Blog

Freddie Mac Says Cash Out Refinance Activity Near Record Low

Freddie Mac's total mortgage portfolio shrank rather dramatically in March, dropping 9.1 percent on an annualized basis from February figures. This was the third straight month that the portfolio decreased in size. The portfolio at the end of March was valued at $2.225 trillion. The annualized growth rate for the entire year is -4.4 percent.

In February, Freddiern Mac announced it would begin purchasing substantially all 120days or more delinquent mortgages from its related fixed-rate andadjustable rate PCs, which totaled approximately $73 billion. Thepurchases of these loans from related PCs were reflected in the PCfactor report published on March 4 but not in Table 1 of theMonthly Investor summary because they were purchased from loans alreadyin Freddie Mac PC portfolio.

However, according to the Monthly Volume Summary issued by Freddie Mac, the mortgage related investment portfolio skyrocketed, increasing by an annualized rate of 35.5 percent. In February the portfolio was contracting at an annualized rate of 18.5 percent.

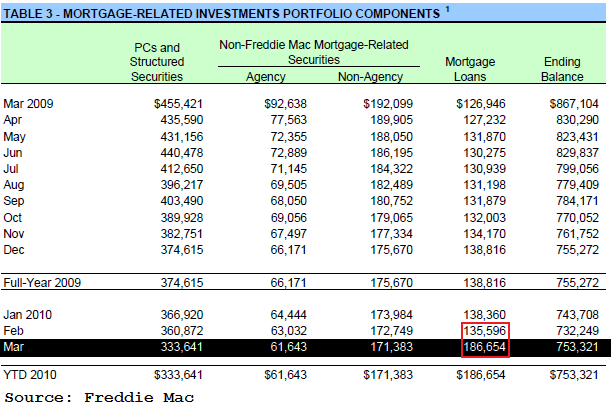

The surge in the size of the retained portfolio was partially a result of government sponsored enterprise's purchase of single family mortgage loans that were 120 days or more delinquent from its PCs. The mortgage-related retained investment portfolio had an ending balance of $753.3 million in March compared to $732.25 million in February. Below is a breakdown of that portfolio in March compared to February 2010 and March 2009, expressed in $millions, was:

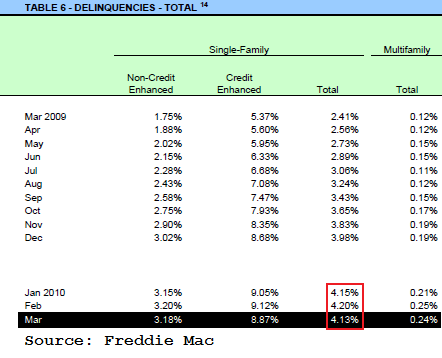

Delinquencies in all of Freddie Mac's categories dropped for the first time in the past year. 4.13 percent of single family mortgages were delinquent at the end of March compared to 4.20 percent in February and 2.41 percent in February 2009. The delinquency rate for the non-credit enhanced portion of the portfolio decreased from 3.20 percent in February to 3.18 percent in March and the credit enhanced portion dropped from 9.12 percent to 8.87 percent. Multi-family vacancies were also down slightly from 0.25 percent to 0.24 percent.

Freddie Mac also announced that, during the first quarter of 2010, one-half of borrowers who refinanced their conventional loans benefited from an interest rate reduction of at least 16 percent. The Enterprise's first quarter Refinance Report stated that the average borrower moved into a loan with a rate 0.9 percentage points lower than their old loan.

The majority of persons refinancing during the period either kept their outstanding loan balance the same or reduced it as a result of the refinancing. 18 percent of borrowers put cash in to the transaction to reduce the balance. “Cash-out” borrowers, those who increased the mortgage loan balance by at least 5 percent, represented 28 percent of new loans. This is the second lowest percentage of cash-out mortgages in a quarter since Freddie Mac began tracking the data in 1985. The fourth quarter of 2009 had the lowest cash out figure at 24 percent. Through most of 2006 and 2007 over 80 percent of homeowners who refinanced increased the principal balance of their mortgages. The home equity cashed out in the first quarter of 2010 totaled $9 billion, the smallest quarterly inflation-adjusted amount since the third quarter of 2000. During the 2006-2007 period referenced above the cash-out numbers each quarter were in the $70-85 billion range. Freddie Mac attributed the decline in cash-out numbers to reduced home prices and tighter underwriting standards for loan-to-value ratios. The median appreciation of the collateral property was a negative 4 percent over the median prior loan life of 4.0 years.

Date is collected from a sample of properties on which Freddie Mac has funded two successive loans, and the latest loan is for refinance rather than for purchase. The analysis does not track the use of funds made available from these refinances.

“Rates on 30-year fixed-rate mortgages during the first quarter remained low, averaging 5.0 percent in Freddie Mac's Primary Mortgage Market Survey®,” noted Frank Nothaft, Freddie Mac vice president and chief economist. “The median interest-rate savings for borrowers who refinanced their conventional loan in the first quarter was 0.9 percentage points. Refinances were about three-fourths of originations during the first quarter. In total, the lower rate translates into about $2 billion in interest savings for these borrowers over the first 12 months of the new loan.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment