Blog

FHA Loan Problems Mounted in April as Foreclosure Starts Soar 73%

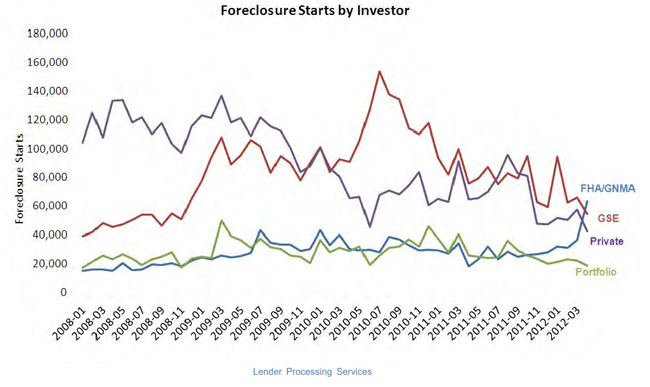

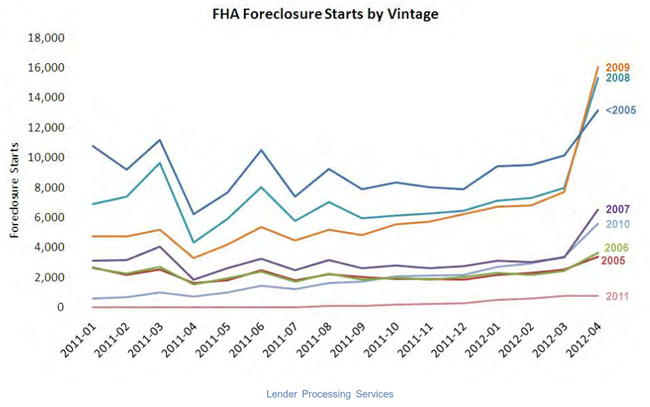

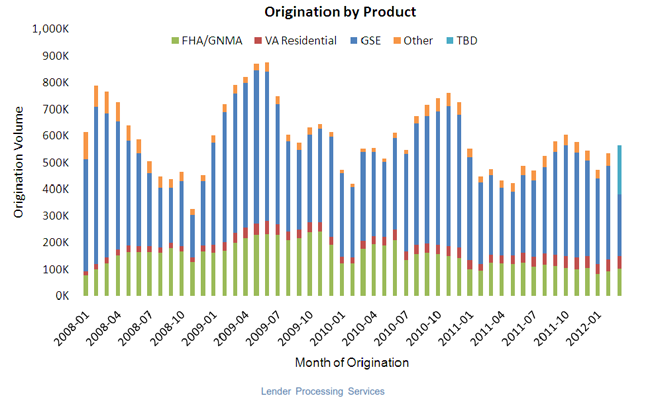

The performance of FHA loans dominates the April Mortgage Monitor report released Thursday by Lender Processing Services (LPS). While GSE and private loans saw significant drops in foreclosure starts and portfolio loans trended down slightly, foreclosure starts for FHA loans soared, jumping 73 percent in April. While all 2005+ vintages of FHA loans had increased numbers of starts, the increases for loans originated in 2008 and 2009 were dramatic.</p

</p

</p

</p

</p

“In 2008, when the loan origination market virtually dried up, the FHA stepped in to fill the void,” explained Herb Blecher, senior vice president for LPS Applied Analytics. “FHA originations tripled that year, and increased to five times historical averages in 2009. High volumes like that, even with low default rates, can produce larger numbers of foreclosure starts. That represents a lot of loans to work through – the 2008 vintage alone represents some $14 billion of unpaid balances in foreclosure, and the overall FHA foreclosure inventory continues to rise.”</p

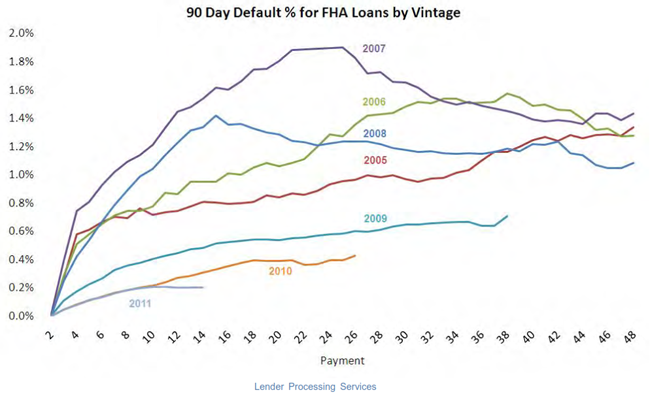

Despite the increase in every vintage, loans originated for FHA after 2009 are performing distinctly better. At the two year mark the delinquency rate for the 2010 vintage is 0.4 percent compared to 1.3 percent for loans originated in 2006 and 1.8 percent for the Class of 2007. </p

</p

</p

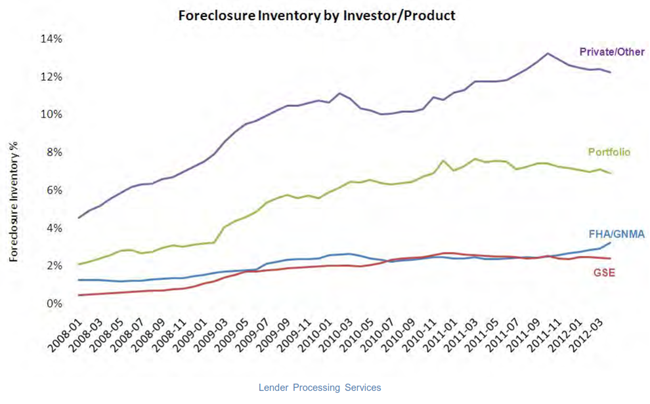

Nationally there were 181,584 foreclosure starts recorded during April compared to 186,446 in March and 187,323 one year earlier. The national pre-foreclosure sale rate (foreclosure inventory) was 4.14 percent, exactly the same as in March and in April 2011. There is still a tremendous difference between the inventory in non-judicial states (2.46 percent) and that in judicial states (6.50 percent.) The inventory for GSE, private, and portfolio loans decreased slightly during the month but those improvements were offset by a sharp jump in the FHA foreclosure inventory driven in turn by the jump in foreclosure starts.

</p

</p

Foreclosure sales continue to decrease, down 2.6 percent from March. Sales were down 2.0 percent in non-judicial states while those in judicial states were largely unchanged. Even those states that saw increases in foreclosure sales saw only incremental increases in terms of real numbers, and all were still far below pre-moratoria levels.</p

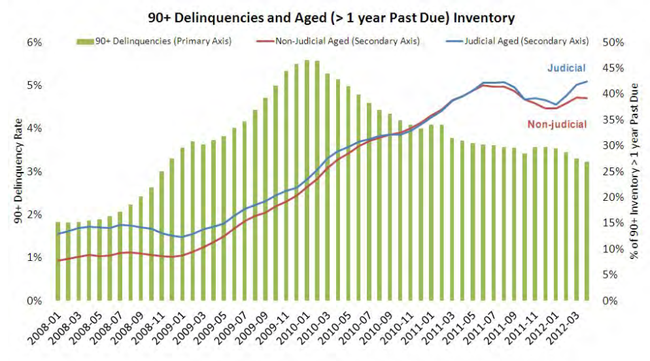

The delinquency rate in April was 7.12 percent, up slightly from 7.09 in March but well below the 7.97 percent rate a year earlier. The rate of seriously delinquent loans and loans in foreclosure decreased to 7.37 percent from 7.44 percent. In April 2011 the rate was 7.86 percent. This decrease masks the fact that the age of the delinquent loan inventory continues to increase.</p

</p

</p

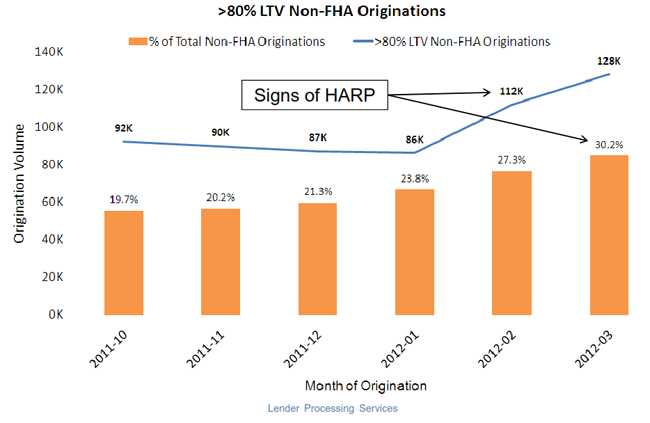

On the loan origination front, LPS reported that activity was up for the second straight month and was the highest in four months. Non-FHA originations rose from 27.3 percent of originations in March to 30.2 percent in April and the volume of non-FHA loans with loan-to-value ratios higher than 80 percent increased from 112,000 in March to 128,000 in April. Both increases were noted by LPS as “signs of HARP.” </p

</p

</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment