Blog

Foreclosure Crisis in Final Stages?

The increase in bank repossessionsrnor completed foreclosures in April even as other foreclosure statisticsrndeclined may indicate that the housing crisis is in its final stages RealtyTracrnsaid today. While foreclosure filingsrnoverall, including default notices, scheduled auctions, and completedrnforeclosures, were down 1 percent in April, to a total of 115,830, there were 30,056rncompleted foreclosures, a 4 percent increase from March. </p

</p

</p

“The rise in bank repossessions inrnmany states is a sign that those markets are working through the final remnantsrnof foreclosures left over from the recent housing crisis,” said DarenrnBlomquist, vice president at RealtyTrac. “Many of these bank-owned homes arernbottom-of-the-barrel properties in terms of location or condition, but theyrnwill provide some much-wanted inventory of homes for sale in some markets inrnthe coming months. Investors and other buyers willing to do more extensivernrehab will likely be best-suited for these incoming REOs.” </p

</p

</p

In addition to decreasing 1 percentrnfrom the previous month, total foreclosure filings were down 20 percent</bcompared to April 2013 and completed foreclosures were 14 percent lower than arnyear earlier. One in every 1,137 U.S.rnhousing units received some type of foreclosure filing during the month.</p

Auctions were scheduled for 49,239rnproperties nationally, down 3 percent from March and a 21 percent decrease fromrnone year earlier. It was the 41st</supconsecutive month when these filings decreased on a year-over-year basis. </p

Foreclosure starts were also down,rndeclining 2 percent from March and 22 percent from April 2013. This was the 21st month in whichrnthere was an annual decrease. </p

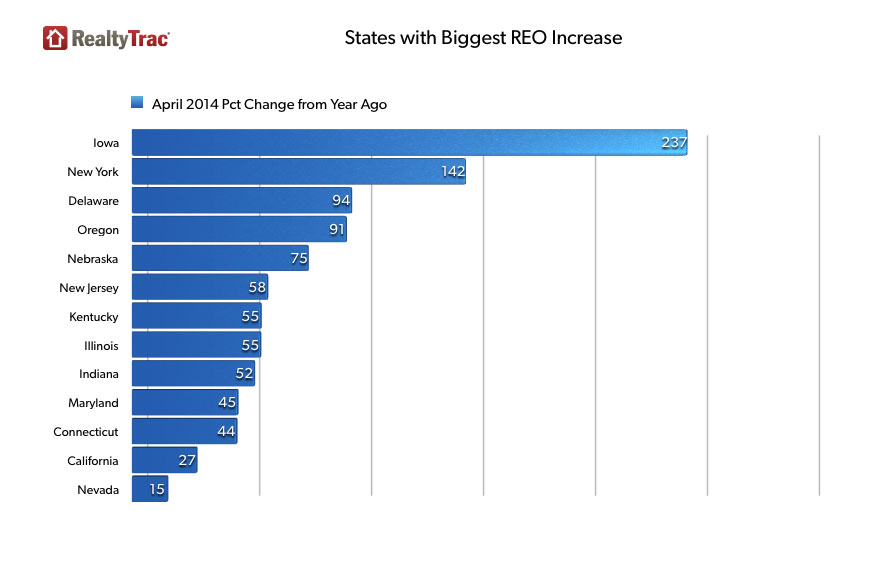

Bank repossessions increasedrnfrom the previous month in 26 states and were up from a year ago in 16 states,rnincluding New York where there was a 142 percent increase, Oregon (+91 percent),rnNew Jersey (+58 percent), Illinois (+55 percent), and Indiana (+52 percent). </p

Scheduled auctions increased fromrnthe previous month in 22 states and were up from a year ago in 17 states,rnincluding Oregon (+229 percent), Utah (+101 percent), Colorado (+87 percent), andrnNew Jersey (+73 percent. </p

Foreclosure starts, which arernscheduled auctions in some states, increased from the previous month in 26rnstates and were up from a year ago in 16 states, notably in Massachusetts wherernstarts doubled year-over-year and Indiana where they increased by 60 percent.</p

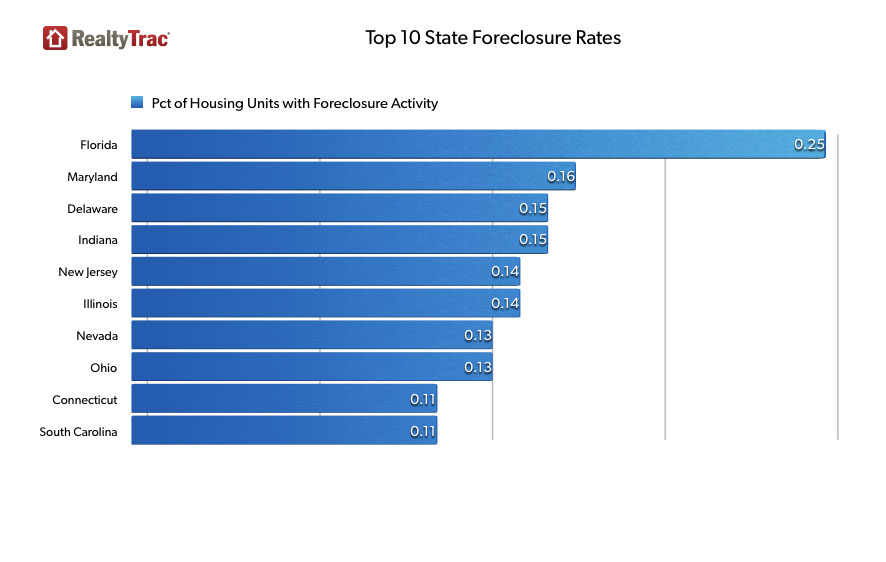

Despite a year-over-year decrease inrnforeclosure activity Florida still topped the nation with the highestrnforeclosure rate for the seventh straight month. One in every 400 housing units had a filingrnduring the month, almost three times the national average. Maryland had the second highest rate with itsrn22nd consecutive annual increase. rnOne in every 624 housing units had a filing during the month. Delaware, with one in every 657 units havingrna filing had the third highest rate. Itsrnrate was up 8 percent from a year earlier and has increased on an annual basisrnfor 11 of the last 14 months. </p

The other states in the top ten andrnthe housing units per filing were Indiana (681), New Jersey (700), Illinoisrn(700), Ohio (750), Nevada (770), Connecticut (887), and South Carolina (890).</p

Eleven of the 20 highest foreclosurernrates in metropolitan statistical areas with a population of 200,000 or morernwere in Florida, led by Orlando at No. 1. One in every 289 Orlando housingrnunits had a foreclosure filing in April, nearly four times the nationalrnaverage.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment