Blog

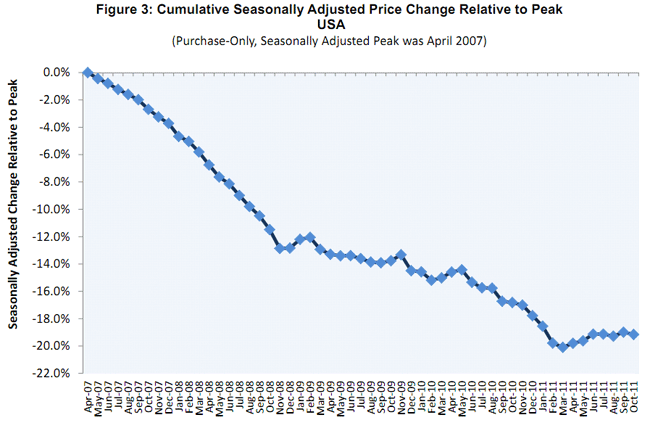

FHFA: Home Prices Down 20% From Peak of Housing Boom

The value of U.S. residential unitsrncontinued to decline in October and is now down almost 20 percent from thernlevels reached at the peak of the housing boom according to the monthly HousingrnPrice Index released Thursday by the Federal Housing Finance Agency (FHFA). Home values in October were down 2.8 percent comparedrnto prices in October 2010.</p

</p

</p

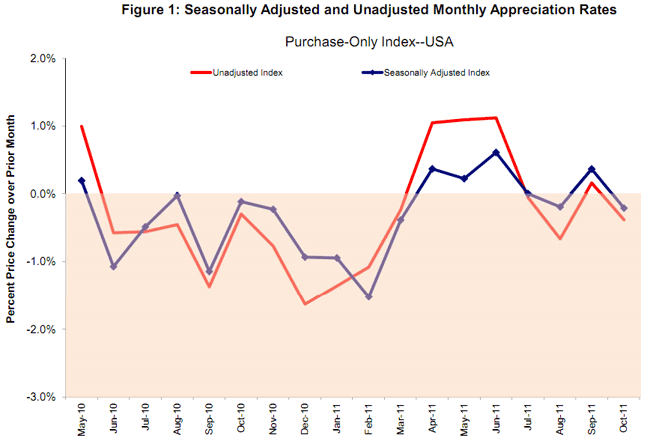

Last month FHFA reported that September’srnprices reflected an annual increase of 0.9 percent, but today’s report revisedrnthat figure downward to 0.4 percent. Seasonally adjusted prices in October wererndown an additional 0.2 percent from the revised September figures.</p

</p

</p

The FHFA monthly index is a weightedrnindex measuring price changes in repeat sales of the same properties purchasedrnwith mortgages sold to or guaranteed by Fannie Mae or Freddie Mac. As additional mortgages are acquired by therngovernment sponsored enterprises they are used to identify repeat transactionsrndating back to 1975.</p

For the nine census divisions thernseasonally adjusted monthly price changes from September to October ranged fromrn-1.0 percent in New England to +2.0 percent in the East South Central division.</p

The October changes bring prices in thernU.S. back to the level that existed in February 2004.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment