Blog

Fannie Economist Sees Rates Rising to Top of Range

Almost one year ago Mark Palim, FanniernMae’s Vice President of Applied Economic and Housing Research, analyzed what impact risingrnrates might have on the housing recovery. rnWhen he wrote about this for the company’s website last July, rates whichrnhad recently (in May) bottomed out at 3.35 percent had increased by 116 basis pointsrnto 4.51 percent. </p

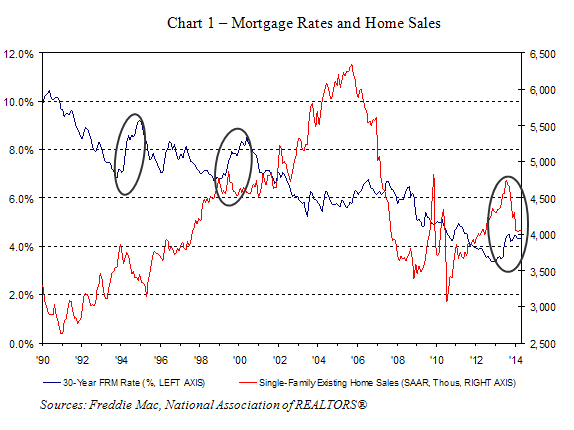

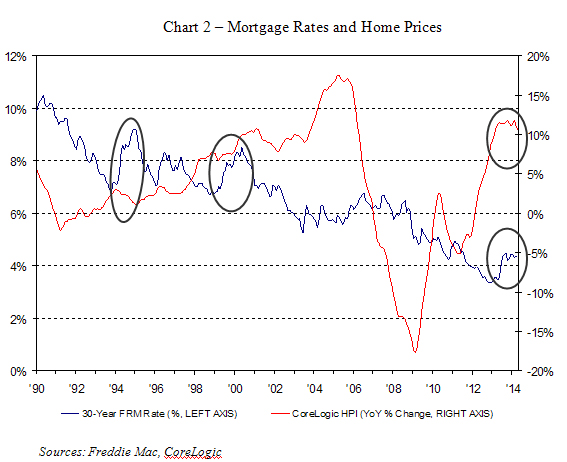

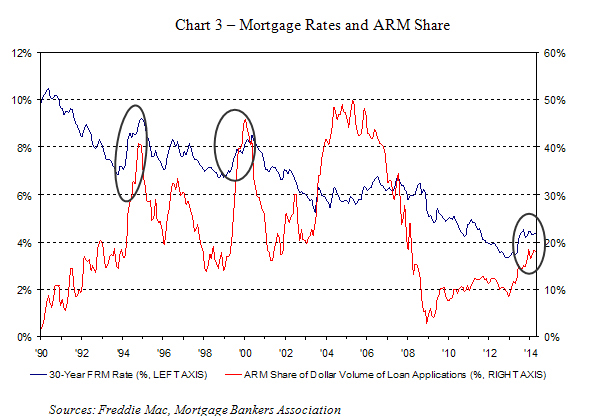

At that time Palim said there was no historical precedent for knowing the impact onrnthe housing market of an interest rate change, either up or down, because of arnFederal Reserve policy of quantitative easing but we could review the history ofrnlarge interest rate movements. He examined<btwo such periods since 1990; a 14-month period from Octoberrn1993 to December 1994, when mortgage rates increased by 237 basis points (fromrn6.83 percent to 9.20 percent) and a longer period with a smaller rate increase,rnOctober 1998 to May 2000, when rates increased by 180 basis points (from 6.71rnpercent to 8.51 percent). Palim concluded that that rate changesrndon’t have much impact on pries but do contribute to a decrease in homernpurchase volume and an increase in the use of adjustable rate mortgages (ARMs.) That latter change, he said, might be mutedrnthis time by the new Qualified Mortgage (QA) rule. </p

Rates continued to rise through that summer,rnreaching 4.57 percent in September. rnSince then they have oscillated in a relatively low range to a low ofrn4.10 percent and last week stood at 4.17 percent. This week the economist revisitedrnhis analysis in an article for Fannie Mae’s FMrnCommentary titled “Mortgage Rates and the Housing Recovery – A YearrnLater” to see what the impact has and will have on the housing market and ifrnhis July 2013 assessment was correct. </p

Home price and sales data through lastrnApril, he said, shows a general pattern consistent with history and hisrnexpectations in 2013; a sharp adjustment to higher mortgage rates tends tornprecipitate a reduction in the volume of sales rather than a decline in prices.rnChart 1 shows that rising rates (80 basis points from May 2013 to April 2014)rnwere met with a drop in existing single family homes sales of 7.7 percent. There has been an ever larger drop, 14.5rnpercent, from their recent high in July 2013 of 4.75 million units. </p

</p

</p

InrnApril 2013 home prices according to several national readings includingrnCase-Shiller and CoreLogic, were rising by double digits. Prices have continued to rise since then butrnthe annual appreciation is no longer accelerating. Chart 1 shows thernyear-over-year change in home prices in April 2014 was 10.5 percent havingrnpeaked at 11.9 percent in February 2014 (CoreLogic HPI). The continued strongrnappreciation in home prices occurred during a period when mortgage rates rosernby 80 basis points. </p

</p

</p

During recent earlier periods ofrnsharply rising interest rates, the ARM share of mortgage applications accordingrnto the Mortgage Bankers Association rose to over 40 percent by dollarrnvolume. This time, Palim says, the risernin the ARM share is nowhere near that. rnSince April 2013, the ARM share has risen from 11.2 percent to 18.0rnpercent in April 2014. “We believe thisrnis likely due to tighter underwriting standards for ARMs, including the impactrnof the Ability-To-Repay rules, and recognition by some borrowers that if theyrnopt for an ARM today, when their rate resets they are more likely to be payingrna higher rate when interest rates rise to levels more consistent withrnhistorical norms.”</p

</p

</p

Looking forward to the remainder ofrnthis year, Palim expects that mortgage rates will rise to the upper end of thernrange established over the past year as the economy recovers from what he callsrna soft patch during the first quarter of 2014. rnTight inventories and investor demand kept home prices rising well aheadrnof the growth in household income in 2013 but he expects that dynamic to wanernof the course of 2014. The FederalrnHousing Finance Agency (FHFA) purchase-only home index which forms part of thernFannie Mae Economic and Housing Outlook, forecasts an increase of about 5rnpercent in home prices in 2014 compared to a 7.6 percent gain in 2013. Palim said that home sales, despite thernrebound from recent lows earlier this year, will post a small decline, itsrnfirst in four year, compared to 2013.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment