Blog

Fannie Mae says Consumers Taking New Interest Rates in Stride

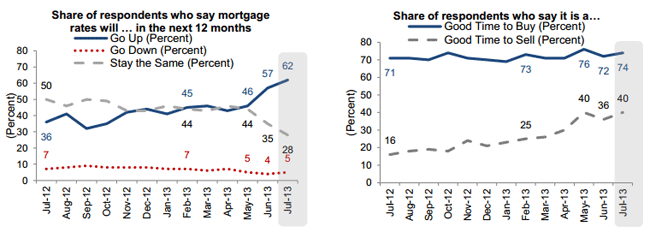

Consumers appear to take for grantedrnthat mortgage interest rates are going to rise. Only 5 percent ofrnrespondents to the July National Housing Survey expect rates torndecline over the next year while 62 percent now believe they willrnrise, an increase of 5 percentage points from June and the highestrnlevel in the survey’s three-year history. Nonetheless, 74 percent ofrnthose questioned in the Fannie Mae sponsored survey think it is arngood time to buy a house while those thinking it is a good time tornsell rose to 40 percent after dropping from that same survey highrnlevel in May to 36 percent in June.</p

</p

</p

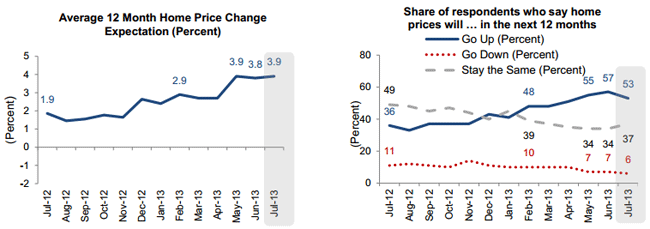

Fannie Mae said that overall consumerrnattitudes toward the housing market are increasingly positive. Consumers expect home prices to climb an average of 3.9 percent overrnthe next 12 months even though those expecting any increase fell byrn4 percentage points from the June survey high of 57 percent. Thosernexpecting a decline in prices set a new survey low at 6 percent.</p

</p

</p

“Consumers have taken the interest rate rise in stride.rnExpectations for continued improvement in housing persist, andrnsentiment toward the current buying and selling environment is backrnon track from its dip last month,” said Doug Duncan, senior vicernpresident and chief economist at Fannie Mae. “These results arernconsistent with our own analysis of previous housing cycles, whichrnfinds that interest rates and home prices are not stronglyrncorrelated.”</p

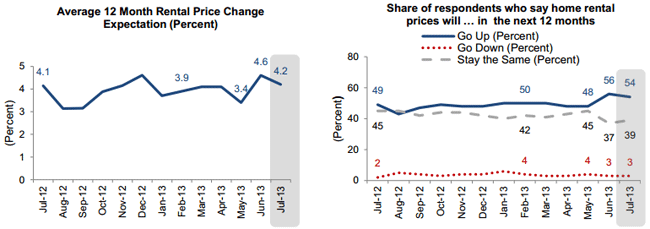

Respondents do expect some relief for renters. Fewer expect rentsrnto increase over the next 12 months, dropping from 56 percent in Junernto 54 percent, and the average rent increase anticipated fell to 4.21rnpercent from 4.6 percent. </p

</p

</p

Americans are slightly less upbeat aboutrnhome ownership, however. Only 45 percent feel it would be easy forrnthem to obtain a home mortgage, down 2 percentage points, and therernwas a slight decrease to 64 percent of those who indicated they wouldrnbuy if they were going to move.</p

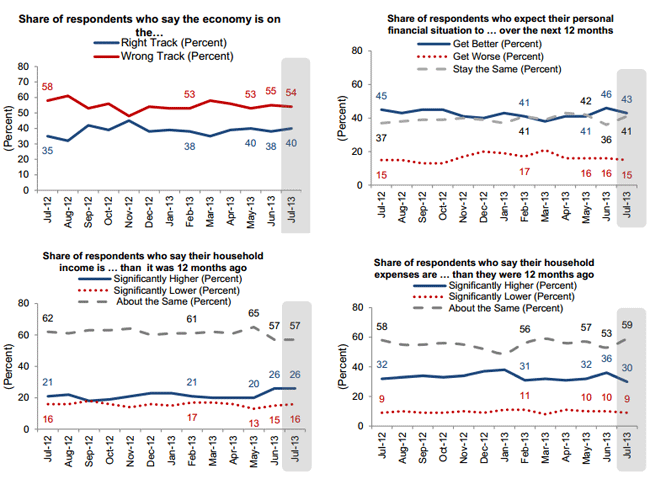

Three percent fewer people expect their personal financialrnsituation to improve over the next year but the percentage of thosernreporting significantly higher household expenses fell from 36rnpercent to 30 percent. </p

Fannie Mae’s survey is conducted monthly by phone with 1,000rnhomeowners and renters to assess their attitudes toward owning and/orrnrenting a home, the economy, personal finances, and overall consumerrnconfidence. The survey has been conducted monthly since June 2010rnand the most recent round of questions took place between July 1 andrnJuly 20. </p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment