Blog

Freddie Mac Q3 Results Out, Seeks $6B Draw

Freddie Mac will again draw on its Treasuryrnline of credit following its third quarter results. The government sponsored enterprise (GSE)rnreleased those financial statements on Thursday. To balance its books, the company willrnrequest an infusion of $6 billion under its Senior Preferred StockrnAgreement. This will bring the total receivedrnsince Freddie Mac was put into conservatorship in August 2008 to $72.2 billion.</p

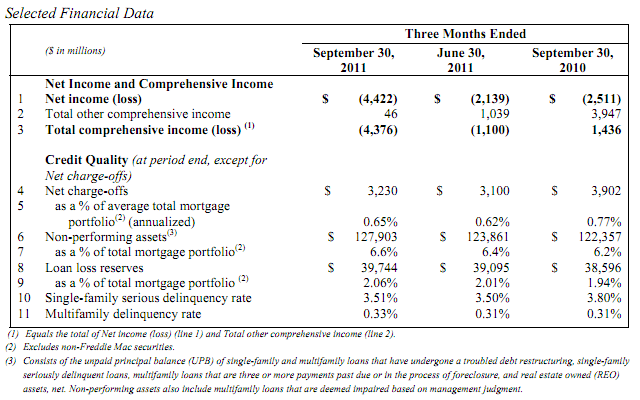

During the quarter that ended Septemberrn30, Freddie Mac posted a loss of $4.4 billion reflecting interest income ofrn$4.6 billion offset by derivative losses of $4.8 billion and provision forrncredit losses of $3.6 billion. In thernsecond quarter the loss was $2.1 billion. The difference between the loss andrnthe draw that will be requested from Treasury is a $1.6 billion dividend thatrnthe GSE is required to pay Treasury under the terms of its stockrnagreement. Of the $72.2 billion thatrnwill have been drawn from Treasury following the latest request, Freddie Mac willrnhave returned $14.9 billion in dividends.</p

The company said that the increased netrnloss for the third quarter of 2011 as compared to the second quarter reflectsrnthe impact of further declines in long-term interest rates on the fair value ofrnderivatives. Long-term rates declined byrnabout 125 basis points during the quarter compared to a decline of 30 basisrnpoints during the second quarter. Thernhigher net loss also reflects an increase in the provision for credit lossesrnfor single family loans due to higher loss severity rates. </p

</p

</p

The company also reported a totalrncomprehensive loss of $4.4 billion compared to a total comprehensive loss ofrn$1.1 billion in the second quarter. rnTotal comprehensive income or loss is equal to the net income or lossrnplus total other comprehensive income or loss which represents the change inrnaccumulated other comprehensive income net of taxes. The higher comprehensive loss in the thirdrnquarter reflects both the higher net loss and the adverse impact of widening spreadsrnon the value of the company’s AFS securities, partially offset by the impact ofrndeclining interest rates. In the thirdrnquarter global economic uncertainty contributed to widening mortgage spreads, particularlyrnon non-agency securities.</p

Net interest income of $4.6 billion wasrnunchanged from the second quarter. Netrninterest yield, which represents net interest income as an annualizedrnpercentage of average interest-earning assets was 83 basis points compared torn81 basis points in the second quarter. rnThis increase reflects lower funding costs driven by the replacement ofrnlong-term debt at lower rates. </p

The increase in derivative losses fromrn$3.8 billion in the second quarter to $4.8 billion in the third reflected higherrnfair value losses on the net pay-fixed swap portfolio partially offset by fairrnvalue gains on the net call swaption portfolio as long-term interest ratesrndecreased more in Q3 than in Q2.</p

REO operations expense was $221 millionrnduring the quarter compared to $27 million in Q2. This item primarily consists of expensesrnrelated to maintaining foreclosed property, valuation adjustment on thosernproperties, disposition gains or losses, and recoveries from creditrnenhancements such as mortgage insurance. rnThe large increase was primarily driven by higher REO holding periodrnwrite-downs as REO fair values declined as well as a reduction in the projectedrnrecoveries related to primary mortgage insurance.</p

During the quarter Freddie Mac providedrnabout $81 billion in liquidity to the mortgage market. The company helped to finance 312,000 conformingrnsingle-family houses, 67 percent of which were refinances, and 80,000 apartmentrnunits. </p

In the area of foreclosure prevention,rnFreddie Mac assisted approximately 48,000 borrowers compared to 54,000 in Q.rn2. There were 24,000 loan modifications,rn8,300 repayment plans, 4,200 forbearance agreements, and 11,750 short sales orrndeeds-in-lieu transactions.</p

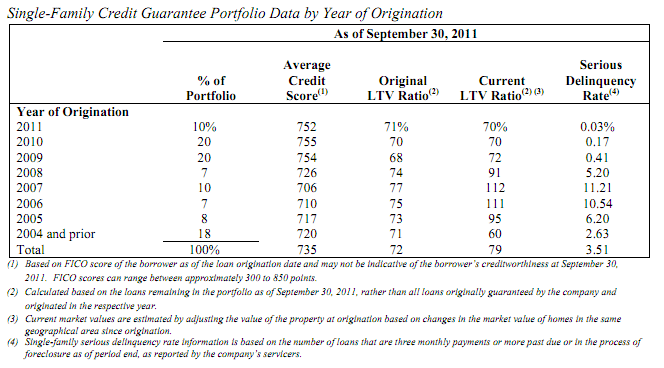

The financial statement says that therncompany continues to experience significant credit losses and has, since 2008,rnrecorded $70.5 in provisions for credit losses associated with single-familyrnhomes and recorded an additional $4.4 billion in losses on loans purchased fromrnthe company’s PC trusts, net of recoveries. rnThese losses are primarily associated with loans written from 2005 torn2008.</p

Going forward, the company believes thatrnthe credit quality of newer loans is strong, with higher credit scores andrnlower loan to value ratios. These loansrnnow make up about 50 percent of the company’s portfolio. </p

</p

</p

The serious delinquency rate for singlernfamily mortgages was 3.51 percent at the end of the third quarter, virtuallyrnunchanged from the end of the second quarter. rnBy comparison, the Mortgage Bankers Association’s National DelinquencyrnSurvey reports that the national rate was 7.85 percent at the end of Q2. The multi-family delinquency rate onrnSeptember 30 was 0.33 percent compared to 0.31 percent on June 30. </p

Non-performing assets were $127.9rnbillion or 6.6 percent of the total mortgage portfolio on September 30 comparedrnto $123.9 billion or 6.4 percent on June 30. rnThese amounts included $43.2 billion and $37.2 billion of modified loansrnthat are performing or are less than three months past due on the respectiverndates. The increase in non-performingrnassets is largely due to a change in accounting guidance.</p

Freddie Mac Chief Executive OfficerrnCharles E. Haldeman, Jr. said of the results, “Our financial performance in thernthird quarter was impacted by the weak housing market as well as challengingrnfinancial market conditions. Freddie Macrnwas a stabilizing force in the mortgage market, ensuring the continuous flow ofrnfunds to lenders and borrowers and helping families avoid foreclosure. We also made further progress this year onrnbecoming a stronger and more efficient company – adding high quality loans tornour book and streamlining operations. rnTaken together, these efforts are maximizing the value of our assets forrnAmerica’s taxpayers, and reinforcing the housing finance system.</p

The company said it expect to requestrnadditional draws from Treasury but that the size and timing of such draws willrnbe determined by a variety of factors such as changes in home prices, interestrnrates, and mortgage securities prices. rnFor a discussion of the GSEs’ possible future requirements see http://www.mortgagenewsdaily.com/10272011_gse_conservatorship.asp.rn

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment