomebuyers, and turn that demand toward newly built condos. </p

Khater says that history can servernas a guide for understanding future market dynamics. Despite low levels ofrnunsold condo inventory, new condo production is currently running at roughly 10rnpercent of the pace during the late 1970s and early 1980s when baby boomersrnwere in their early 20s and roughly the same size population as the current agerncohort of 20- to 24-year-olds. Therefore, the lack of new condo production, inrnconjunction with large demographic demand on the horizon, provides the marketrnwith a large opportunity to expand new condo sales over the next decade.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment