Blog

Giving New Meaning to "Shadow Inventory"

Since the beginning of the housing crisis in 2008 housing experts haverncited concern over the “Shadow Inventory” and the pitfalls it could present tornany recovery of the housing market. Backrnthen, as every month brought news of mounting delinquencies, risingrnunemployment, and pending adjustments to adjustable and teaser rate mortgagesrnthe shadow inventory had a particular definition; the number of homes with mortgages that are 90 or more daysrndelinquent and that have a reasonable likelihood of ultimately being foreclosedrnand becoming bank-owned real estate even though they are not yet publiclyrnlisted for sale. </p

While lenders and servicers arernstill trying to rid themselves of backlogs of REO and there are still concernsrnover homes which may be held off the market for various reasons, the cry forrnmonths has been that there are not enough homes for sale. Sales, appeared to have been hampered by arnlack of inventory as new home builders cut back on construction and currentrnhomeowners have deferred moving, each awaiting a better market. </p

The number of homes thought to be inrnthe shadow inventory has dropped from 3 million at the peak in January 2010 tornabout 1.7 million in January of this year. Mark Fleming, CoreLogic’s chief economist,rnsaid recently that the traditional view of the shadow inventory doesn’t tellrnthe whole story anymore and he puts forth two new ways of looking at how arndifferent version of shadow inventory may still be holding back recovery. </p

In a CoreLogic Insights piece titled The Rise of Housing Obsolescence and Shadow Demand Fleming points to declining sales of both new and existing homes in March as compared to a year earlier and to an even greater drop in applications for purchase mortgages. He quotes National Association of Realtors (NAR) Chief Economist Lawrence Yun who routinely cites inventory shortages as one cause of both sluggish sales and prices that are rising faster than historical norms. But Fleming says that while there are only 2 million existing homes for sale – similar to the inventory in the early part of the last decade, “There are even fewer homes for sale that do not suffer from housing obsolescence – properties that are no longer desirable because their characteristics do not match what buyers are looking for in a home.”</p

Fleming said these are homes that are located in locations that are no longer popular, or are lacking amenities buyers want. Thus the inventory of homes that buyers actually want to purchase is even smaller than Multiple Listing Service numbers would indicate and many people who are looking and qualified to purchase are holding back, waiting for a home they really want. “Just as shadow inventory is the stock of properties in delinquency or foreclosure that are not yet for sale,” he says, “these buyers waiting in the wings are the new “shadow demand.”</p

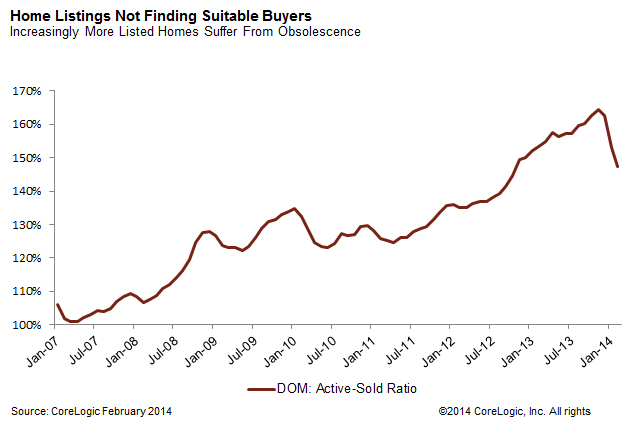

We can see that housing obsolescence is on the rise by looking at the ratio of average days on market (DOM) for all homes for sale to that for homes sold over time, he said. The higher the ratio, the longer all homes take to sell relative to those that actually do sell and indicates that a portion of the inventory is languishing on the market. In 2007 there was barely any difference in DOM for the entire inventory and for sold houses; today homes that sell do so in about two-third the amount of time as the overall inventory average.</p

</p

</p

Fleming said the housing andrnfinancial crisis has forced the industry to come up with new measurements forrnevents and activities that were not previously monitored such as negativernequity and shadow inventory. Now he saysrnwe need to pay attention to obsolescence. rn”Maybe the reason that home sales aren’t increasing is because buyersrncan’t find anything they want to buy. More viable homes for sale are needed torndraw this demand out of the shadows.”rn</p

In a second article, A New Source of Shadow Inventory, therneconomist maintains that the definition of the term should be expanded torninclude non-distressed existing homeowners who have no incentive to sellrnbecause the prevailing mortgage rate is higher than the mortgage on theirrnexisting home. Roughly half of the 50rnmillion mortgaged homes in the U.S. have below-market-rate mortgages and if asrnconventional wisdom says, homeowners typically sell once every seven years, therernmay mean 3.57 million likely sellers who will not list their homes because therncost of financing a new home will be higher.</p

Fleming says that adding these “rate-disenfranchisedrnsellers” to the traditional shadow inventory results in a new estimate of 5.27rnmillion homes as of January 2014. Comparedrnto one year ago, when the interest rate was 4 percent, only 28 percent ofrnpotential sellers or 2 million might have been dissuaded from listing,rnexpanding that shadow inventory from 2.2 million under the traditionalrndefinition to 4.2 million homes. </p

He says this group of potential,rninactive buyers could keep growing as mortgage rates continue to edge upwardrnand could put yet another damper on the recovering housing market. “We thoughtrnthe shadow inventory was improving,” he says, “but rising rates may actually berndriving a substantial increase instead.”

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment