Blog

Fannie Mae Economists Expect Housing Recovery to Continue

Fannie Mae’s economists arernpredicting continued slow growth in the second half of the year. The first half was marked by improvements inrnsome economic sectors offset by declines in others. The economists report said they continue tornsee “downside risks that outweigh possible upside surprises, as the economyrnlimps along.”</p

Weak growth in the second half ofrnthe year will be supported somewhat by consumer spending and, to a lesserrnextent, by business and residential investment. rnNegatives include federal, state, and local governments, trade declinesrnespecially in the Euro zone and China, a slowdown in manufacturing, andrnbusiness investment in equipment and software.</p

Consumer spending will remain thernprimary driver of economic growth with both nominal income and nominalrndisposable income increasing 0.3 percent while nominal spending rose 0.4 percentrnas did real consumer spending, the biggest increase in that category sincernFebruary.</p

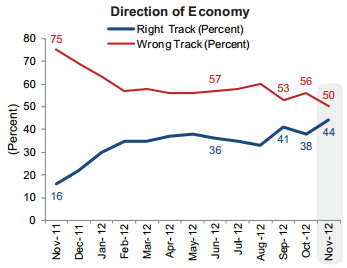

Despite the “challenging backdroprnof the overall economy” Fannie Mae’s economists expect the housing recovery tornpersist. According to the August FanniernMae National Housing Survey, consumer attitudes toward the housing marketrnremain positive. Even while the numberrnof respondents who said the economy was headed in the wrong direction increasedrnby 2.0 points to 60 percent, respondents who thought it was a good time to sellrna home reached the highest level in over two years. Thernsurvey also showed expectations for home prices over the next six months increasingrnfor the tenth consecutive month.</p

Housing activity has improvedrnsubstantially over the past year and housing supply and demand are now betterrnaligned. The inventories of both new andrnexisting homes have been trending down but remain someone elevated over what isrnconsidered to be normal levels. Thernsupply/demand equilibrium has been driven more by factors such as a drop in newrnhome supply because of the extraordinarily slow pace of homebuilding activityrndating back several years and a slowing of foreclosures because of increasedrnmodification efforts than by a pickup in demand.</p

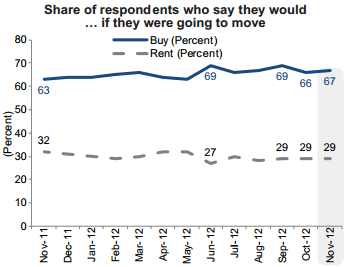

Increased construction activityrnhas been concentrated in the multifamily sector where construction comparesrnfavorably to that in previous recoveries. rnThis construction has been caused by increasing demand for rentalsrnbecause of credit tightening for mortgages, declining homeownership rates, andrnpersons moving out of homeownership because of economic problems. </p

</p

</p

Sales of both new and existingrnhomes increased in July and year-to-date new home sales in July were 22 percentrnhigher than a year earlier, the recent trough for such sales. Existing home sales have increased 9 percentrnon an annual basis, the best showing since 2007. </p

</p

</p

Single family homernstarts are running 20 percent higher than last year although there was a dip inrnJuly. Multi-family starts are up almostrn40 percent from the same period last year. rnStarts are projected to rise by 23 percent this year and as a result ofrnthis and increased home improvement spending residential investment contributedrnto the GDP during the first half of the year and is expected to continuernmodestly through the rest of 2012.</p

Home sales arernexpected to increase about 9 percent this year, consistent with predictions atrnthe beginning of the year. The increasernin home sales is modest especially given the low interest rates but the nextrnround of quantitative easily should allow mortgages rates to continue tornsupport the housing and mortgage markets for the rest of the year, especially inrnthe area of refinancing.</p

Mortgage originations</bare projected to rise to $1.58 trillion from an estimated $1.36 trillion lastrnyear with refinancing accounting for 69 percent of that total. Single family mortgage debt will decline byrnan additional 1.2 percent by the end of the year, the fifth consecutive drop.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment