Blog

FHFA Reports Home Prices Increase 1.4% in Q4 on Low Inventories

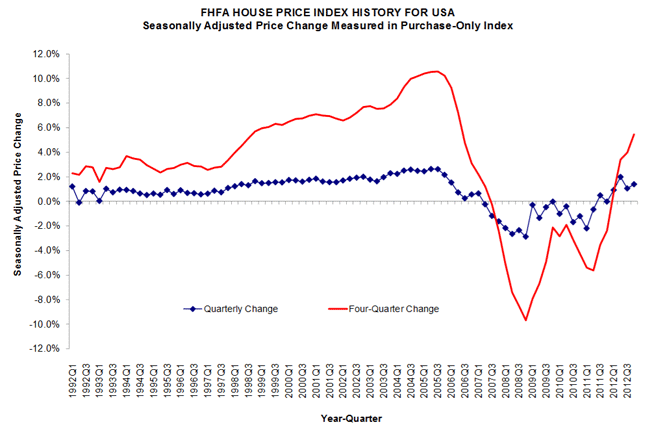

U.S. home prices were up 1.4 percent inrnthe fourth quarter of 2012 compared to the third quarter the Federal HousingrnFinance Agency (FHFA) said today. FHFA’srnseasonally adjusted purchase-only house price index (HPI) rose 5.5 percent on arnseasonally adjusted basis compared to the same quarter in 2011 and was up 0.6rnfrom November to December.</p

The cost of other goods and servicesrnrose 1.7 percent in 2012, so the purchase prices of homes in the HPI measurernwere up at triple that rate. Whenrnadjusted for inflation, the annual increase in home prices in 2012 was 3.7rnpercent. </p

The HPI rose in December in seven of thernnine census divisions. The SouthrnAtlantic division showed no change from November and the Middle Atlantic divisionrnwas down 0.1 percent. On an annual basisrnthere were increases in every division. rnThe Mountain and Pacific divisions made the strongest improvements with increasesrnof 14.7 percent and 12.6 percent respectively. rnThe seasonally adjusted HPI rose in the fourth quarter in 38 states andrnthe District of Columbia. </p

</p

</p

“The fourth quarter was another strongrnone for house prices, as it was the third consecutive quarter where U.S. pricerngrowth exceeded one percent,” FHFA Principal Economist Andrew Leventis said. “While a significant number of homes remainedrnin the foreclosure pipeline, the actual number of homes available for sale wasrnvery low and fell over the course of the quarter.”</p

FHFA noted that there is a recent gaprnbetween the home price appreciation reflected in the purchase-only index andrnthe all-transactions metric. The latterrnindex incorporates appraisals from refinancing and has shown very modest growthrnrelative to the purchase only index. rnFHFA is analyzing this discrepancy.</p

FHFA’s purchase only HPI is based onrnprice changes in repeat sales on the same single-family properties. More than 6 million repeat sales transactionsrnare covered in the index based on data obtained from Fannie Mae and Freddie Macrnmortgages originated over the past 38 years.</p

In a separate release FHFArnreported that the National Average Contract Mortgage Rate for the Purchase ofrnPreviously Occupied Homes by Combined Lenders was 3.35 percent in January, anrnincrease of 6 basis points from December. rnThe average rate on conventional 30-year fixed-rate mortgages (FRM)rnincreased 6 basis points to 3.53 percent. rnThis rate reflects market conditions prevailing in mid-to-late December.</p

The contract rate on the composite ofrnall loans – fixed and adjustable rate – was 3.34 percent compared to 3.28rnpercent in December and the effective rate was 3.46 percent, up 4 basis pointsrnfrom December.</p

Initial fees and charges were an averagernof 0.95 percent of the loan balance in January, down 20 basis points. Twenty-six percent of loans for homernpurchases originated in January were no-point mortgages, up from an 11 percentrnshare in December. Loan terms averagedrn27.1 years, down 0.3 years from the previous month and the average loan amount wasrn$254,700, a drop of $19,400 from December. rnThe average loan-to-value ratio was 76.4 percent.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment