Blog

HARP 2.0 Activity Surges on Interest Rates, Program Enhancements

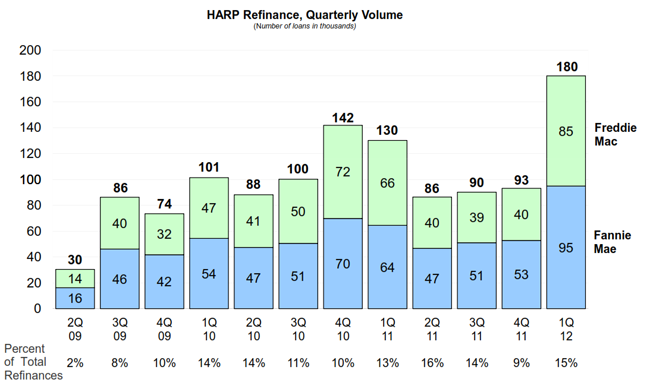

The new version of HARP, the Home Affordable Refinance Program, appears to be gaining in popularity judging by the quarterly figures rolled out today by the Federal Housing Finance Agency. According to its March 2012 Refinance Report more than 180,000 homeowners refinanced through HARP 2.0 in the first quarter of 2011 compared to about 93,000 in the fourth quarter of 2011. HARP 2.0 is only available to homeowners who have mortgages that are owned or guaranteed by Fannie Mae or Freddie Mac.</p

The Refinance Report covers all refinancing activity by Fannie Mae and Freddie Mac. Overall refinancing volume surged during the first quarter as interest rates continued to drop, week after week, to new historic lows. The two companies refinanced a total of 1,178,419 mortgages in the first quarter compared to 1,029,610 refinances in the fourth quarter of 2012 and slightly fewer numbers in the first quarter of 2011. Fannie Mae originated 761,922 of the first quarter total and Freddie Mac 416,497.</p

HARP has been around since the first quarter of 2009, established to assist homeowners to refinance even if the value of their home had slipped below loan-to-value underwriting standards. HARP originally had a LTV ratio limit of 105 percent, raised to 125 percent later in the year. The program reached far fewer borrowers than the program’s designers had anticipated. During the 11 quarters that the original program was available it exceeded 100,000 loans in only three, peaking at 142 thousand in Q4 2010. </p

Enhancements to HARP were announced last fall and rolled out in January. The changes included completely eliminating the loan-to-value (LTV) ceiling for borrowers who chose fixed-rate loans and the elimination or lowering of fees for some borrowers. The enhanced program is commonly referred to at HARP 2.0.</p

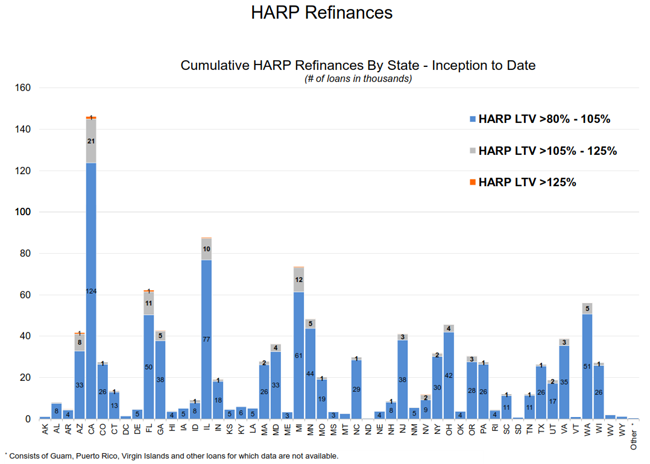

Of the 180,185 HARP loans closed during the quarter, 94,901 were with Fannie Mae and 85,284 with Freddie Mac. The majority of the loans, 138,893, have LTV’s between 80 and 105 percent; about 37,000 have ratios between 105 and 125 percent. Only a handful (4,434) are loans that are truly underwater with LTVs exceeding 125 percent but over half of these were in three states, California, Florida, and Arizona. Loans with LTVs over 105 percent had the greatest percentage increase, nearly tripling (13,000 to 37,000) from the fourth quarter of 2011 to the first quarter of 2012. Both Freddie and Fannie saw similar rates of increase.</p

</p

</p

There were over 211,000 Streamlined Refis during the quarter; 144,300 through Fannie Mae and 66,800 through Freddie Mac.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment