Blog

Freddie Mac Survey Finds Hybrids Shoring up ARM Market

Adjustable rate mortgages have lostrnmuch of the popularity they enjoyed in the mid-2000s and Freddie Mac’s 28th</supAnnual Adjustable-Rate Mortgage Survey for 2012 found that hybrid ARMs,rnespecially the 5/1 hybrid are the most popular ARMs offered by lenders.</p

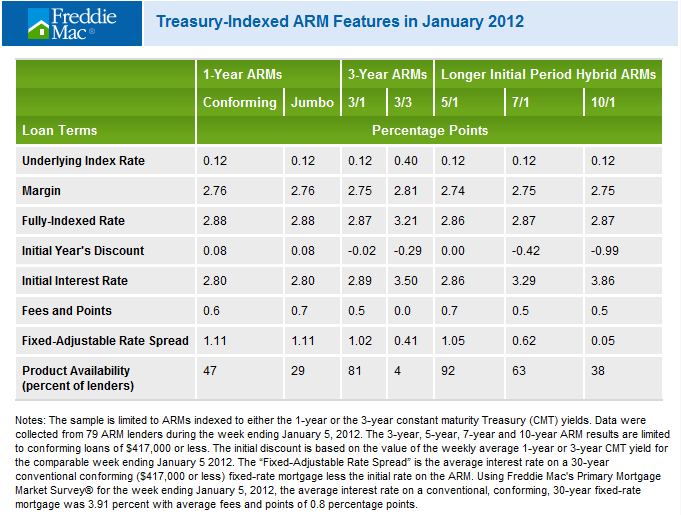

With ARM initial period rates atrnhistorically low levels, reflecting, in part, the low levels of the Treasuryrnyields that are used as indexes, the survey, conducted between January 3 andrnJanuary 5, found there was, in fact, little difference in the initial interestrnrate for the traditional one-year adjustable, the 3/1 hybrid and the 5/1rnhybrid. The longer-term products such asrnthe 7/1 and 10/1 hybrids were, because of their long initial fixed-rate period,rnpriced closer to the rate on a 30-year fixed rate mortgage.</p

The 5/1 hybrid ARM continued to bernthe most popular loan product (sic) offered by lenders and nearly all of thernARM lenders who participated in the survey offered such a loan. Following the 5/1 in popularity were the 3/1rnand the 7/1. Less than one-half of the lendersrnnow offer the one-year adjustable, and only 4 percent offered a 3/3 ARM thatrnadjusts once every three years. The 7/1rnand 10/1 ARMs, were available from 63 percent and 38 percent of the surveyrnparticipants, respectively.</p

The survey found that the interestrnrate savings for the 5/1 hybrid compared to the 30-year fixed-rate mortgage wasrnabout 1 percentage point in early 2012. rnThis was virtually unchanged from the savings found in the January 2011rnsurvey.</p

Of the 121 ARM lenders surveyed, 65rnpercent offered loans tied to constant-maturity Treasuries, down from 71rnpercent in 2011; the remaining offered products tied to future rates indexed tornthe London Interbank Offered Rate (LIBOR). With the onset of the debtrncrisis in the Eurozone, the 1-year LIBOR rate less the 1-year constant-maturityrnTreasury yield peaked over the week ending January 6 at over 1 percentagernpoint, compared to around 0.5 percentage points over the same week in 2011. Asrna result, 1-year LIBOR indexed ARMs may have adjusted up or did not adjustrnmaterially down compared with Treasury-indexed ARMs. The uncertainty overrnLIBOR movements may have led some current borrowers to avoid LIBOR ARMs.</p

Frank Nothaft, vice president andrnchief economist, Freddie Mac said of the survey findings, “Homebuyers havernshied away from ARMs, particularly traditional 1-year ARMs, because they arernwary of the risk and uncertainty. Borrowers who have taken out ARMsrngenerally prefer hybrids, because these products include an extended initialrnperiod where the interest rate is fixed. ARMs today are financing just over 10rnpercent of new home-purchase loans. In June 2004, ARMs hit a peak share of 40rnpercent of the home-purchase market but by early 2009, that share had fallen tornjust 3 percent, according to the Federal Housing Finance Agency. We arernexpecting ARMs to gradually gain back some favor with mortgage borrowers risingrnto a 14 percent share of the home-purchase market in 2012.”</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment