Blog

First Increase Since 2010 for Annual Foreclosure Rate

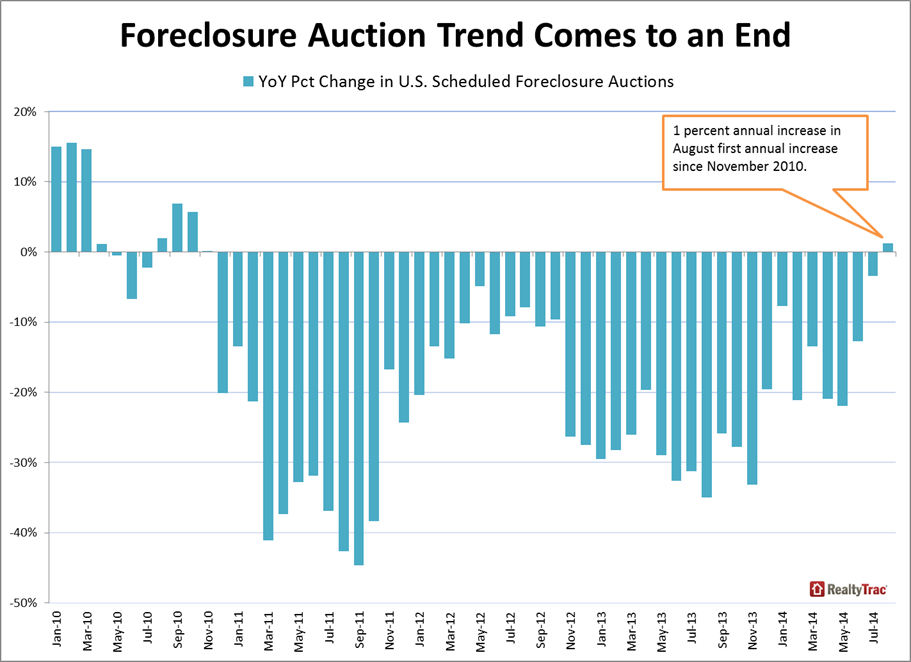

Foreclosure activity increased significantly in August according to thernU.S. Foreclosure Market Report released Thursday by RealtyTrac. The increase included the first year-over-yearrnuptick in scheduled foreclosure auctions in nearly four years.</p

There were foreclosure filings on a total of 116,913 properties duringrnthe month. Filings include defaultrnnotices or foreclosure starts, scheduled auctions, and bank repossessions orrncompleted foreclosures. While there wasrna 7 percent increase from the total number of filings in July, it was 9 percentrnbelow the level of activity one year earlier. rnThe number of filings in August translates to one in every 1,126 U.S.rnhousing units.</p

There were 51,192 properties on which foreclosure auctions were scheduledrnfor the first time in August. This was 1rnpercent fewer than in July but was a 1 percent increase over the numberrnscheduled in August 2013, the first annual increase in this figure after 44rnstraight months of decline. Scheduledrnauctions in judicial foreclosure states increased 5 percent from a yearrnearlier. </p

</p

</p

Daren Blomquist, RealtyTrac vicernpresident said, “The August foreclosure numbers demonstrate that althoughrnthe foreclosure crisis is well behind us, the messy business of cleaning up therndistress lingering from the housing bust continues in many markets. The annual increase in foreclosure auctions -rnthe first since the robo-signing controversy rocked the foreclosure industryrnback in late 2010 – indicates mortgage servicers are finally adjusting to thernnew paradigms for proper foreclosure that have been implemented in many states,rnwhether by legislation or litigation or both.”</p

Foreclosure starts and bank repossessions</balso increased. Starts were up 12rnpercent from July to 55,000. It was thernsecond consecutive monthly increase in starts and their number was virtuallyrnunchanged from one year earlier. Completedrnforeclosures totaled 26,343, up 2 percent from July but 33 percent lower thanrnin August 2013 and the 21st consecutive year-over-year decline.</p

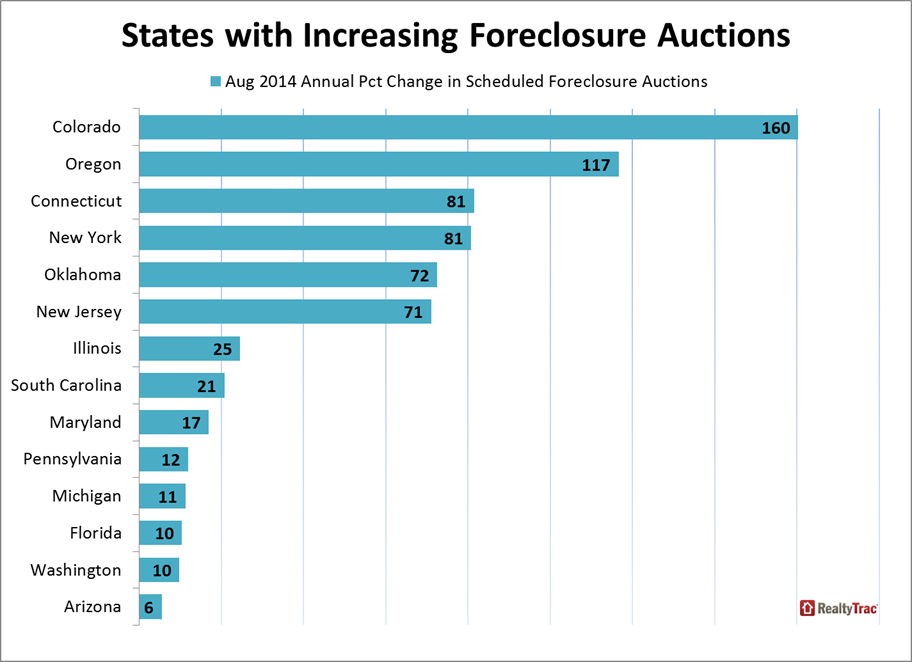

Scheduled auctions were up from arnyear earlier in 24 states. The largestrnannual increases were in Colorado (+160 percent), Oregon (+117 percent), andrnNew York (+81 percent.) Of the 19 statesrnwhere foreclosure starts increased on an annual basis the greatest gains werernin Oklahoma (+147 percent), Indiana (+136 percent) and New Jersey (+115rnpercent). Bank repossessions increased in seven states with Georgia having farrnand away the largest increase at 146 percent. rnIt was trailed by Hawaii (+42 percent) and Oregon (+20 percent.)</p

</p

</p

Six of the nation’s 20 largest metrornareas posted year-over-year increases in foreclosure activity: Washington, D.C.rn(+18 percent); New York (+18 percent); Baltimore (+12 percent); and Atlanta andrnPhiladelphia (+11 percent each). </p

Florida with a filing on one in everyrn400 housing units, three times the national average, had the highest rate of foreclosurernactivity in the nation for the 11th consecutive month. The state saw a 74 percent month-over-monthrnjump in foreclosure starts in August to a total of 6,368, the first increasernafter 17 months of decline. </p

Nevada moved back up the list fromrnthird to second in foreclosure activity in August with one in every 524 unitsrnreceiving a foreclosure filing and a 36 percent increase from July inrnforeclosure starts. It was the state’s worstrnmonth for starts since October 2013.</p

Foreclosure starts increased 72rnpercent during the month in Maryland and were up 20 percent from a yearrnearlier. The state ranked third inrnforeclosure activity; one in every 532 housing units received a filing.</p

New Jersey and Georgia rounded outrnthe top five states for foreclosure activity. rnIn New Jersey the rate was one in every 553 housing units and in Georgiarnit was one in every 582. </p

One of Georgia’s larger cities,rnMacon, had the highest foreclosure rates among metropolitan areas with arnpopulation over 200,000. One in everyrn154 housing units received a filing in August. rnThe second most active area was Atlantic City, New Jersey where filingsrnhave increased on an annual basis for 28 of the last 30 months. There were filings in August for one in everyrn292 housing units, nearly four times the national average. </p

Onernin every 294 Orlando housing units had a foreclosure filing in August, thernnation’s third highest metro foreclosure rate and overall activity was up 33rnpercent from a year ago. The increasernaffected year-over-year numbers for all three filing types. Foreclosure starts increased 18 percent,rnscheduled auctions 63 percent. REOs rosern15 percent to the highest level since January 2013.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment