Blog

Freddie Mac’s Portfolio Shrinks in May. Delinquency Rate Flat

Freddie Mac's total mortgage portfolio shrunk by $7.53rnbillion or 4.0 percent during the month of May, resuming the decline that beganrnin January. </p

Despite a 3 percent upwardrnblip in April, the portfolio has dropped 2.9 percent since the first of thernyear and now has a total balance of $2.22 trillion. The total portfolio, however, is still 18.2rnpercent larger than it was in May 2009. rnThe annualized liquidation rate in May was 17.8 percent compared to 19.2rnpercent in April.</p

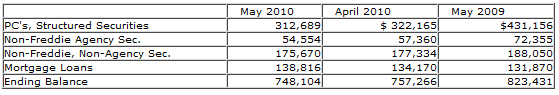

The refinance-loan purchase and guarantee volume in the Mortgage-RelatedrnInvestments Portfolio was 17.1 billion, down from 18.4 billion in May. The Investments Portfolio declined in valuernto 748.1 billion, a decrease of $9.2 billion or 14.5 percent from April and 2.3rnpercent since May 2009. The breakdown of that portfolio in May compared to Aprilrn2010 and May 2009, expressed in $millions, was:</p

</p

</p

The delinquency rate among single family based mortgages wasrnunchanged from April at 4.06 percent. rnThis is the third month in a row there has been no increase in the totalrndelinquency rate, however delinquencies are still running much higher than onernyear ago when the rate was 2.73 percent. Delinquencies represented 3.15 percent of thernnon-credit enhanced portfolio, also unchanged from last month, while the raternin the credit-enhanced portion of the portfolio ticked up one basis point to 8.69rnpercent. Multi-family delinquenciesrnincreased from 0.25 percent in April to 0.32 percent. </p

Thernmeasure of Freddie Mac's exposure to changes in portfolio market value averagedrn$455 million in May with a duration gap that averaged 0 months. These measuresrninclude the impact of purchases and sales of derivative instruments used tornlimit exposure to changes in interest rates.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment