Blog

Homebuilder Confidence Falls. Same Problems Persists After Tax Credit Expiration

The National Association of Home Builders released the monthly Housing Market Index today. </p

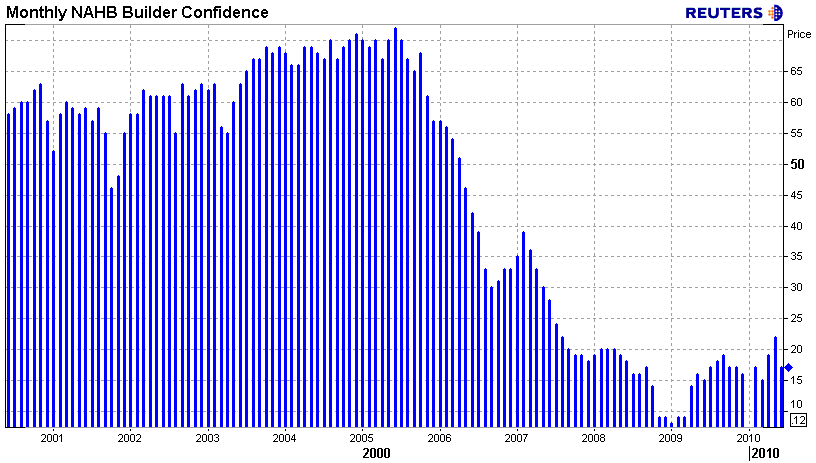

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number overrn 50 indicates that more builders view conditions as good than poor.</p

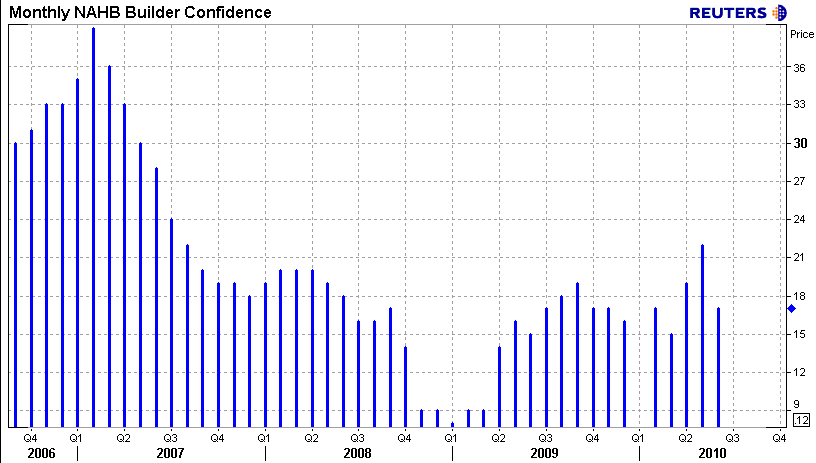

After recording month over month improvements in April and May, home builder confidence declined in June. The Housing Market Index dropped five points to 17…</p

</p

</p

This modest move lower is small in the grand scheme of things but still the largest month over month drop since November 2009 . The NAHB Housing Market Index is only 9 points above the record low print of 8.</p

</p

</p

Excerpts from the release…</p

Each of the HMI’s component indexes recorded declines in June. </p<ul

NAHB Chairman Bob Jones, a home builder from Bloomfield Hills, Michigan says:

“The home buyer tax credit did its job in stoking spring sales and we expected a temporary pull back in the builders’ outlook after the credit expired at the end of April…However, the reduction in consumer activity may have been more dramatic than some builders had anticipated, which resulted in their lower confidence levels.”</p

NAHB Chief Economist David Crowe says:

“We expected some softening in the market following the expiration of the home buyer tax credit and this report seems to verify this assumption….In the coming months, an improving economy, rising employment, low mortgage rates and stabilizing home values should help the housing market move forward. But as today’s HMI data shows, builders still remain very cautious and are aware that several factors could impede the nascent housing recovery, including serious problems in obtaining financing for the production of housing, faulty appraisal practices and competition from short sales and foreclosed properties.”

</p

This is the same thing the NAHB was saying in January.</p

HERE is some content about the above mentioned appraisal issues</p

HERE is some content about short sales, foreclosed properties, and shadow inventory</p

HERE are some of the “incentives” being pushed by Realtors and homebuilders

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment