Blog

Half those Eligible have not Refinanced; Fannie Mae asks "Why?"

Nearly half of the homeowners who could refinancerntheir homes have not done so despite the prolonged availability of record lowrnmortgage interest rates. Fannie Mae’srnEconomic & Strategic Research Group recently conducted two separate analysesrnof data from the company’s National Housing Survey (NHS) to find out why. Results were published recently by Li-NingrnHuang, Ph.D. Senior Manager of the group in Fannie Mae’s FM Commentary blog.</p

Responses to the NHS (conducted in the first quarter of 2013) indicate that 40 to 50 percent of those surveyedrnhad not refinanced the mortgage on their current home. Further, only 25 to 30 percent said they hadrnrefinanced in the past three years as mortgage rate declined to historic lows. Amongrnthe group that had not refinanced in the last three years only 10 percent saidrnthey were “very likely” to refinance in the future. A Federal Reserve studyrnconducted in 2001 and 2002 confirmed this behavior, finding that only aboutrnhalf of homeowners with mortgages refinanced at least once after buying theirrnhomes.</p

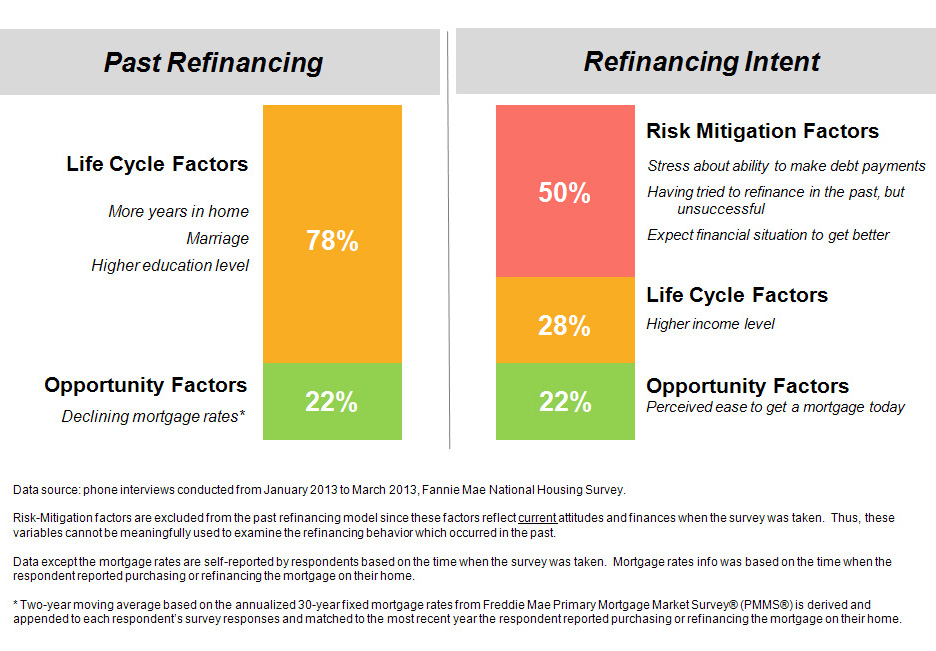

Fannie Mae’s first analysis looked at the factors associated with havingrnrefinanced in the past and the second studied the factors that could motivate thernintent to refinance over the following 12 months. Factors were grouped into three categories:</p<ul class="unIndentedList"<liLife Cycle. (Age,rnmarital status, education level, income, children in home, years in home.)</li<liOpportunity: (Perceivedrnease of getting a mortgage, mortgage rate regime (declining, stable, rising).)</li<liRisk Mitigation.rn(Stress over payments, concern about job loss, prior failure to get arnloan, perceived underwater status, doubt about wisdom of homeownership,rnexpectation of improving finances)</li</ul

</p

</p

Life cyclernfactors were the dominant variable borrowers associated with their past refinancingrnbehavior, especially the number of years the borrower had owned the home. Mostrnhad refinanced after six to 15 years. rnMarriage and higher education levels were also associated with homeowners’rnpast refinancing behavior. Among opportunityrnfactors previous refinancers most frequently cited declining mortgage interest rates.</p

Borrowers who want to refinance inrnthe next 12 months think differently from those who have not refinanced. Such borrowers want to mitigate their riskrnand are specifically more worried about their personal finances and want to refinancernto get them under control. Many have “triedrnto refinance but have been unsuccessful.” Borrowers who perceive it will be easy forrnthem to get a mortgage are more motivated to refinance and life cycle statusrnsuch as income is also a driver. </p

The important role that life cyclernfactors play in past refinancing behavior suggest that a borrower’s financialrnexperience and literacy, possibly gained through homeownership length andrneducation, may encourage mortgage refinancing. Findings suggest that arnbetter awareness of one’s financial situation could encourage consumers tornconsider refinancing and to take action. In addition, resources and toolsrnthat help build financial literacy and awareness could lead to higher rates ofrnrefinancing.</p

Huang said the NHS results also showrnthere may be other factors influencing people against a refinance. Forrnexample, the considerations of “not enough savings” and “high closing costs”rnare top refinancing barriers cited in the study. Situational factors suchrnas the relative size of the original and remaining mortgage principal and thernnumber of years expected to remain in the house could affect borrowers’rnassessment of refinance benefits. Further research into the situationalrnfactors that may impact borrowers’ decision making as well as borrowers’rnfinancial literacy and awareness is needed to provide deeper insights into thernissues that influence refinancing behavior.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment