Blog

Ginnie Mae Contemplates MBS Evolution

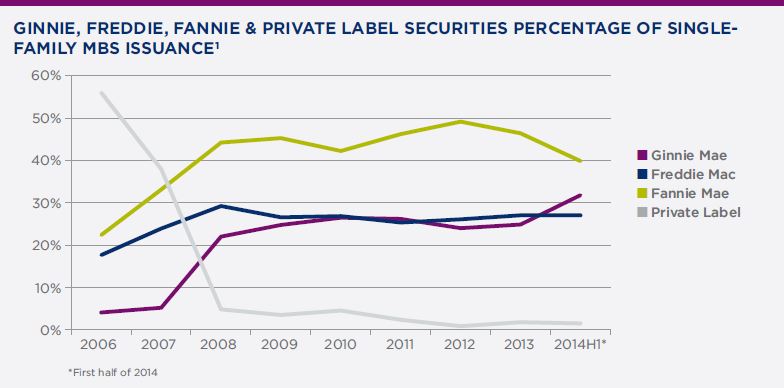

Atrnits second annual summit for stakeholders on Monday the Government National MortgagernAssociation (Ginnie Mae) issued a policy paper detailing how it intends to meetrnthe challenges it currently confronts in the aftermath of the housingrncrisis. The central challenge according tornAn Era of Transformation is “Thernretreat of commercial banks from mortgage lending and servicing and thernreplacement of this capacity by non-depository institutions with more complexrnfinancial and operational structures.” rnThis change, the paper says, represents a significantly differentrnoperating environment than that for which the program was originally designed,rnbut “There has never been doubt that the [financial crisis] aftermath would transformrnthe way mortgage lending operates in the United States.”</p

Thernpaper was authored by Michael Drayne, Senior Vice President of the Office of Issuerrnand Portfolio Management with consultation from Theodore Tozer and Mary Kinney,rnPresident and Executive Vice President and COO respectively of Ginnie Mae.</p

The<bretreat of commercial banks from home lending and servicing was not a pre-ordainedrnevent; during the crisis it would have been reasonable to envision a future in whichrnmortgage lending was regulated so it would become even more exclusively the provincernof traditional banking institutions. But instead, banks have weighed the costs andrnbenefits of these business lines and concluded that less exposure is more prudent.rn</p

Thernbusiness model of the Ginnie Mae mortgage-backed security (MBS) program did notrncontemplate the complexities of the current evolving environment. The paper highlights five Strategic Views thatrnexplain Ginnie Mae’s focus on the perspectives that will drive its actions and thernspecific initiatives that will shape its future.</p

GinniernMae emerged following the government’s movement entry into the housing markets duringrnand after the Great Depression. First FanniernMae was chartered to create a secondary market for FHA and later VA loans andrn30 years later Congress split off Freddie Mac to accommodate the purchase ofrnconventional mortgages and created Ginnie Mae to pursue the creation of arnmortgage-backed securities (MBS) market for government secured loans. Today Ginnie Mae along with Freddie Mac andrnFannie Mae (the GSEs) are the dominant conduits of capital into the U.S.rnhousing finance system and, the paper says, there is nothing on the horizon indicatingrnthis might change. </p

</p

</p

Asrnissuer Ginnie Mae guarantees, for a statutorily capped fee, that the owner ofrnan MBS will receive its principal and interest payments. The fee for thernguaranty is readily accepted by the market and sufficient to compensate GinniernMae which has never posted an annual loss. rnIts securities are in high demand across the globe.rn</p

Thernsuccess of the MBS programs with capital markets however has bred a criticalrndependency in that every pool of securitized and guaranteed mortgages must havernan institution willing to take full responsibility for its servicing,rnremitting, and reporting. It is with theserninstitutions, the Ginnie Mae issuers, where the marketplace is changing sornrapidly today.</p

Whilernthere are many similarities between Ginnie Mae and the GSEs there are also<bimportant distinctions. The UrbanrnInstitute recently summarized them thus: </p

1. rnGinniernMae securities consist exclusively of loans that are backed by the federal government.</p

2. rnGinniernMae guarantees only the pass-through payments to security-holders, not the creditrnperformance of the underlying loans.</p

3. rnGinniernMae securities enjoy the explicit full faith and credit guarantee of the UnitedrnStates Government.</p

These,rnin turn, give rise to other more-nuanced distinctions with a common element;rnthe vastly narrower scope of Ginnie Mae’s concern, capability and responsibilityrnwhen compared to the GSEs. Ginnie Mae’s potential for losses occurs almost entirelyrnat the point where an issuer fails to fulfill its responsibilities under the programrnand almost certainly would involve the failure of the firm itself. Loan level losses below a level precipitating suchrnfailure are covered by the insuring agency with any shortfall absorbed by thernissuer. rn</p

Therernare other differences as well: Ginnie Maerndoes not use its balance sheet to make a market, nor purchase loans or securities.rnThe GSEs historically made a market in loans and securities, using their vastlyrnlarger, leveraged balance sheets. </p

GinniernMae also has limited ability to oversee servicing of assets while the GSEs are responsiblernfor the full spectrum of risk. They are securityrnguarantors as a byproduct of their broader role as asset gatherers and managers.</p

Thernindividual issuers of Ginnie Mae securities are responsible for servicing thernassets just as the insuring agencies are for the loan level credit risk andrnalso for establishing and enforcing the servicing standards in order to protectrntheir loan guaranty.</p

Therndifference in scope gives Ginnie Mae a heightened sensitivity to the health andrnliquidity of the overall market for agency MSRs where its risk is concentratedrnin its counterparties’ success or failure. This places a premium on the existencernof a broad universe of high-quality counterparties that are willing and able tornadminister the MSR assets underlying Ginnie Mae’s securities. The company alsornhas an extremely limited ability to operate in the MSR market and prefers thatrnfailed issuers portfolios be absorbed by other issuers rather than acquiringrnthem itself.</p

Asrnnoted earlier, the retreat of banking institutions from mortgage lending is onernof the clear defining developments of the post-crisis era. The Ginnie Mae StrategicrnViews articulated in this paper all derive from this trend.rn</p

</p

</p

There are three primary drivers of this post-crisisrnretreat of the banks:</p<ul class="unIndentedList"<liThernimpending imposition of capital standards (via the Basel III standard) that couldrnhave the effect of penalizing the ownership of MSRs.</li</ul<ul class="unIndentedList"<liArnrecognition that existing servicing organizations were inadequate to the currentrnlevels of defaulted loans and more onerousrnregulatory standards coupled with an unwillingness to invest in therninfrastructure needed to change this.</li</ul<ul class="unIndentedList"<liEnormousrnretroactive costs of settlements and penalties that have made servicing appearrnto be increasingly challenging and economically uncertain.</li</ul

Thernthird driver is by far the most significant and likely to have the most durablernimpact. The possibility of unpredictable government-driven costs will continuernto constrain enthusiasm on the part of banks which have experienced them andrncould facilitate rising prices for the consumer. </p

GinniernMae’s program has never made a fundamental distinction between bank andrnnon-bank issuers but in light of its dependence on capable private firms willingrnto support the MBS it guarantees, this pullback is not welcomed and leads to GinniernMae’s Strategic View I: </p

“Policy-makers should be concerned with the retreatrnof banks holistically; not just the trend’s most direct result (the rise of non-depositories),rnbut also to its causes and long-term significance for the market.</p

“GinniernMae will advocate for an environment in which the importance of preserving residentialrnmortgage servicing as an economically viable activity, and mortgage servicing rightsrnas an attractive asset class, is recognized.”</p

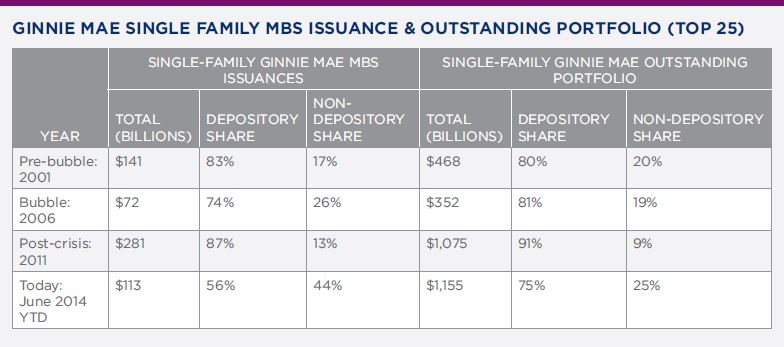

Thernbanks retreat from mortgage lending has occurred as investment capital is plentiful.rnNon-bank institutions-many of them relatively new- have risen to take the placernof banks, though the speed and scale of the transition is giving interested governmentalrnentities pause. A comparison of Ginnie Mae’srntop ten issuers by unpaid principal balance (UPB) lists from June 2011 and Junern2014 gives a flavor of the transformation:</p

</p

</p

Therernare two principal types of larger non-depositories emerging. The first are established firms that conductrnmortgage banking traditionally and wish to expand their exposure to MSRs onrnattractive terms. The second and more significantrnfirms are those which have developed primarily in the post crisis era. A subset of these have profilesrncharacteristic of a network more than a full-scale mortgage banker. They to link capital with operating platformsrnfor the purpose of overseeing MSR investments and do not aspire to becomerntraditional mortgage bankers.</p

Smallerrnmortgage banks had become heavily dependent on banks as their conduits torncapital markets, but post crisis have sought direct access to those markets inrnsubstantial numbers. This includesrnparticipation in the Ginnie Mae MBS program and has led to heightened demandrnfor Ginnie Mae approval. This means therncompany will need to manage a significantly larger number of counterparties. The company is exploring ways to invite broadrnaccess through non-traditional ‘gateway” issuers. An example is its new partnership with thernFederal Home Loan Bank of Chicago in which the bank it would act as the issuerrnfor its smaller member banks. </p

“STRATEGICrnVIEW II. The rising prominence of non-depository firms, and the accompanying trendrntoward specialization and the establishment of networks of firms, represents a naturalrnmarket response to prevailing factors, such as the pressures on legacy bank servicers.rnThough there are legitimate concerns about accompanying risks, there is also valuernin the diversity and innovation that such firms can bring.</p

“GinniernMae is supportive of a responsible evolution of the residential finance marketplacernand is willing to explore making appropriate modifications to its MBS program andrnsecuritization platform to reflect such evolution.”</p

Arncounterparty landscape dominated by enormous banking institutions with substantialrnresources, diverse lines of business and deep access to low-cost funding is an appealingrnproposition for a government guarantor. rnEach step away from it increases the possibility of loss. Issuers which are with regulated institutionsrnalso allow a guarantor to outsource a significant portion of its riskrnmanagement to banking regulators but as the non-banks rise in importance nornequivalent to the regulators is emerging. The increasernof non-depository institutions as counterparties will require substantial changesrnto Ginnie Mae’s monitoring and governing practices.</p

Inrnaddition to financial oversight the post-crisis transformation requires a needrnto oversee areas of operational risk. rnThe new breed servicers tend to rely on networked arrangements withrnfinancial, origination, and servicing capacities each in separate locations andrnthe core function of the primary entity is to manage and oversee the separaternpieces and there is more room for breakdowns in such arrangements.</p

STRATEGICrnVIEW III. Ginnie Mae will upgrade its ability to assess both the financial and operatingrncapacity of its issuers, and the establishment of new measures and standards. Threernareas will be the subject of particular focus:rn</p<ul<liCloserrnscrutiny of an issuer'srnliquidity and sources ofrnfunding, given the requirement that they remitrnrequired paymentsrnto security-holders under any eventuality.</li<liMore frequent and detailedrnMSR portfolio valuations</li<liGreater attention to operational capability and dissemination of data-driven operational performance information, recognizing the importance of non-financial factors tornthe health of the MBS program.</li</ul

Servicing guaranteed mortgage loans is a capitalrnintensive proposition andrnmarket liquidity will be of primary importance as residential financing adjustsrnto post-crisis reallocations of institutions and assets.</p

TornGinnie Mae “Market liquidity” first refers to an adequaternsupply of funding for mortgage servicing activity and the provisionrnof accessible sources of fundingrnat the point of need. The most critical point an issuer’srnability to fund servicing advancesrnon loans that are in default.</p

Ginnie Mae’srnsecond definition of “market liquidity” isa market that will permit the ownership of Ginnie Mae MSRs to change hands. Ginnie Mae’s mission to attractrnglobal capital into the U.S. housing markets could be thwarted by an insufficient supplyrnof institutions to service the securities and underlying loans it guarantees and lack of ability to transfer MSR could make institutions less willing to invest in these assets.rnGinnie Mae has far fewer resourcesrnfor and less control over, thernservicing of pools and loans as comparedrnto the GSEs, rendering it more reliant on the existencernof a deep pool of qualified servicers. </p

Ginnie Mae’s approval rights over the transferrnof the MSRs of the securities it guaranteesrnand its guarantor function make the acquiringrnservicer’s ability to fulfill its obligations under the MBS program critically important. Decisions to decline a transfer are likelyrnthe result of concern that the proposed transaction presentedrnthe possibility of undue risk of losses, which could inure to Ginnie Mae in the event of a future default by an issuer.</p

This counterparty risk decision, though, is made amidst the backdroprnof a larger concern for the maintenance of a liquid market for MSRs. Ginnie Mae’s actionsrnwith respect to servicingrntransfers are therefore mindful of both counterparty risk at the micro level and marketrnliquidity at the macro level.</p

Thernexisting structure of the Ginnie Mae program already impedes liquidity</bbecause it is dominated by pools of loans outrnof which transferring of individual loans is not possible. Upgrading systems to provide for loan level servicingrnand bond administration is an important strategic initiative forrnGinnie Mae.</p

MSR strips, the segmentation of cash flows into narrower streamsrnthat can be owned by investors completely removed from the operational aspects of producing them may be established throughrnprivate market arrangements or in the form of tradable securities. A plausiblernfuture may involve increasing levels of economic ownership</bof MSRs by passive investors.rn</p

Accordingly, Ginnie Mae will considerrnMSR strip arrangements, though it has not yet committed to develop a securitized product. The development of loan level servicingrncapability is a higher priority initiative.</p

STRATEGIC VIEW IV. Much of Ginnie Mae’s strategic efforts over the near future will be directed at providingrnfor market liquidity:</p<ul

Asrnthe universe of non-bank issuers grows Ginnie Mae must consider possible increases in issuer failuresrnand thus has given consideration to the posture it will take toward issuer infractions and has begun to adapt its approach to issuer non-compliance.</p

The most seriousrnthreat to the narrowly-defined naturernof Ginnie Mae’s wouldrnbe a spate of issuerrnfailures sufficient to introducerndoubt about the rationale and soundnessrnof the MBS program. This has happenedrnwith the GSEs and even FHA. At the same time the narrow responsibility enablesrnGinnie Mae to succinctly describe the essential duties of issuers: to reportrnpool date in a timely and accurate manner and manage and pass-through funds onrnbehalf of security holders. </p

Failure on the second score is the ultimate failure and thesernhave historically resulted in Ginnie Mae’s declaration of default and extinguishmentrnof approval status and the issuer’s rights to the MSRs which revert torngovernment property. The failure of Taylor, Bean & Whitaker underlined therndifficulty of making a small government agency designed to administer a guaranty programrnalso an asset managerrnso Ginnie Mae’s strategic direction will be fostering the maximum potential forrnpermitting MSRs from failed institutions to be absorbed by other private firms.rn</p

STRATEGIC VIEW V. “Because a spiralingrnseries of compliancernfailures could pose a threatrnto the continued viability of the MBS program, institutions that clearly demonstrate difficulty complyingrnwith essential program terms will be deemed unacceptable risks and will be removed from the MBS program.</p

When issuer failure necessitates the transfer of MSRs Ginnie Mae’srnwill seek place such MSRrnassets in the hands of a more suitable Ginnie Mae-approved private sector owner, rather than to seize and manage them itself.”</p

Adapting to changingrncircumstances, while preserving the integrityrnand strength of its MBS program must be performed by Ginnie Mae as a delicate balancingrnact. Ginnie Mae’s overriding goal will be to protectrnand preserve the utility,rnrelevance and remarkably successful trackrnrecord of the Ginnie Mae MBS program.rn

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment