Blog

Home Remodeling Growth Projections Extended

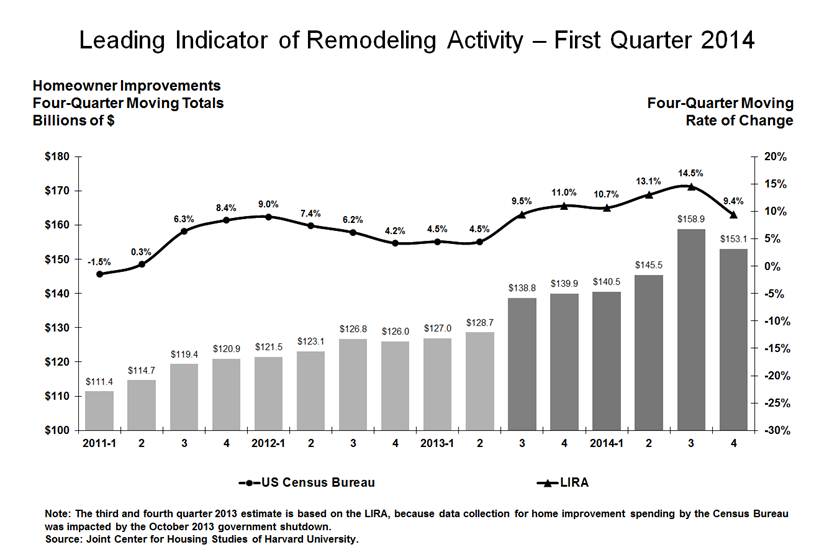

Home remodeling remains strongrnthroughout the country although it has begun to experience some of thernmoderation that has been predicted since late last year. The Remodeling Futures Program at the JointrnCenter for Housing Studies of Harvard University said its LIRA (LeadingrnIndicator of Remodeling Activity) continues to show solid growth in the marketrnthis year but momentum should begin to moderate in the fourth quarter. </p

According to the Joint Center, “Sluggishnessrnin the housing market and specifically in home sales may result in arndeceleration of home improvement spending from double-digit annual growthrnthrough the third quarter to a year-over-year gain in the high single digits byrnthe end of the year.”</p

</p

</p

The LIRA is a moving average designed tornestimate national homeowner spending on improvements for the current quarterrnand subsequent three quarters. The indicator, measured as an annualrnrate-of-change of its components, provides a short-term outlook of homeownerrnremodeling activity and is intended to help identify future turning points inrnthe business cycle of the home improvement industry. </p

This is the second consecutive quarter</bthat the duration of the recovery anticipated by the LIRA has beenrnextended. The model released in October 2013 anticipatedrna slowdown beginning in the second quarter of 2014. That was extended to the third quarter in thernJanuary although the rate of that growth was downgraded from October estimates. The Center now projects that growth in thernmoving average will continue into the third quarter, increasing 6 basis pointsrnto 14.5 percent. It will then slow inrnthe fourth quarter, with spending decreasing from $158.9 billion to $153.1rnbillion, a decrease of 5.8 percentage points. </p

“Home improvement spending has already recovered a significant share of itsrnlosses from the downturn,” says Kermit Baker, director of the RemodelingrnFutures Program at the Joint Center. “As spending moves into the next phase,rnwe expect to see recent double-digit growth tail off to its longer-term averagernin the mid-single-digit range.”</p

The Center also announced that, becausernof the upheaval in financial markets over recent years, it has found therntraditional relationship between interest rates and home improvement spendingrnhas significantly deteriorated. As arnconsequence, starting this quarter long-term rates have been removed from thernLIRA estimation model.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment