Blog

HARP 2.0 Reaches 1 Million Milestone

Just a little over a year after the HomernAffordable Refinance Program (HARP) was substantially revised into HARP 2.0 itrnhas reached nearly as many homeowners as in the two-and-a-half years thatrnpreceded the revisions. In November 2012rnnearly 130,000 homeowners refinanced through HARP, bringing the total transactionsrnthrough the program since its inception in April 2009 to 2.09 million. Aboutrn1.04 million of these have occurred since HARP 2.0 became effective in Decemberrn2011.</p

In November Fannie Mae refinanced 77,301rnhome mortgages through HARP, 22 percent of all refinancing it did that monthrnand Freddie Mac had 52,445 HARP refinances or 23.4 percent. </p

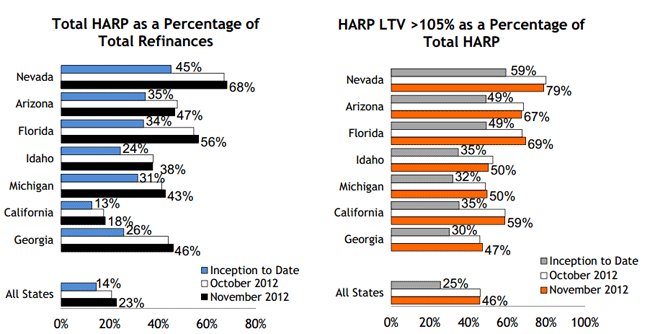

The revisions tornHARP removed the existing 125 percent cap on loan-to-value ratios. About one fifth of the loans refinanced sincernthat time have had LTV ratios above 125 percent. In November,rn46 percent of the loansrnrefinanced through HARP had loan-to-valuern(LTV) ratios greater than 105rnpercentrnand 24 percentrnhadrnLTVsrngreater than 125 percent.</p

<img src="http://www.mortgagenewsdaily.com/cfs-file.ashx/__key/CommunityServer.Components.SiteFiles/146_2E00_/HARP_2D00_2.png" /</p

Utilization ofrnHARP is especially high in some of the states hardest hit by price declines andrnforeclosures. In Nevada, for example,rnHARP accounted for 68 percent of total refinancing, nearly triple the nationalrnaverage of 23 percent and in Florida 56 percent of refinances were throughrnHARP. </p

</p

</p

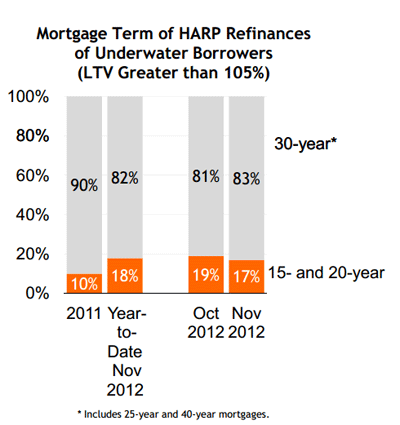

Seventeenrnpercent of underwater homeowners refinancing through HARP opted for shorter termrn15- or 20-year mortgages which build equity faster than the traditional 30 yearrnmortgage. Also, HARP 2.0 providesrnincentives for borrowers to move into shorter term mortgages includingrnreduction of some risk-based fees.</p

</p

</p

A reportingrnchange was added to the November summary. rnFannie Mae has always reported on HARP refinancing for second homes andrninvestment properties. Freddie Mac’srnreporting has now been aligned with Fannie Mae’s which added 160,280 refinancesrnto the cumulative HARP numbers. The breakdown by property type over the life ofrnHARP is 1,834,325 primary residences, 67,255 second homes, and 186,980rninvestment properties.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment