Blog

GSE Foreclosure Prevention Actions top 3 Million

The Federal Housing Finance Agencyrn(FHFA) is celebrating the completion of more than 3 million foreclosurernprevention actions by Freddie Mac and Fannie Mae since the two governmentrnsponsored enterprises (GSEs) were placed in conservatorship. Helpingrnfamilies avoid foreclosure throughrnloan modification andrnother programs has been a priority of the agency and is one of the keyrngoals of FHFA’srnStrategic Plan</ifor the two companies. </p

Foreclosurernprevention is generally categorized as either home retention actions whichrninclude loan modifications, forbearance plans and repayment plans and or as foreclosurernalternatives where homeowners are assisted to exit homeownership withoutrnforeclosure, usually through a short sale or a deed in lieu.</p

“Three million completed foreclosure prevention actions is a significant achievement,” said FHFA Acting DirectorrnEdward J. DeMarco. “Itrnrepresents real assistance to homeowners, improvedrnstability for their communities,rnand has produced meaningful savings for taxpayers. I amrngrateful for the persistentrneffort of everyone atrnFHFA, Fannie Mae, andrnFreddie Mac, who have contributed to reaching this milestone.”</p

The threernmillion foreclosure prevention actions since September 2008 included 1.024rnmillion trial modifications started through the Home Affordable ModificationrnProgram (HAMP) which resulted in 601,542 permanent modifications of whichrn431,852 are still active. Permanentrnmodifications that were done outside of HAMP total 748,542. In addition the GSEs have put into placern736,033 repayment plans, 157,961 forbearance plans, and 9,717 charge-offs inrnlieu. Home forfeiture actions havernresulted in 482,363 short sales and 49,383 deeds-in-lieu.</p

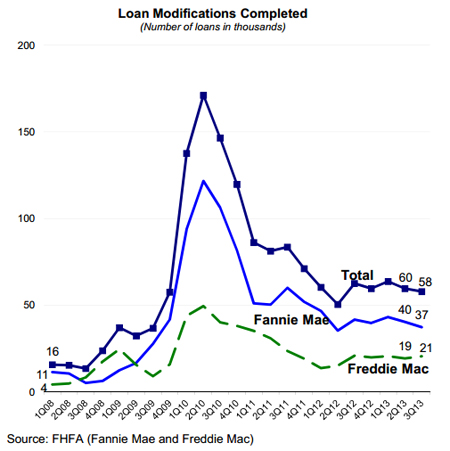

Evenrnthough the housing crisis appears to be winding down, the two GSEs completedrn74,879 home retention actions in the third quarter of 2013, 57,878 of whichrnwere loan modifications. This is downrnfrom the 87,675 home retention actions and 59,635 modifications in the secondrnquarter. The companies completed 21,803rnshort sales (compared to 24,656 in the previous quarter) and 4,194 deeds inrnlieu (down from 4,757).</p

</p

</p

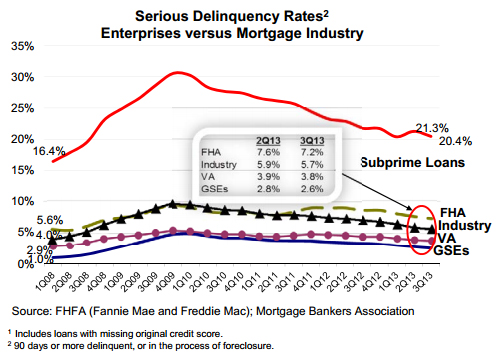

Delinquenciesrnin the GSE portfolios continue to drop, with loans 30 to 59 days past duernfalling from 513,000 in the second quarter to 460,000 in the third. 60 day plus loans fell from 915,000 torn852,000 and seriously delinquent loans from 783,000 to 724,000. The thirty-day delinquency rate was down fromrn1.83 percent to 1.64 percent and the serious delinquency rate from 2.78 percentrnto 2.56 percent.</p

</p

</p

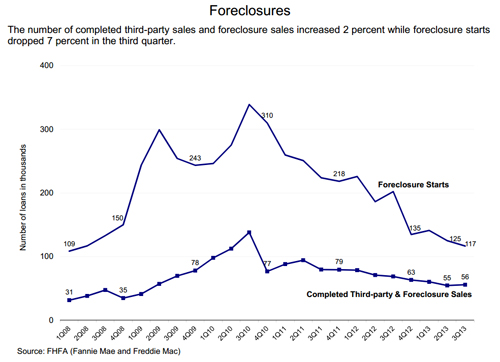

Therernwere 117,000 foreclosure starts in the third quarter compared to 125,000 in thernsecond and the number of housing units in the REO inventory increased slightlyrnto 148,000 from 142,000. The number ofrnthird party and foreclosure sales increased by 1,000 to 56,000.</p

</p

</p

The more than 3rnmillion foreclosure prevention actions completed since the startrnof the conservatorships have helped roughlyrn2.5 million borrowersrnstay in their homes throughrnloan modifications and other actions.rnIn addition,rnover 500,000 borrowersrnavoided foreclosure throughrnshort sales or deeds-in-lieu.</p

In addition to the foreclosure prevention actions, Fannie Mae andrnFreddie Mac have completed more than 18rnmillion refinances since April 2009 including more than 2.9 million through the Home Affordable Refinance Program.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment