Blog

Home Prices Continue Higher, Some States Above Pre-Crisis Peaks

Home prices nationwide have nowrnrecovered to within 13.5 percent of the peak they reached in June 2006. The national Home Price Index (HPI) providedrnby Black Knight Financial Services’ Data and Analytics Division is $233,000, inchingrncloser to the $270,000 HPI that was the pre-crisis peak. This presents anrnincrease of 7.6 percent from an HPI of $217,000 in March 2014 and a 0.7 percentrnincrease from February. </p

Some areas, notably the States ofrnTexas and Colorado and some of the larger cities in Texas, surpassed their 2006rnprice levels last summer and the Texas locations have continued to post new peakrnHPI levels virtually every month since. rnTexas established a new record level again in February at $188,000 andrnColorado after dropping back for a few months also set a new high ofrn$259,000. Other locations lag far behind the nationalrnaverages. Florida, for example, isrnstill more than 33 percent below its peak, Arizona is down over 31 percent andrnIllinois lags by a quarter and California by 23.4 percent. </p

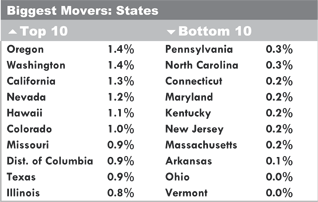

Ten states had increases in their HPI’s greater than thatrn0.7 national monthly average. Oregon andrnWashington posted monthly gains of 1.4 percent followed by California Nevada,rnand Hawaii at 1.3, 1.2, and 1.1 percent respectively. Other states with larger averages werernColorado, Missouri, the District of Columbia, Texas, and Illinois. The smallest improvements were in Ohio andrnVermont which were unchanged from February, Arkansas, up 0.1 percent, andrnConnecticut, Maryland, Kentucky, New Jersey, and Massachusetts each of whichrnhad a 0.2 percent increase in their respective HPIs. </p

</p

</p

Eight of the ten most improved metropolitan areas were in Californiarnwith San Jose and San Francisco leading at 2.6 percent and 2.2 percent gainsrnrespectively. Other cities with improvementsrnranging from 1.4 to 1.8 percent were Santa Rosa, Vallejo, Modesto, Stockton,rnand San Louis Obispo and Oxnard. Seattlernand Portland, Oregon also broke through with monthly increases of 1.7 and 1.5rnpercent. While Austin, Dallas, andrnHouston had smaller monthly gains than other cities (each increased by 0.9rnpercent) all three established new peak prices during the month.</p

ThernBlack Knight HPI combinesrntherncompany’s property and loan-level databasesrnto produce a repeat salesrnanalysis of home prices asrnof their transaction dates every month for each ofrnmore than 18,500 U.S. ZIPrncodes. The Black Knight HPI represents the price ofrnnon-distressed sales by takingrninto account pricerndiscounts for REO andrnshort sales.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment