Blog

Fannie Mae: Technology has Role to Fill in Mortgage Shopping Experience

A recent study by Fannie Mae found some distinct differences in the ways<bhigher income earners look for a mortgage compared to lower incomernearners. Steve Deggendorf,rnFannie Mae’s Director of Business Strategy looked at the shopping behaviors ofrnthe two groups through the company’s regular National Housing Survey during thernsecond quarter of 2013.</p

Deggendorf not only found distinct differences in the shoppingrnbehaviors of higher and lower income mortgage borrowers but also foundrnopportunities for online tools that could improve the ability of all borrowersrnto shop for a mortgage. Carefulrnshopping, he says, “could help mortgage borrowers obtain betterrnoutcomes, including lower costs, fewer surprises at the loan closing table, andrnhigher long-term satisfaction with their choices.”</p

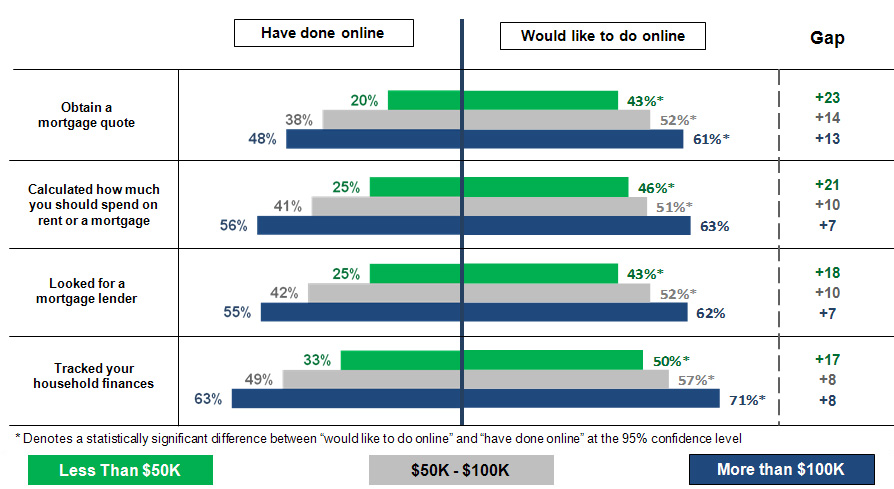

The study defined the two income groups as those with family incomes belowrn$50,000 and those above $100,000 and found that in general the higher incomernborrowers were more likely to rely on their own mortgage calculations and usernof tools to assess how and how much to borrow. rnThey were also more likely to pick a lender based on itsrncompetitiveness. The lower income grouprnwas more likely to rely on real estate agents, mortgage lenders, family, andrnfriends for advice and recommendations. In addition the higher income group more oftenrnsaid that a better ability to compare multiple loan offers would make shoppingrneasier while the lower income respondents wanted earlier to understand loan termsrnand costs.</p

The higher income group tended to use online shopping about twice as much asrnthe lower income group however all groups would like to increase their usagernindicating that the Internet will likely play a growing role for all borrowersrnand that there is a need for shopping enhancements.</p

</p

</p

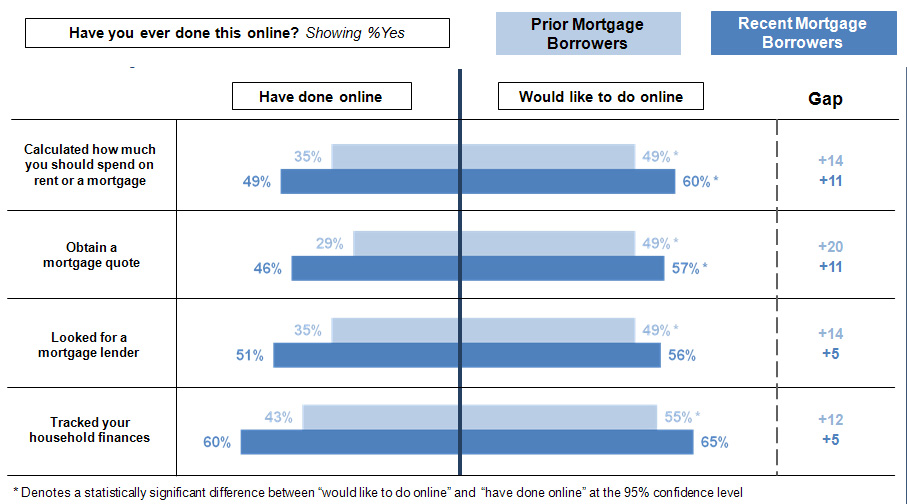

The study found that those who have obtained a mortgage in the last threernyears were more likely to have used technology in their mortgage shopping thanrnborrowers from an earlier period. Deggendorfrnsaid this could be partially explained by the growing use of on-line tools inrngeneral but also by recent borrowers having higher income and education levelsrnthan earlier ones. </p

</p

</p

Despite a general increase in the use of mobile technology (tablets andrnsmart phones) respondents said they tended to rely on their personal computers</bwhen shopping for financial products and were also likely to continue to dornso. Respondents also indicated that social mediarnwould probably continue to play a small role in mortgage shopping as isrncurrently the case.</p

Deggendorf says many researchers have observed that the use ofrnonline research and mobile tools enable consumers to obtain product reviews andrncompare prices both at home in in stores. rnHe says that only time will tell what inroads enhanced technology toolsrnallow us to make in improving outcomes for more complex activities such asrnmortgage shopping. They could, forrnexample, offer real-time information and education where and when needed suchrnas when house-hunting or sitting face-to-face with a lender. “Enhanced online tools,rnespecially given the aspiration to use them much more often in the future,rncould help consumers of all incomes to become better mortgage shoppers andrnachieve better outcomes by addressing the issues they think will make thernprocess easier, such as enhancing their understanding of mortgage terms and costsrnand their ability to make simultaneous comparisons of loan terms from multiplernlenders.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment