Blog

Fannie Mae's Losses Narrow but Treasury Advance Requested

Fannie Mae is reporting a net loss ofrn$2.4 billion for the fourth quarter of 2011 compared to a net loss of $5.1rnbillion in the third Quarter. For thernentire 2011 year it reports a net loss of $16.9 billion compared to $14.0rnbillion in 2010. </p

The fourth quarter losses reflect $5.5rnbillion in credit-related expenses, most of which are related to its pre-2009rnbook of business and due largely to a decline in home prices. The increase in net loss from 2010 to 2011rnwas attributed to a $6.1 billion increase in net fair value losses in 2011 duernto losses in the company’s risk management derivatives in 2011 caused by arnsignificant decline in interest rates. rnThese fair value losses were offset by fair value gains related tornmortgage investments, however only a portion of these investments is recordedrnat fair value in its financial statements.</p

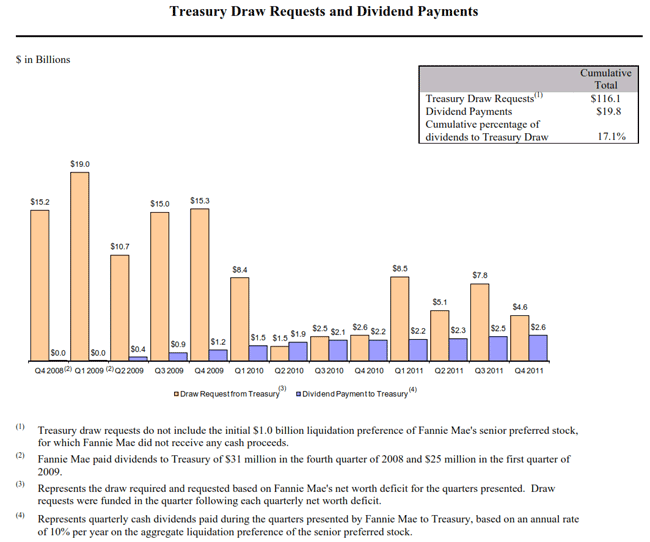

The net worth of the company had a netrndeficit of $4.6 billion as of December 31 reflecting the $1.9 billion loss andrnits payment to Treasury of $2.6 billion in senior preferred stock dividendsrnduring the fourth quarter compared to $2.5 billion in Quarter Three. The Federal Home Mortgage Finance Agencyrn(FNFA), conservator of Fannie Mae, will submit a request to the TreasuryrnDepartment for a draw of $4.57 billion to eliminate the net worth deficit. This brings the total obligation of therncompany to $117.1 billion which will require an annual dividend payment tornTreasury of 11.7 billion. To date therncompany has paid $19.8 in dividends to the Treasury Department.</p

</p

</p

Net revenues, primarily Net Interest Incomernfor the quarter was $4.53 billion compared to $5.48 billion in the thirdrnquarter and Net Losses and Expenses (including credit-related expenses) werern$6.92 billion, down from $10.56 billion. rnNet Losses in the two quarters were $2.41 billion and $5.09 billion and therntotal comprehensive losses were $1.9 billion and $5.28 billion for the thirdrnand fourth quarters respectively. </p

For the year net revenues were $20.44rnbillion compared to $17.49 billion in 2010. rnNet Losses and Expenses were -$37.39 billion compared to -$31.59 billionrnfor a Net Loss of -$16.86 billion, compared to -14.02 billion. Total Comprehensive loss for the year was -$16.41rnbillion compared to -$10.57 billion. Therncompany will have paid $9.61 billion in dividends to the Treasury in 2011rncompared to $7.70 billion in 2010.</p

Fannie Mae reports that 53 percent ofrnits single-family guaranty book of business at the end of the year consisted ofrnloans purchased or guaranteed since the beginning of 2009. Single-family conventional loans added to thernbook since that date have a weighted average loan-to-value at origination of 68rnpercent and a weighted average credit score of 762. </p

Single-family credit losses from 2009rnthrough 2011 combined with the amounts the company had reserved for losses asrnof this report total approximately $140 billion. By far the largest of these losses werernattributable to single-family loans purchased between 2005 and 2008. The company expects these losses will remainrnelevated because of further expected defaults in its legacy book of businessrnand resulting charge-offs that will occur over a period of years. Also, a significant portion of its reservesrnrepresent concession to borrowers when loans were modified and will remain inrnthe reserves until the loans are fully repaid or redefault.</p

The company’s single-family seriousrndelinquency rate has decreased each quarter since the first quarter of 2010,rnattributable both to its home retention solutions and to its acquisition ofrnloans with strong credit profiles. Therncompany expects that the delinquency rate will remain elevated due to homernprice changes, other macroeconomics changes, the length of the foreclosurernprocess and the extent to which borrowers with modified loans continue to makerntimely payments.</p

Fannie Mae acquired 47,256 single familyrnhomes through foreclosure in the fourth quarter compared to 45,194 in the thirdrnquarter. The company disposed of 51,344 REOrnproperties in the quarter, down from 58,297 in the third quarter. As of December 31, 1022 the company wasrnholding 118,528 REO properties compared with 122,616 at the end of Septemberrnand 162,489 on December 31, 2010. The carryingrnvalue of the single-family REO was $9.7 billion compared with $11.0 billion atrnthe end of the third quarter and $15.0 billion at the end of 2010.</p

The company’s single family foreclosurernrate in the third quarter for 1.13 percent annualized compared with 1.15 forrnthe first three quarters of the year and 1.46 percent for 2010.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment