Blog

Fed Report Shows Decrease in Household Debt and Delinquencies

There is good news about Americans and their debt in a quarterly report issued by thernFederal Reserve Bank of New York's Consumer Credit Panel; keeping in mind, ofrncourse, that everything is relative. Forrnexample, aggregate consumer debt and household delinquency rates, while stillrnin abysmal territory, both declined during the second quarter of 2010. </p

The report usesrndetailed Equifax credit report data to construct a longitudinal quarterly panelrnof individuals and households covering the period 1999 to 2009. The panel is a nationally representative 5rnpercent sample of individuals with social security numbers and an Equifax creditrnhistory. The survey includes allrnindividuals sharing the panel members' address, allowing the survey designersrnto construct household-level debt for a representative sample of US households. The database that results from the survey'srndesign includes approximately 40 million individuals each quarter. To reduce costs, a further 2 percent sample isrntaken for analysis resulting in a final sample of 240,000 individuals. </p

The study distinguishesrndebt across the following types of accounts: rnmortgage accounts (including home equity installment loans (HEL)), homernequity revolving accounts (HELOCs), auto loans, credit cards, student loans,rnand other loan accounts including consumer finance, retail stores and gasrnstation accounts.</p

As of June 30,rnAmerican consumers owed $11.7 trillion, down 1.5 percent from the previousrnquarter and 6.5 percent below the peak level for consumer debt ($12.5 trillion)rnat the end of the third quarter of 2008. This downward trend has now continued forrnseven quarters. </p

Mortgage indebtednessrnhas declined 6.4 percent since its peak, also in Q3 of 2008. HELOCs were down 4.4 percent since peaking inrnlate 2008 and early 2009. Consumer indebtednessrnexclusive of mortgage and HELOC accounts was down 1.5 percent from the previousrnquarter and now totals $2.31 trillion, a decrease of 8.4 percent from thern2008Q3 peak.</p

</p

</p

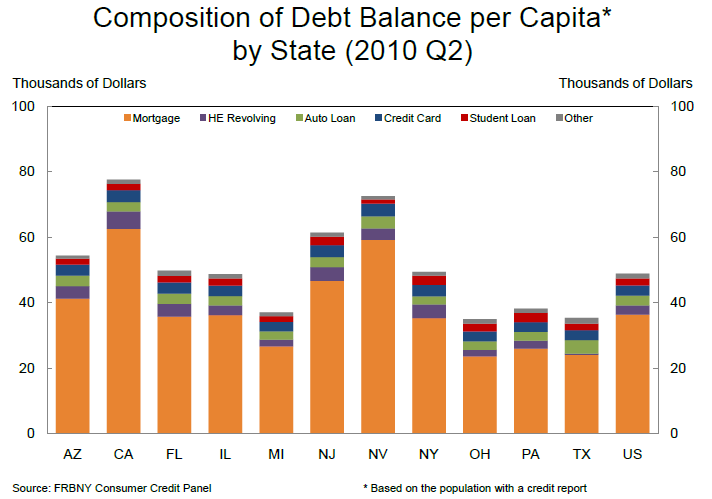

On a state-by-state basis,rnthe highest per capita debt load is in California followed by Nevada, and NewrnJersey. Those three states also lead thernnation in the highest mortgage debt loads and highest rate of delinquentrnconsumer debt.</p

</p

</p

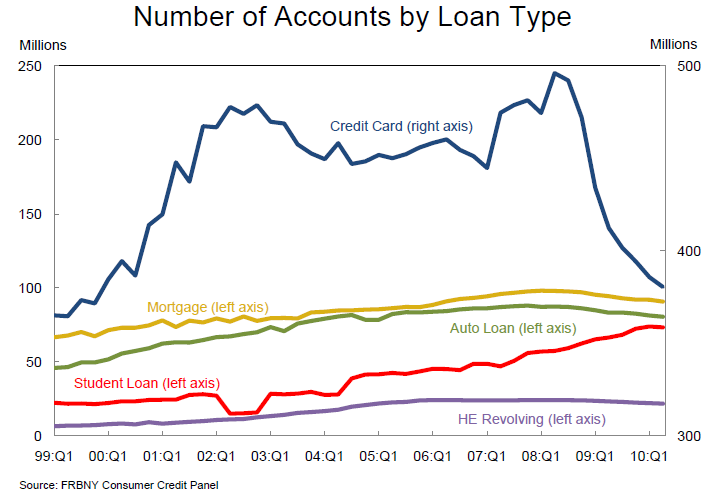

Approximately 272rnmillion credit accounts were closed over the four quarters ending June 30 andrn161 million accounts were opened. Creditrncards have accounted for most of the net reduction in accounts over the pastrntwo years and fell 4 million to 381 million open accounts during the secondrnquarter. The number of credit cardrnaccounts has dropped steadily since reaching a peak of nearly 500 million openrnaccounts in mid-2008. The increase in creditrninquiries in the first half of 2010, however, indicates that demand for creditrnmay be ticking up.</p

</p

</p

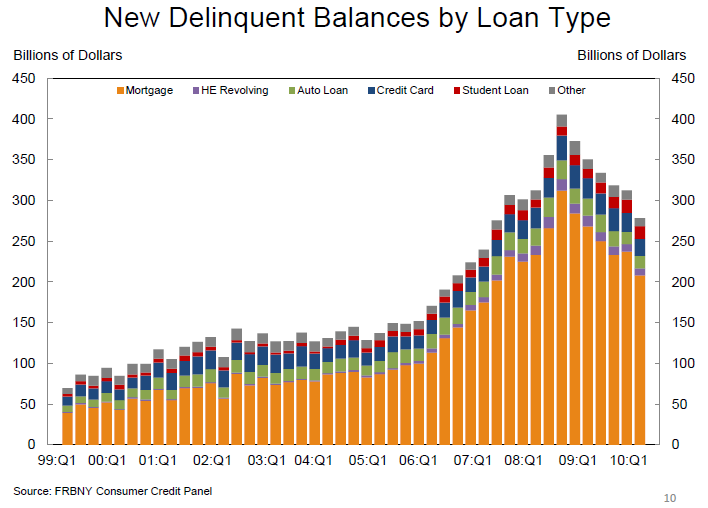

Household delinquenciesrndeclined during the quarter for the first time since early 2006. At the end of the quarter 11.4 percent ofrnoutstanding debt was in some stage of delinquency, down from 11.9 percent atrnthe end of the first quarter. Currentlyrnabout $1.3 trillion of consumer debt is delinquent and $986 billion is at leastrn90 days in arrears. Delinquent balancesrnare 2.9 percent lower than one year ago, but serious delinquencies havernincreased 3.1 percent.</p

</p

</p

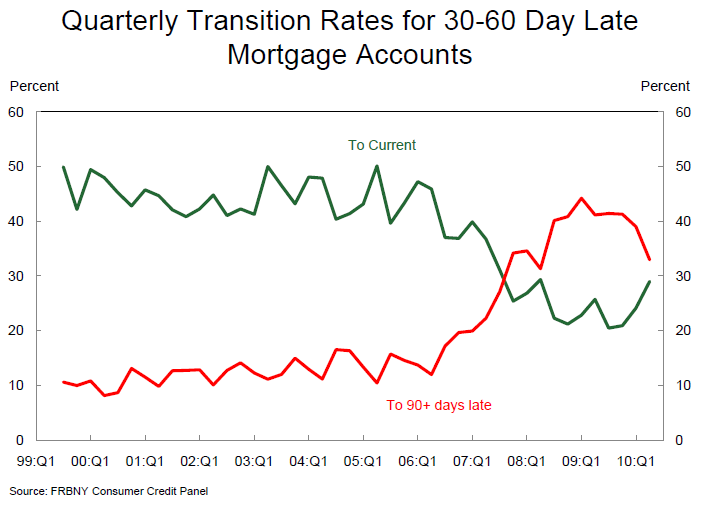

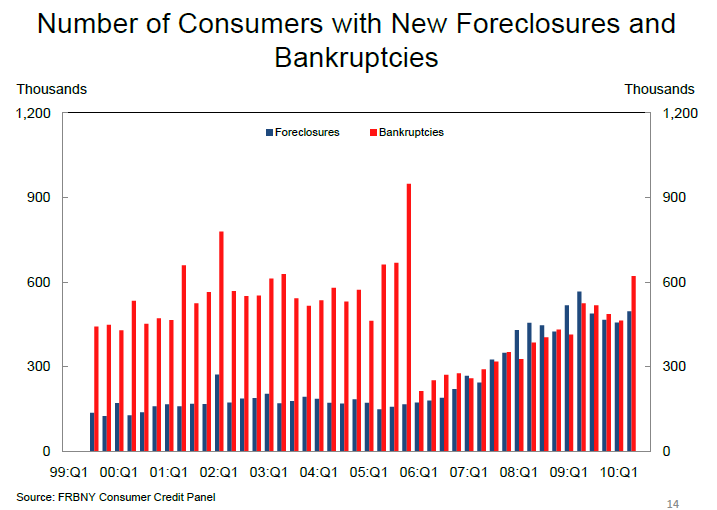

About 496,000rnindividuals had a foreclosure notation added to their credit report during thernquarter, up 8.7 percent from Quarter One and about 2.6 percent of mortgages thatrnwere current at the beginning of the quarter were no longer so at the end. Better news was that the number of earlyrndelinquencies that transitioned into serious status improved sharply, from 39rnpercent to 33 percent and the cure rate – transitions from delinquent torncurrent – rose to nearly 30 percent. rnBoth standards, however, remain at what the report termedrn”unfavorable levels by pre-crisis standards.” </p

</p

</p

Bankruptcy filings duringrnthe quarter, reached 621,000. This isrnthe highest rate for filings since the Bankruptcy Reform Act of 2005 went intorneffect. The report states that there isrntypically an increase in filings between the first and second quarter each yearrnbut usually in the vicinity of 20 percent rather than the 34 percent first-to-secondrnquarter increase this year. </p

</p

</p

Mortgagernoriginations fell 4.1 percent to $364 billion but were still over 20 percentrnabove the low reached at the end of 2008. rnMortgages are being originated at less than half the average rate in thern2003-2007 period.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment