Blog

FEEDBACK NEEDED: Simplifying Mortgage Disclosures

Transparency is critical and today much of the paperwork associated with a mortgage is far too confusing. </p

Recent government regulations have made credit products, especially mortgages, even more opaque with mandated disclosures in obscure legal language produced in small type. As a result, an extra burden has been imposed on lenders while providing no additional benefit to consumers. </p

Elizabeth Warren, Special Advisor to the Secretary of the Treasury for the Consumer Financial Protection Bureau, told a House subcommittee on March 17th that, “A simple, straightforward and consistent presentation of a credit agreement is the best way to level the playing field between consumers and lenders – and among different types of lenders – and foster honest competition.” </p

So on May 18th, the Consumer Financial Protection Bureau (CFPB) put pen to paper and released their first attempt at simplifying home loan disclosures by combining the Good Faith Estimate and Truth in Lending statement. </p

The industry responded with more than 13,000 comments. Now the CFPB has offered an even newer version. And they want more feedback. </p

A few words from the CFPB…</p

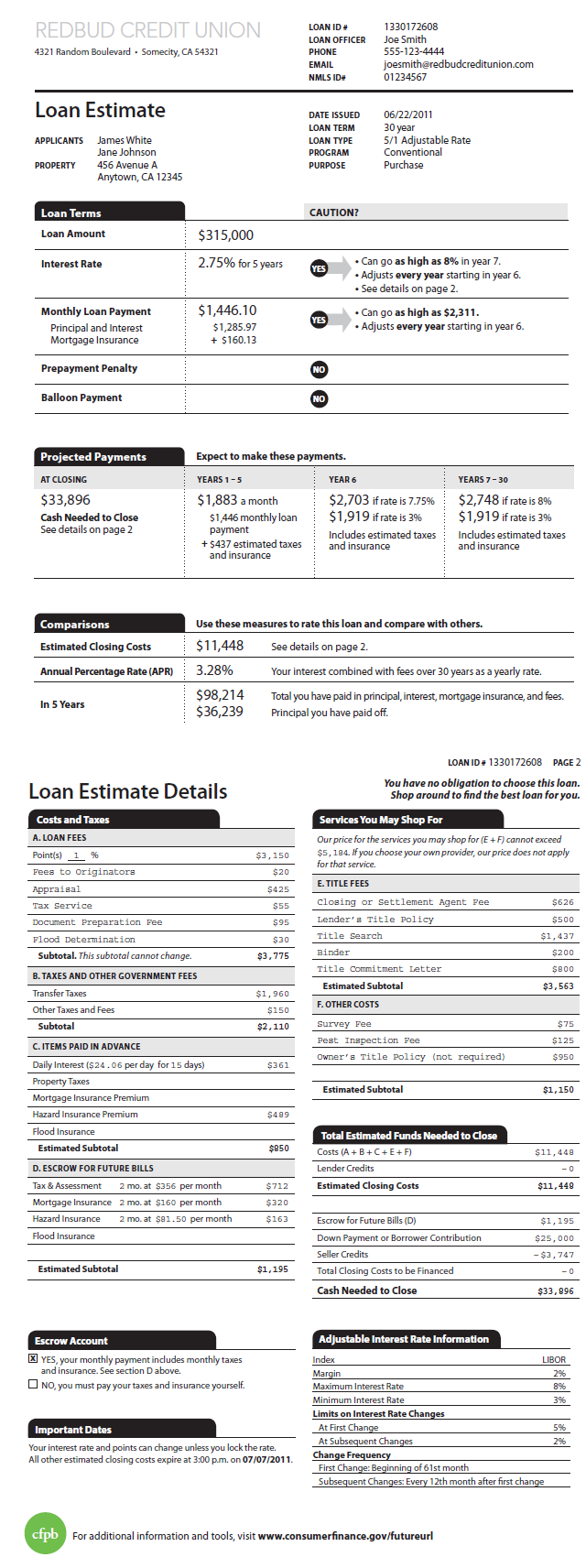

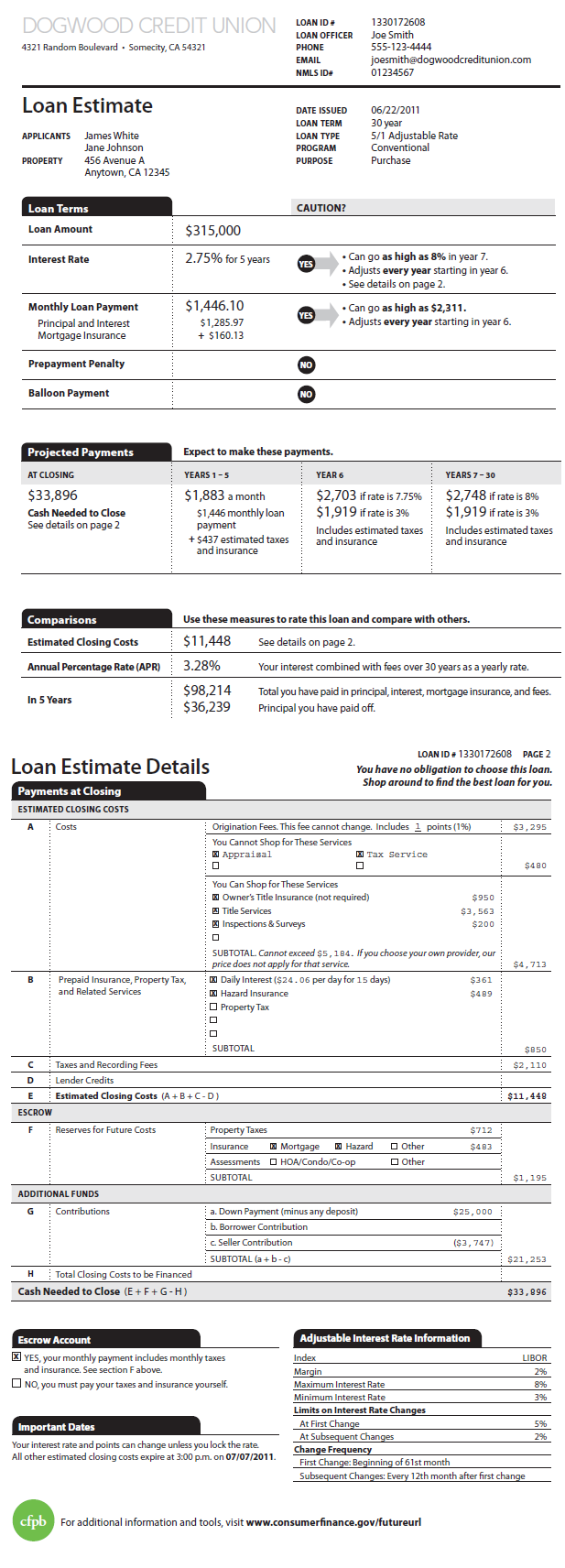

Below are the latest disclosure forms for the same loan product, which come to us from the (fictitious, of course) Redbud Credit Union and Dogwood Credit Union …</p<ul

Just like last time, here are a few questions we’d like you to keep in mind as you review:</p<ul

In the first round, the back page was the same on both versions. The front page – the “shopping sheet” – was different. This time, the first page is the same on both versions, and the focus is on the back page, which deals with closing costs: how well do these new drafts communicatern that information? Which format would you prefer to have your customer use to compare your loan with another?</p

OPTION 1</p

</p

</p

OPTION2</p

</p

</p

WHAT VERSION DO YOU LIKE MORE? <—-SHARE YOUR FEEDBACK WITH THE CFPB</p

This round is open for feedback until Tuesday, July 5th, at 7pm Eastern time. </p

PS. Dare I say the CFPB is using common sense to communicate with the industry and consumers? I think that’s what’s happening here….

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment