Blog

Distressed Inventory Dampens Builder Confidence

Therernare a lot of reasons why the nation’s homebuilders continue to feel skittish aboutrnthe housing market according to both the Chairman and Chief Economist of thernNational Association of Home Builders (NAHB.) rn</p

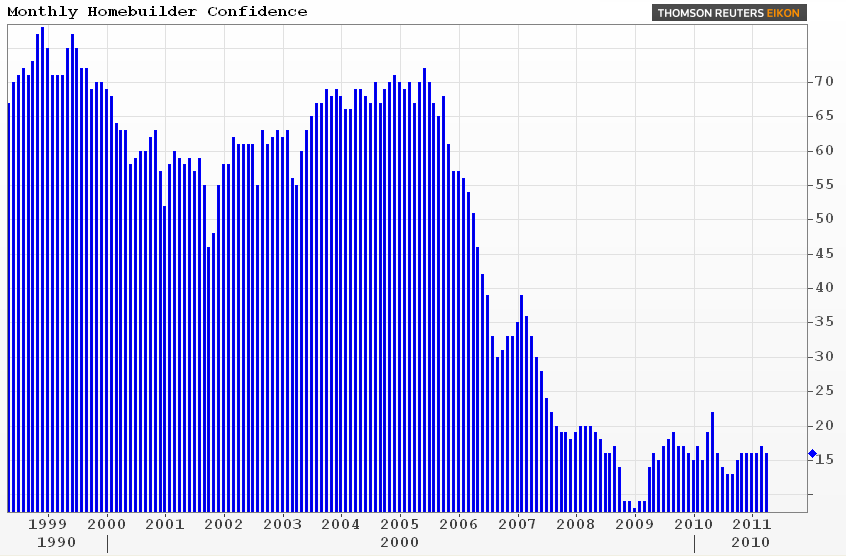

The two commented on the NAHB/Wells Fargo Housing Market Index (HMI) forrnApril which showed builder confidence for April has slipped back into itsrnprevious rut after improving slightly last month. The overall score was 16, downrnone point from the March figure. ThernIndex has registered a read of 16 in five of the last six months. </p

</p

</p

ChairmanrnBob Nielsen and Chief Economist David Crowe both cited the continued high levelrnof foreclosures and distressed properties on the market as factors in therndownturn and said builders also fear that recent legislative and regulatoryrnproposals could make it harder to get a mortgage. </p

Crowernsaid, “While pockets of improving activity are appearing in some markets, thernbest sales activity appears to be happening in the lower price ranges, wherernfirst-time buyers have greater flexibility than repeat buyers who must sellrntheir current home.” </p

The HMIrnis derived from a monthly survey that NAHB has been conducting for more than 20rnyears. Builders are asked to report onrntheir perceptions of current single-family home sales and sales expectationsrnfor the next six months as “good,” “fair” or “poor” and on current buyerrntraffic as “high to very high,” “average” or “low to very low.” Scores fromrneach component are then used to calculate a seasonally adjusted index where anyrnnumber over 50 indicates that more builders view sales conditions as good thanrnpoor. The HMI has not reached above 50 since late in 2006.</p

Each ofrnthe three questions is used to construct a component index. The sales outlook for the next six months fellrnthree points to 23, the lowest score since last October, while the currentrnsales component fell one point to 16. <bPerceptions of buyer traffic, however, improved and that index rose arnsingle point to 13. </p

“While builders in some areas are starting to see a pickup in traffic of prospective home buyers, many consumers remain skittish about the health of the housing market and overall economy, particularly in view of recent legislative and regulatory proposals that could make it much harder to get a mortgage,” noted NAHB Chairman Bob Nielsen, a home builder from Reno, Nevada. “At the same time, builders are competing against a large number of foreclosed and distressed properties on the market, which are holding down prices and appraisals and making it tough for potential clients to sell their existing homes.”</p

The news was a little better on a regional basis. Builders in the South were particularlyrnpessimistic; the overall index for that region dropped four points to 15. As thisrnis the region with the largest representation in the index it had a strongrninfluence on the national figure. Two ofrnthe regions, Northeast and Midwest each gained two points to 20 and 14rnrespectively. The West was unchanged at 17

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment