Blog

Household Net Worth Continues to Decline Even as Debt Lessens

The net worth of U.S. households worsened during the thirdrnquarter of 2011 according to the Federal Reserve’s Flow of Funds Summary forrnthe quarter. The figure, whichrnrepresents the difference between the values of a household’s assets and itsrnliabilities, declined about $2.4 trillion to an estimated $57.4 trillion.</p

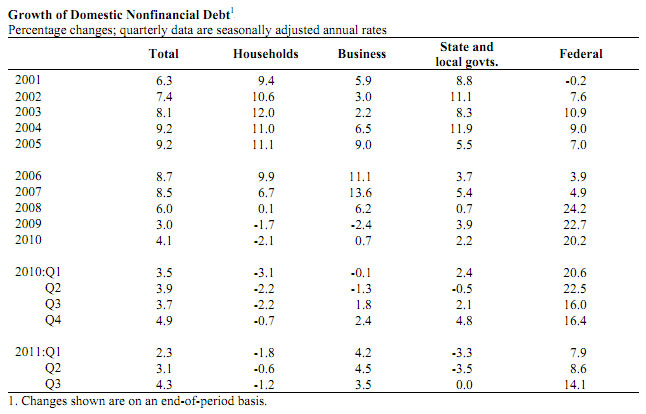

Household debt declined by an annual rate of 1.25 percent,rncontinuing the contraction that began in the third quarter of 2008, almostrnentirely because of a drop of 1.25 percent (annualized) in mortgage debt,rnalthough this rate has lessened since the first half of the year. In contrast, consumer credit rose for thernfourth quarter in a row with an annualized rate of increase in the thirdrnquarter that was also 1.25 percent.</p

Nonfinancial business debt was up at a rate of 3.50 percent,rna 1 point decrease from the rate in the second quarter. Corporate bonds outstanding and businessrnloans increased while commercial mortgage debt continued to decline although atrna more moderate pace than in 2010. Overallrndomestic nonfinancial sectors expanded at a seasonally adjusted annual rate ofrn4.25 percent, about 1.25 percentage points faster than in the second quarter. </p

State and local government debt was unchanged during thernquarter while debt held by the federal government increased at an annual raternof 14 percent.</p

At the end of the third quarter outstanding domesticrnnonfinancial debt totaled $37.8 trillion, household debt was 13.2 trillion,rnnonfinancial business debt was $11.5 trillion and total government debt wasrn$13.1 trillion.</p

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment