Blog

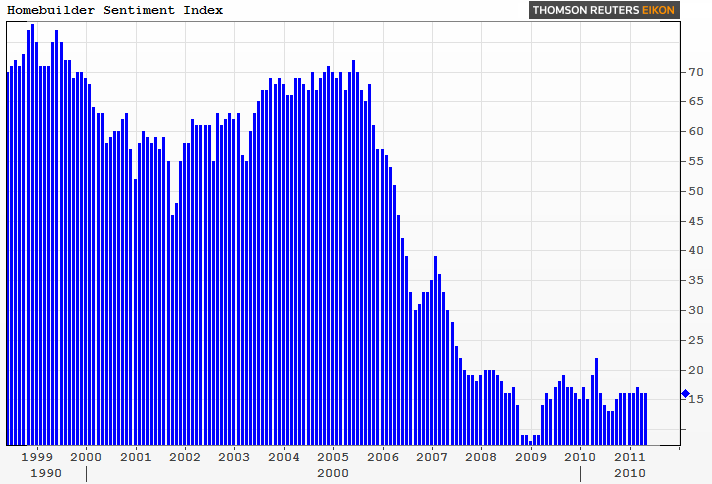

Homebuilders Go Numb. Confidence Index Frozen

The National Association of Homebuildersrn(NAHB) reported on Monday that its Housing Market Index (HMI) came in at 16 for the sixth time in seven months. The HMI isrna measure of builder confidence gleaned from homebuilders’ responses to arnmonthly survey that has been conducted by NAHB for over 20 years.</p

“Builder confidence has hardly budgedrnover the past six months as persistent concerns regarding competition fromrndistressed property sales, lack of production credit, inaccurate appraisals,rnand proposals to reduce government support of housing have continued to cloudrnthe outlook,” said NAHB Chairman Bob Nielsen. “In addition, many builders inrnthis month’s survey cited high gas prices as a further contributor to consumerrnanxiety and reluctance to go forward with a home purchase.” </p

</p

</p

The NHAB/Wells Fargo survey asks homebuilders to gauge both current single-familyrnhome sales and their expectations for those sales over the next six months as “good,”rn”fair,” or “poor.” They are also askedrnto rate current traffic of perspective buyers as “high to very high,” “average”rnor “low to very low.” In addition to the composit HMI, a component index isrnconstructed for each of the three sets of responses. A score over 50 on any index indicates thatrnmore builders view sales conditions as good rather than as poor. The index has not had a score over 50 sincernlate in 2006.</p

The component measuring buyer traffic increased one point to 14, the secondrnmonth in a row and the second time this year for a one-point bump. It is also the highest score for the trafficrnindex since May 2010. Current sales arernrated at 16, also a one point increase but the index measuring future salesrndropped two points to 20.</p

“The HMI component index measuring traffic of prospective buyers increasedrnby one point for the second time this year as prospective buyers show growingrninterest but remain extremely hesitant due to a number of factors,” said NAHBrnChief Economist David Crowe. “Asked to identify reasons that potentialrncustomers are holding back at this time, 90 percent of builders surveyed saidrnclients are concerned about being able to sell their existing home at a favorablernprice, while 73 percent said consumers think it will be difficult for them tornget financing. Clearly, access to credit for both builders and buyers remains arnconsiderable obstacle to the revival of the new-homes market.” </p

Regionally, the HMI results were mixed, with the Northeast at 15 and the Westrn16, a five and a two-point drop respectively. rnThe Midwest was unchanged at 14 while the South’s HMI increasedrnone-point to 16.

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment