Blog

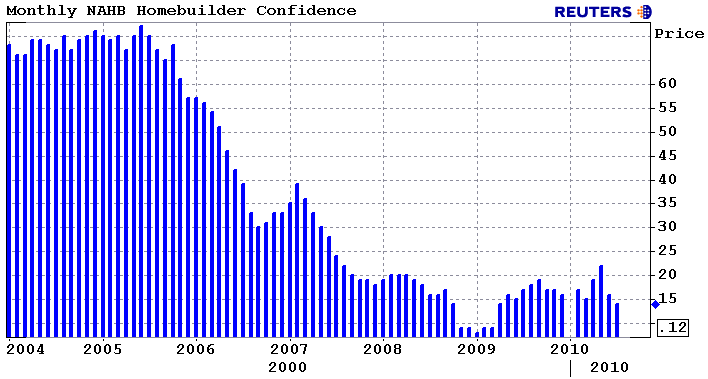

Home Builder Confidence Expectedly Low in July

Judgingrnfrom responses to the July survey of their attitudes toward the market conductedrnby the National Association of Home Builders (NAHB), new home builders aren't expectingrnany sudden changes of fortune in their immediate futures.</p

Eachrnmonth NAHB asks its members to describe their current perceptions of the marketrnfor new homes, their projections for six months in the future, and theirrnmeasure of the current level of buyer traffic. From the responses, which arerngiven along a continuum of poor to good in the first two instances and very lowrnto very high in the third, NAHB constructs the NAHB/Wells Fargo Housing MarketrnIndex (HMI). A score below 50 on any ofrnthe individual questions/components or the composite index indicates that morernbuilders have a negative attitude toward the market than a positive one. </p

The composite portion ofrnthe HMI declined two points from the June figure to 14. This is the second straight month the indexrnhas decreased and the lowest level it has reached since April 2009. </p

</p

</p

Each of the three componentrnindexes also indicated a drop in confidence. rnThe component measuring current market conditions dropped two points torn15 while the component reflecting projections of conditions in six months wasrndown one point to 21. Builders'rnattitudes about the current buyer traffic they are seeing took the worst hit,rndropping three points to 10.</p

“This month's lowerrnHMI reflects a number of underlying market conditions that builders are seeing,rnincluding hesitant home buyers, tight consumer credit, and continuingrncompetition from foreclosed and distressed properties that are priced below therncost of construction,” said NAHB Chief Economist David Crowe. “Thernpause in sales following expiration of the home buyer tax credits is turningrnout to be longer than anticipated due to the sluggish pace of improvement inrnthe rest of the economy. That said, we do believe that favorable factors suchrnas low mortgage rates, affordable prices, and demographic trends will helprnrevive consumer demand for new homes this year, and that new-home sales willrnimprove by 10 percent in 2010 from 2009.”</p

Regionally, the HMI July resultsrnwere mixed. The Northeast, which has a smaller survey sample and therefore is pronernto greater monthly volatility, posted a seven-point increase to 23 this month,rnwhile the Midwest posted a one-point improvement to 15. The South and West eachrnposted five-point declines to 14 and 9, respectively. </p

NAHB has conducted the homernbuilder survey for 20 years.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment