Blog

Foreclosure Inventory Down Over 30 Percent From Last Year

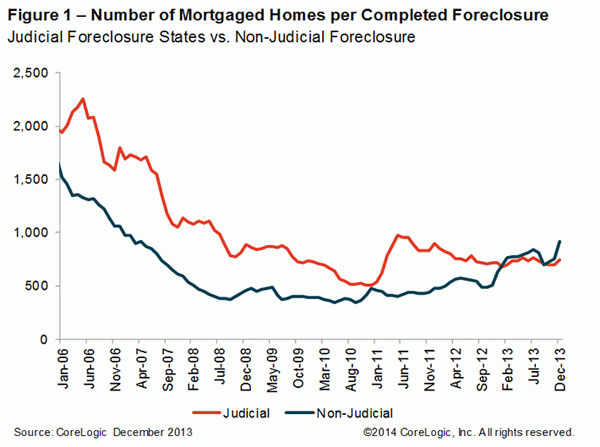

Completed foreclosures dropped by nearlyrna quarter in 2013 compared to 2012 CoreLogic said today. There were 620,111 homes foreclosed byrnlenders during the year compared to 820,498 in 2012, a decrease of 24rnpercent. Since September 2008, the daternusually used to mark the beginning of the housing crisis, there have been approximatelyrn4.8 million homes lost to foreclosure.</p

CoreLogic’s National Foreclosure Report for December says there were 45,000rncompleted foreclosures during the month, down 14 percent from 52,000 fromrnDecember 2012 and a 4.1 percent decrease from the 47,000 foreclosures completedrnin November. By way of comparison, therncompany said there were an average of 21,000 completed foreclosures a month inrnthe more typical period between 2000 and 2006. </p

</p

</p

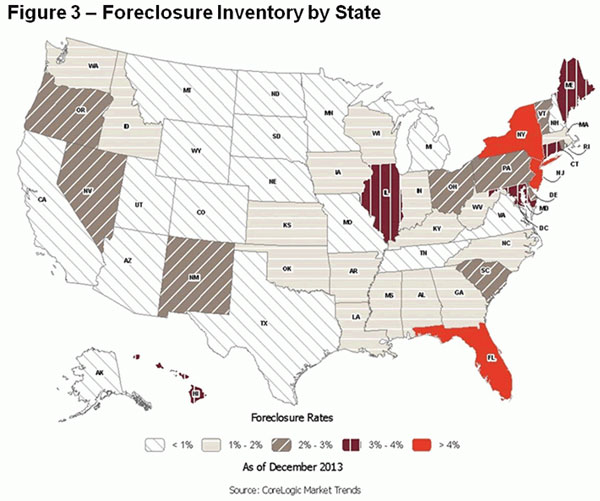

Approximately 837,000 homes nationwidernwere in some stage of foreclosure during the month of December, representingrn2.1 percent of mortgage homes. This is arn31 percent reduction in the so-called foreclosure inventory which consisted ofrn1.2 million properties a year earlier, 3.0 percent of homes with a mortgage.</p

The foreclosure inventory fell byrnmore than 30 percent in December on a year-over-year basis, twice the declinernfrom a year ago,” said Mark Fleming, chief economist for CoreLogic.rn”The decline indicates that the distressed foreclosure inventory isrnhealing at an accelerating rate heading into 2014.”</p

</p

</p

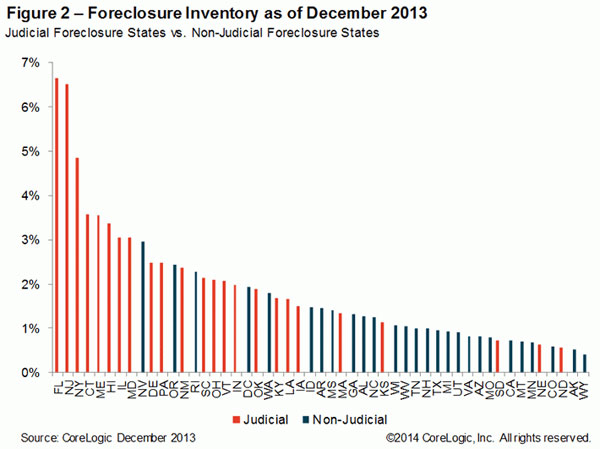

Five large states accounted forrnnearly half of the 600,000 plus completed foreclosures in 2013. Florida led with 119,000 followed by Michiganrn(53,000), California (39,000), Texas (39,000) and Georgia (35,000). States with the highest foreclosure inventoryrnas a percentage of all mortgaged homes were Florida (6.7 percent), New Jerseyrn(6.5 percent), New York (4.9 percent), Connecticut (3.6 percent) and Maine (3.6rnpercent).</p

In a press release accompanying thernreport Anand Nallathambi, president and CEO of CoreLogic said, “Clearly,rn2013 was a transitional year for residential property in the United States. Higherrnhome prices and lower shadow inventory levels, together with a slowly improvingrneconomy, are hopeful signals that we are turning a long-awaited corner,”rnsaid. “The housing market should continue to heal in 2014, but we expectrnprogress to remain very slow.”</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment