Blog

February was Strong Month for Remodeling Permits

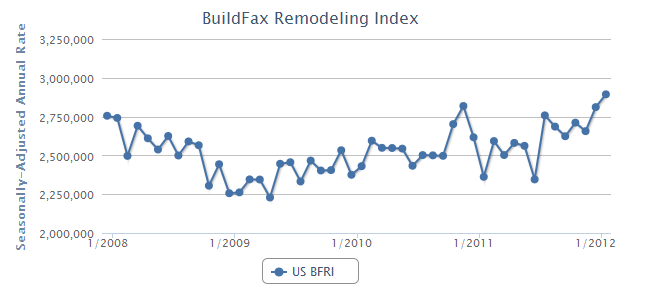

As has been indicated in reports from the Joint Center on Housing and the National Association of Home Builders, home remodeling is emerging as a bright spot in the home construction industry. Now another source is indicating that the increase in home improvement projects is national in scope.</p

The BuildFax Remodeling Index(BFRI) reports that building permits for residential remodeling were authorized in February at a seasonally-adjusted annual rate of 2,894,000, an increase of 3 percent from the revised January rate of 2,811,000 and 23 percent higher than in February 2011 when the annual rate was 2,362,000.</p

These upbeat numbers are reflected in every region of the country. In the Northeast permits were up 24 percent from January to an annual rate of 627,000, 33 percent above the pace a year earlier. Permits in the South, issued at a rate of 1,194,000 reflected an increase of 3 percent month-over-month and a 25 percent increase from February 2011. The Midwest saw permits issued at an annual rate of 516,000, up 4 percent and 22 percent over the two earlier periods and in the West the increases were 9 percent and 21 percent for an annual rate of 830,000.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment