Blog

Despite Season November was "Good Month" for Home Prices

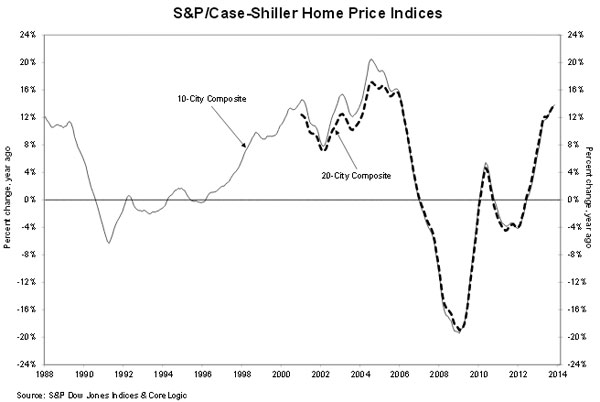

The S&P Case-Shiller CompositernIndices each posted month-over-month declines in November after nine straight monthsrnof growth. The 10-City and 20-CityrnIndices were both down 0.1 percent from October to November but year-over-yearrnthe 10-City was up 13.8 percent and the 20-City 13.7 percent.</p

Monthly results were mixed among the 20rncities with 9 posting increases, nine falling, most only slightly, and tworncities, San Diego and Minneapolis, unchanged. rnMiami had the best showing in November, up 1.2 percent and Las Vegasrnrose 0.4 percent. Dallas rose only 0.1rnpercent but still set a new index high. rnThe largest dip was in Chicago, down 1.2 percent while Charlotte fellrn0.6 percent.</p

David M. Blitzer, Chairman of S&PrnDow Jones Indices’ Index Committee said November was a good month for homernprices. “Despite the slight decline, thern10-City and 20-City Composites showed their best November performance sincern2004. Prices typically weaken as we moverncloser to the winter. Las Vegas, LosrnAngeles, and Phoenix stand out as they have posted 20 or more consecutivernmonthly gains.”</p

</p

</p

Blitzer said the steady rise inrnyear-over-year price increases began in June 2012 and continued, albeit at arnslower pace, in November. “Looking atrnthe year-over-year returns, the Sun Belt continues to push ahead with Atlanta,rnLas Vegas, Los Angeles, Miami, Phoenix, San Diego, San Francisco, and Tamparntaking eight of the top nine spots. rnDetroit continues to recover but remains the only city with prices belowrnits 2000 level.” </p

The prices increases continue, Blitzerrnsaid, despite the jump in mortgage rates last spring. Purchase mortgage applications have beenrnhigher in recent weeks, “confirming home builders’ optimism shown by the NAHBrnsurvey. Combined with low inflation…homernowners are enjoying real appreciation and rising equity values.” These gains, he said, are likely to slowrnduring the coming year.</p

</p

</p

Nine metro areas had larger annualrnreturns in November than in October. rnBoston increased its annual gain from 8.6 percent in October to 9.8;rnCleveland and New York were each up 1.1 percentage points to a 6.0 percentrnannual increase but remain the two lowest ranked among the 20 cities. The otherrnareas where annual gains increased from October to November were Chicago,rnDallas, Las Vegas, Miami, Tampa, and Washington.</p

The strongest annual returns in Novemberrnwere in Las Vegas (+27.3 percent), San Francisco (+23.2 percent), San Diegorn(18.7 percent) and Atlanta (+18.5 percent.) rnAfter New York and Cleveland the smallest increase was in Washington, DCrnat 7.8 percent.</p

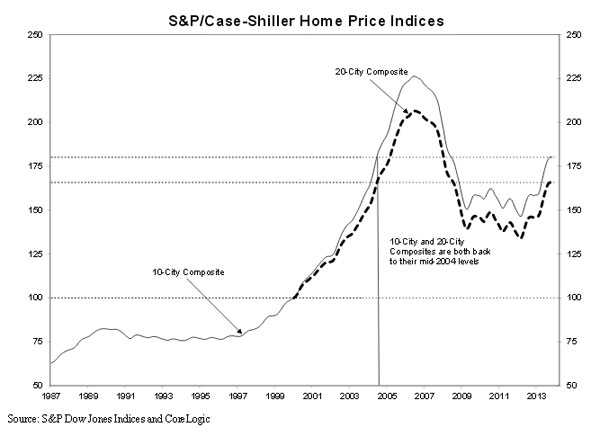

As of November average home pricesrnacross the country were back to levels of mid-2004. Both the 10-and 20-City Composites are nowrndown about 20 percent from their summer 2006 peaks and have recovered by 23.0 percentrnand 23.7 respectively from post-recession lows reached in March 2012.</p

The S&P/Case-Shiller Home PricernIndices are constructed to track the price path of typical single-family homesrnin each metropolitan area in the two indices. rnEach combines matched price pairs of thousands of houses from availablernarms-length sales data. The indices haverna base value of 100 in January 2000 so a current index value of 150 means a typicalrnhome has appreciated 50 percent since that date.</p

Rick Sharga, EVP at Auction.com, shared the following: “Today’s report is indicative of what we’ve been seeing over the last quarter: home price appreciation slowing down, although prices are at much higher levels than they were a year ago.

Much of the increase in home prices in 2013 was due to a rebound in the markets hit hardest during the downturn. And much of that rebound was due to the disappearance of the “foreclosure discount” – distressed properties at the low end of the market were in unusually high demand, often driven by investor activity, and had enormous price increases which skewed the overall numbers a bit. Many of the other published home price indices exclude distressed property sales, and showed lower home price appreciation than Case Shiller.

With less distressed inventory coming to market, and being less discounted when it does come to market, that factor will play much less of a role in 2014 home prices, which suggests that we shouldn’t see nearly as much appreciation this year as we did in 2013.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment