Blog

Existing Home Sales Up Across the Country in November

The National Association of Realtors today released Existing Home Sales data for November 2010</p

HERE is the methodology for the data collection</p

Excerpts from the release…</p

Existing-home sales got back on an upward path in November, resuming a growth trend since bottoming in July, according to the National Association of Realtors®.</p

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 5.6 percent to a seasonally adjusted annual rate of 4.68 million in November from 4.43 million in October, but are 27.9 percent below the cyclical peak of 6.49 million in November 2009, which was the initial deadline for the first-time buyer tax credit.</p

Single-family home sales rose 6.7 percent to a seasonally adjusted annual rate of 4.15 million in November from 3.89 million in October, but are 27.3 percent below a surge to a 5.71 million cyclical peak in November 2009.

Existing condominium and co-op sales declined 1.9 percent to a seasonally adjusted annual rate of 530,000 in November from 540,000 in October, andrn are 32.2 percent below the 782,000-unit tax credit rush one year ago.</p

</p

</p

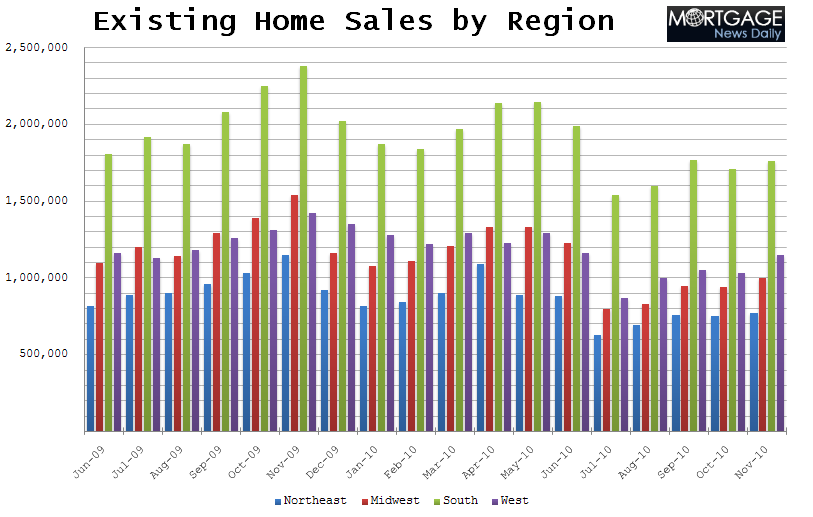

Regionally,rn existing-home sales in the Northeast rose 2.7 percent to an annual pacern of 770,000 in November but are 33.0 percent below the cyclical peak in November 2009. The median price in the Northeast was $242,500, which is 9.2 percent higher than a year ago.</p

Existing-home sales in the Midwest increased 6.4 percent in Novemberrn to a level of 1.00 million but are 35.1 percent below the year-ago surge. The median price in the Midwest was $138,900, down 1.1 percent from November 2009.

In the South, existing-home sales rose 2.9 percent to an annual pace of 1.76 million in November but are 26.1 percent below the tax credit surge in November 2009. The median price inrn the South was $148,000, down 2.6 percent from a year ago.

Existing-homern sales in the West jumped 11.7 percent to an annual level of 1.15 million in November but are 19.0 percent below the sales peak in November 2009. The median price in the West was $212,500, up 0.4 percentrn from a year ago.</p

</p

</p

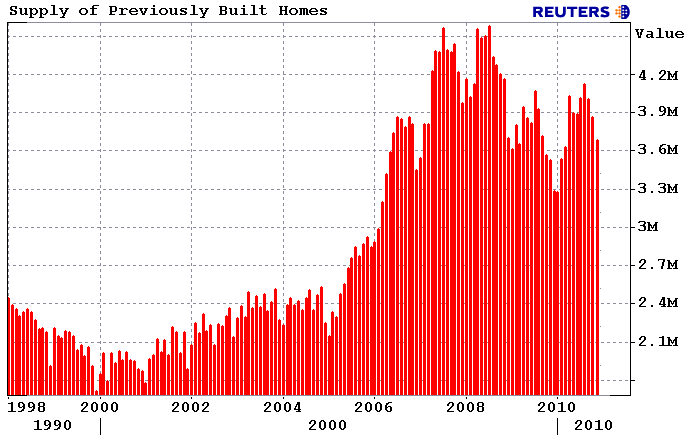

Total housing inventory at the end of November fell 4.0 percent to 3.71 million existing homes available for sale, which represents a 9.5-month supply at the current sales pace, down from a 10.5-month supply in October.</p

</p

</p

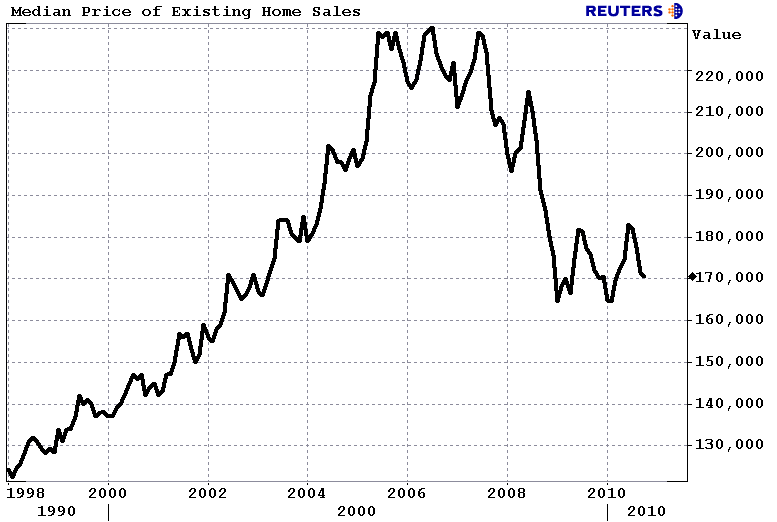

The national median existing-home price for all housing types was $170,600 in November, up 0.4 percent from November 2009. The median existing single-family home price was $171,300rn in November, which is 1.2 percent above a year ago. The median existing condo price was $165,300 in November, down 5.5 percent from November 2009. </p

“At the current stage of the housing cycle, condos are offering better deals for bargain hunters,” Yun said.</p

</p

</p

Distressed homes have been a fairly stable market share, accounting for 33 percentrn of sales in November; they were 34 percent in October and 33 percent inrn November 2009. Foreclosures, which accounted for two-thirds of the distressed sales share, sold at a median discount of 15 percent in November, while short sales were discounted 10 percent in comparison with traditional home sales.</p

A parallel NAR practitioner survey shows first-time buyers purchased 32 percent of homes in November, the same as in October, but are below a 51rn percent share in November 2009 from the surge to beat the initial deadline for the first-time buyer tax credit.</p

Investors accounted for 19 percent of transactions in November, also unchanged from October, but are up from 12 percent in November 2009; thern balance of sales were to repeat buyers. All-cash sales were at 31 percent in November, up from 29 percent in October and 19 percent a yearrn ago. “The elevated level of all-cash transactions continues to reflect tight credit market conditions,” Yun said.</p

Lawrence Yun, NAR chief economist, is hopeful for 2011. “Continuing gains in home sales are encouraging, and the positive impact of steady job creation will more than trump some negative impact from a modest rise in mortgage interest rates, which remain historically favorable,” he said.

Yun added that home buyers are responding to improved affordability conditions. “The relationship recently between mortgage interest rates, home prices and family income has been the most favorable on record for buying a home since we started measuring in 1970,” he said. “Therefore, the market is recovering and we should trend up to a healthy, sustainable level in 2011.”

“In the short term, mortgage interest rates should hover just above recent record lows, while home prices have generally stabilized following declines from 2007 through 2009,” Yun said. “Although mortgagern interest rates have ticked up in recent weeks, overall conditions remain extremely favorable for buyers who can obtain credit.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment