Blog

Housing Market Implications of Adult Children Living With Parents

Sincernthe start of the housing crisis the experts have noted the tendencyrnyoung adults to continue to live in their childhood homes. This theyrnsay is contributing to the diminished rate of household formationrnwhich is, in turn, lowering homeownership rates in the lower agerncohorts with the ultimate effect of holding back the housing andrnconstruction recoveries. </p

Evenrnwhen young adults move out of their parents’ basement, as thernsaying goes, they tend to share housing with other young adults. Therneconomists at CoreLogic have coined the name “the RenterrnGeneration” as an alternative designation for the age group morernbroadly referred to as Millennials, those born between the earlyrn1980s and early 2000s. </p

FanniernMae focused on the issue in a Commentary piece released on Tuesday,rnusing data collected through its National Housing Study (NHS) overrnthe first two quarters of 2014. Adult decision makers were askedrnquestions about their young adult children living at home, so allrnresponses are from the parents’ perspective. The analysisrnaddressed answers regarding two age groups, 18 to 22 year oldsrn(younger adult children) and 23-34 year olds (older adult children.)</p

Authorsrnof the Commentary, WhyrnAre Young Adults Living with Their Parents and When Will They MovernOut? suggestrnthat the issue of Whyrnisrndriven by arncombination of personal financial constraints, age of the adultrnchild, and parental preferences. </p

ThernNHS notes that the percentage of young adults between the ages of 18rnand 34 who are living with their parents increased from the 27rnpercent average that prevailed between 1990 and 2006 to 31 percent inrn2013. This means that some 22 million young adults, a group thatrntraditionally provides a substantial share of first-time homebuyersrnis delaying the decision to form a household. Young adults also havernbeen experiencing higher rates of unemployment and are delayingrnmarriage, other factors surrounding their lack of householdrnformation. </p

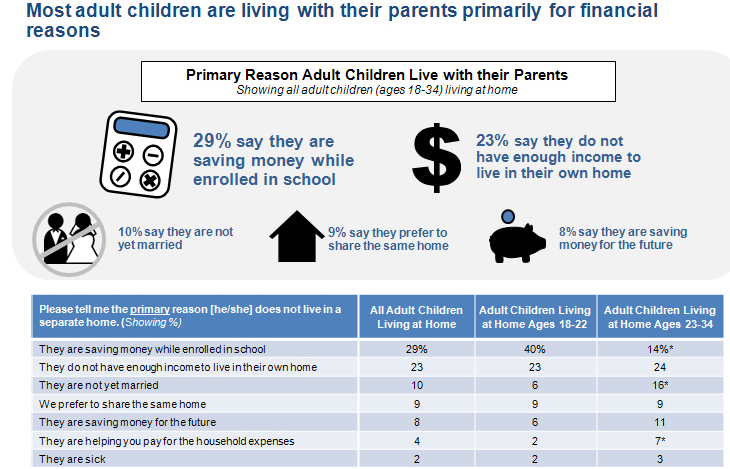

Financialrnreasons were the primary response given by parents for why theirrnadult children are still living at home. As regards the youngerrnadult children, parents by a large margin say that they are “savingrnmoney while enrolled in school.” It has also been reported in thernsurvey that the majority of this group arern”not currently employed in a paying job” or “employedrnpart-time” which impedes their ability to live on their own. </p

Arnwider range of responses was given why older adult children werernstill at home. Top responses include:</p<ul<li

“Theyrndo not have enough income to live on their own.” </p</li<li

“Theyrnare not yet married.” </p</li<li

“Theyrnare saving money while enrolled in school.” </p</li</ul

Inrnaggregate the primary reason for the older age group was financialrnconcerns even though half of that group is employed full time.rn</p

</p

</p

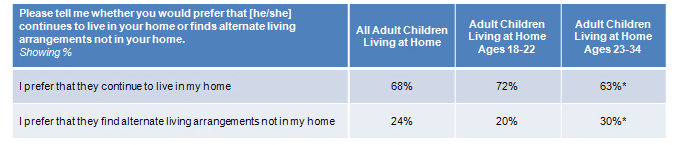

Thernsurvey also found that most parents (68 percent) actually preferrnhaving their adult children live with them. As the chart belowrnindicates this preference was significantly lower among the parentsrnof older adult children than among parents of younger adults.</p

</p

</p

Therernwas also a difference in answers regarding financial attitudes. Arnhigher share of parents of younger adult children said their recentrnpersonal financial situation had gotten better (+5 percent) or wasrnexpected to get better (+11 percent) than the responses from parentsrnwith older adult children. The parents of younger children alsornwere more frequently employed full-time, perhaps partially due to agerndifferences although reported rates of retirement in the two groupsrnwere similar. </p

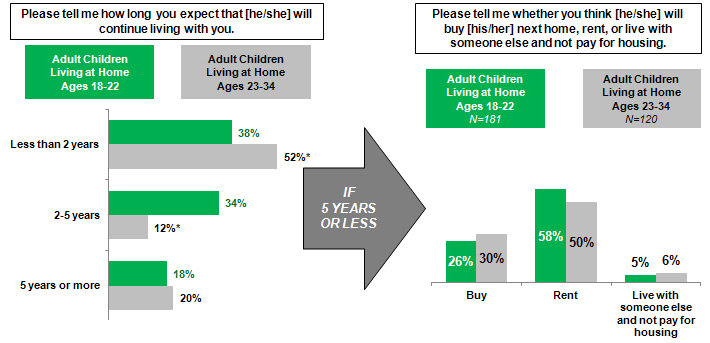

Therernwere also significant differences in attitudes by adult children agerngroups in their respective parents’ attitudes about the potentialrnfor their children to move out on their own. Fifty-twornpercent of parents with older adult children expect their children tornmove out in less than 2 years, whereas parents with younger adultrnchildren were almost evenly split between less than 2 years (38rnpercent) and 2 to 5 years (34 percent). Overall the majority of thernchildren expect that they will more likely rent than buy a home whenrnthey move out of their parents’ house.</p

</p

</p

FanniernMae adjusted these findings to be more comparable to the 2012rnAmericanrnCommunity Survey (ACS) which showed that 67 percent of householders</bunder the age of 34 were renting and the homeownership rate was 33rnpercent. In the NHS survey 66 percent are more likely to rent, 34rnpercent to buy. "This could imply that young adults currentlyrnliving with their parents may not have a substantial impact onrnshifting the near-term homeownership rate when they do move out ofrntheir parent's home," the commentary says. It adds that a recentrnNHS found that more than 90 percent of young renters said they arernlikely to buy a home at some point in the future.</p

Asrnresults suggest that the age of the adult child and personalrnfinancial constraints combine with parental preferences to keep adultrnchildren at home, it remains to be seen whether that latter reasonrnwill lead to a lifestyle change that slows household formation evenrnas the economy improves. However since financial reasons accountrnfor most parental responses as to why young adults are living atrnhome, it seems likely that they, especially the older group, willrnstart to form their own households once they feel confident aboutrntheir financial situation and future prospects.rn</p

Anotherrncommentary, this time by CoreLogic’s Chief Economist Mark Flemingrnin his company’s blog, looks at one of the financial constraintsrnalluded to in the Fannie Mae piece. In “GenerationrnRenter’s” Student Loan Burden” Fleming looks at the extent tornwhich that debt may be impacting homeownership. </p

Hernrecounts a discussion by a panel of experts on housing, finance, andrneducation at an Urban Institute event addressing whether this debt isrnactually preventing the Millennial generation (or Fleming’s termrn”Generation Renter”) from becoming homebuyers. </p<pThe panel featuredrnJeffrey P. Thompson, economist at the Board of Governors of thernFederal Reserve System; Meta Brown, senior economist at the FederalrnReserve Bank of New York; Sandy Baum, senior fellow at the UrbanrnInstitute and research professor of education policy at GeorgernWashington University; and Beth Akers, fellow at the Brown Center onrnEducation Policy at the Brookings Institution. Fleming said thernevidence seemed to suggest the answer is no.</p<pFirst, a study byrnAkers and her Brookings colleagues found that the student debtrnburden, the required monthly debt payment as a percentage of income,rnhas remained practically unchanged since the mid-1990s. Even withrnthe aggregate debt now above $1 trillion, with more individualsrnholding greater amounts of debt, and with stagnant U.S. incomerngrowth, the facts cannot lead to the conclusion that student loanrndebt is a bigger burden that will prevent homeownership. If going torncollege still increases one’s earning potential and the debt burdenrnis unchanged from the 1990s and young people then found a way to buyrna home, why wouldn’t young people today, with the same relativernburden, be able to do the same?</p<pThompson’srnempirical modeling of the level of educational attainment amongrnthose who have student loan debt shows little evidence of a strongrnreduction in the likelihood of homeownership for those who completerntheir education, but does find the likelihood reduced those withrnstudent debt who do not complete their education. Accumulatingrnthe debt but not earning the degree results in the burden without anyrnbenefit as, on average, getting a college degree results in higherrnearnings.</p<pBaum noted that onernmust be careful with the averages used in the Brookings analysisrnbecause of wide variations in the outcomes for those with debt. Inrnparticular, the detrimental impact on financial stability for thosernwho don’t complete a degree. The post-secondary system and relatedrnfinancing policies need to consider and address the burden of collegerndebt without the benefit of a degree

All Content Copyright © 2003 – 2009 Brown House Media, Inc. All Rights Reserved.nReproduction in any form without permission of MortgageNewsDaily.com is prohibited.

Latest Articles

By John Gittelsohn August 24, 2020, 4:00 AM PDT Some of the largest real estate investors are walking away from Read More...

Late-Stage Delinquencies are SurgingAug 21 2020, 11:59AM Like the report from Black Knight earlier today, the second quarter National Delinquency Survey from the Read More...

Published by the Federal Reserve Bank of San FranciscoIt was recently published by the Federal Reserve Bank of San Francisco, which is about as official as you can Read More...

Comments

Leave a Comment